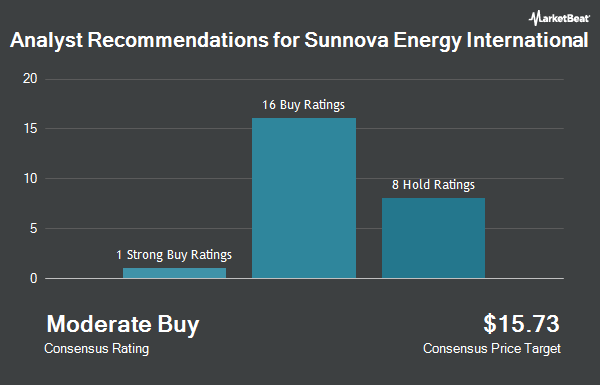

Sunnova Energy International Inc. (NYSE:NOVA - Get Free Report) has earned a consensus rating of "Moderate Buy" from the twenty analysts that are covering the firm, MarketBeat.com reports. Six investment analysts have rated the stock with a hold recommendation and fourteen have assigned a buy recommendation to the company. The average twelve-month price target among brokers that have issued ratings on the stock in the last year is $12.11.

Several research firms have weighed in on NOVA. Jefferies Financial Group began coverage on shares of Sunnova Energy International in a research report on Thursday, October 10th. They issued a "buy" rating and a $15.00 price target on the stock. Citigroup dropped their price target on Sunnova Energy International from $12.00 to $10.00 and set a "buy" rating for the company in a research note on Tuesday, October 22nd. Guggenheim boosted their price target on shares of Sunnova Energy International from $7.00 to $10.00 and gave the stock a "buy" rating in a research note on Friday, July 26th. BMO Capital Markets increased their target price on Sunnova Energy International from $9.00 to $10.00 and gave the company a "market perform" rating in a research report on Monday, October 14th. Finally, The Goldman Sachs Group boosted their price target on shares of Sunnova Energy International from $10.00 to $13.00 and gave the stock a "buy" rating in a research report on Friday, August 2nd.

Read Our Latest Research Report on Sunnova Energy International

Sunnova Energy International Stock Performance

Sunnova Energy International stock traded up $0.05 during mid-day trading on Monday, reaching $5.35. 10,238,128 shares of the stock traded hands, compared to its average volume of 7,697,814. Sunnova Energy International has a 12-month low of $3.37 and a 12-month high of $16.35. The business's 50-day moving average is $9.06 and its 200-day moving average is $6.86. The company has a debt-to-equity ratio of 3.11, a current ratio of 0.97 and a quick ratio of 0.97. The stock has a market capitalization of $667.38 million, a PE ratio of -1.84 and a beta of 2.21.

Sunnova Energy International (NYSE:NOVA - Get Free Report) last released its quarterly earnings results on Wednesday, July 31st. The company reported ($0.27) EPS for the quarter, beating the consensus estimate of ($0.54) by $0.27. The firm had revenue of $219.60 million during the quarter, compared to analyst estimates of $220.38 million. Sunnova Energy International had a negative net margin of 45.76% and a negative return on equity of 8.85%. The business's revenue for the quarter was up 32.0% compared to the same quarter last year. During the same quarter in the prior year, the firm earned ($0.74) EPS. As a group, sell-side analysts predict that Sunnova Energy International will post -1.99 EPS for the current fiscal year.

Insider Transactions at Sunnova Energy International

In other news, insider William J. Berger sold 77,000 shares of the company's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $11.31, for a total value of $870,870.00. Following the transaction, the insider now directly owns 409,045 shares in the company, valued at approximately $4,626,298.95. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Corporate insiders own 4.50% of the company's stock.

Institutional Trading of Sunnova Energy International

Large investors have recently modified their holdings of the company. Wellington Management Group LLP raised its holdings in shares of Sunnova Energy International by 2.3% in the fourth quarter. Wellington Management Group LLP now owns 343,267 shares of the company's stock valued at $5,235,000 after acquiring an additional 7,571 shares in the last quarter. Vanguard Group Inc. raised its holdings in shares of Sunnova Energy International by 2.1% in the 4th quarter. Vanguard Group Inc. now owns 10,486,392 shares of the company's stock valued at $159,917,000 after purchasing an additional 215,905 shares in the last quarter. First Trust Direct Indexing L.P. purchased a new stake in shares of Sunnova Energy International in the 1st quarter worth approximately $66,000. Mirae Asset Global Investments Co. Ltd. boosted its stake in shares of Sunnova Energy International by 7.0% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 102,766 shares of the company's stock valued at $630,000 after purchasing an additional 6,751 shares in the last quarter. Finally, BI Asset Management Fondsmaeglerselskab A S boosted its stake in shares of Sunnova Energy International by 129.9% during the first quarter. BI Asset Management Fondsmaeglerselskab A S now owns 11,788 shares of the company's stock valued at $72,000 after purchasing an additional 6,661 shares in the last quarter.

Sunnova Energy International Company Profile

(

Get Free ReportSunnova Energy International Inc engages in the provision of energy as a service in the United States. The company offers electricity, as well as offers operations and maintenance, monitoring, repairs and replacements, equipment upgrades, on-site power optimization, and solar energy system and energy storage system diagnostics services.

See Also

Before you consider Sunnova Energy International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunnova Energy International wasn't on the list.

While Sunnova Energy International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.