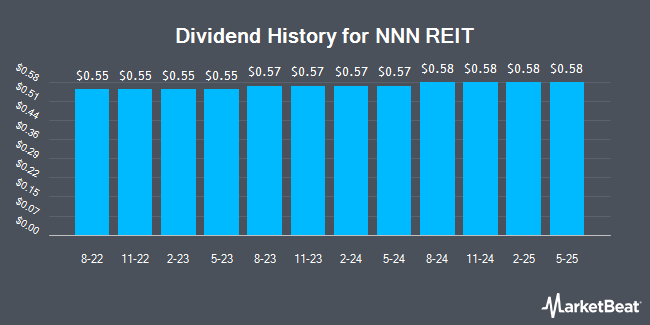

NNN REIT, Inc. (NYSE:NNN - Get Free Report) declared a quarterly dividend on Tuesday, October 15th, RTT News reports. Investors of record on Thursday, October 31st will be given a dividend of 0.58 per share by the real estate investment trust on Friday, November 15th. This represents a $2.32 dividend on an annualized basis and a yield of 4.73%.

NNN REIT has raised its dividend payment by an average of 10.4% annually over the last three years and has increased its dividend every year for the last 35 years. NNN REIT has a payout ratio of 112.6% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities research analysts expect NNN REIT to earn $3.40 per share next year, which means the company should continue to be able to cover its $2.32 annual dividend with an expected future payout ratio of 68.2%.

NNN REIT Stock Performance

Shares of NNN stock traded up $1.07 during mid-day trading on Tuesday, hitting $49.03. The stock had a trading volume of 1,425,339 shares, compared to its average volume of 1,157,477. NNN REIT has a fifty-two week low of $34.61 and a fifty-two week high of $49.56. The company has a debt-to-equity ratio of 1.04, a current ratio of 1.72 and a quick ratio of 1.72. The company's 50-day simple moving average is $47.37 and its 200-day simple moving average is $44.19. The firm has a market cap of $8.99 billion, a PE ratio of 22.49, a PEG ratio of 3.79 and a beta of 1.09.

NNN REIT (NYSE:NNN - Get Free Report) last issued its earnings results on Thursday, August 1st. The real estate investment trust reported $0.58 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.82 by ($0.24). NNN REIT had a return on equity of 9.70% and a net margin of 47.39%. The business had revenue of $216.81 million for the quarter, compared to analysts' expectations of $212.30 million. During the same period last year, the company posted $0.80 earnings per share. The business's quarterly revenue was up 7.0% on a year-over-year basis. Sell-side analysts anticipate that NNN REIT will post 3.3 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on NNN. UBS Group increased their target price on shares of NNN REIT from $41.00 to $46.00 and gave the company a "neutral" rating in a report on Thursday, July 18th. B. Riley lifted their price objective on NNN REIT from $42.50 to $49.00 and gave the stock a "neutral" rating in a report on Wednesday, August 7th. Wells Fargo & Company reissued an "equal weight" rating and issued a $50.00 target price (up previously from $47.00) on shares of NNN REIT in a report on Tuesday, October 1st. Royal Bank of Canada lifted their price target on NNN REIT from $43.00 to $46.00 and gave the stock a "sector perform" rating in a research note on Friday, August 2nd. Finally, StockNews.com raised shares of NNN REIT from a "hold" rating to a "buy" rating in a research note on Friday, August 2nd. Five analysts have rated the stock with a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $46.83.

Read Our Latest Report on NNN

Insider Activity

In related news, EVP Michelle Lynn Miller sold 4,000 shares of NNN REIT stock in a transaction dated Tuesday, August 6th. The stock was sold at an average price of $46.88, for a total transaction of $187,520.00. Following the completion of the sale, the executive vice president now owns 69,756 shares in the company, valued at approximately $3,270,161.28. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Company insiders own 0.82% of the company's stock.

NNN REIT Company Profile

(

Get Free Report)

NNN REIT invests primarily in high-quality retail properties subject generally to long-term, net leases. As of December 31, 2023, the company owned 3,532 properties in 49 states with a gross leasable area of approximately 36.0 million square feet and a weighted average remaining lease term of 10.1 years.

Featured Articles

Before you consider NNN REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NNN REIT wasn't on the list.

While NNN REIT currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.