Diversify Wealth Management LLC purchased a new stake in Novartis AG (NYSE:NVS - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 6,168 shares of the company's stock, valued at approximately $704,000.

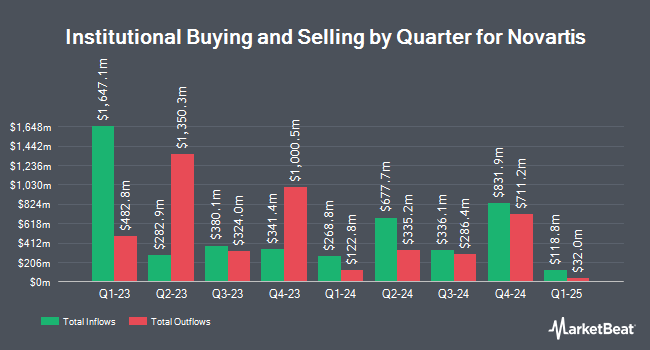

A number of other hedge funds have also recently bought and sold shares of NVS. New Millennium Group LLC bought a new stake in shares of Novartis during the second quarter valued at approximately $28,000. Clearstead Trust LLC raised its stake in shares of Novartis by 73.5% in the 1st quarter. Clearstead Trust LLC now owns 269 shares of the company's stock valued at $26,000 after buying an additional 114 shares in the last quarter. Lynx Investment Advisory bought a new position in shares of Novartis during the 2nd quarter worth about $29,000. Industrial Alliance Investment Management Inc. acquired a new stake in shares of Novartis during the 2nd quarter valued at about $30,000. Finally, Richardson Financial Services Inc. acquired a new stake in shares of Novartis during the 2nd quarter valued at about $30,000. 13.12% of the stock is owned by institutional investors.

Novartis Price Performance

Novartis stock traded up $0.94 on Friday, reaching $109.34. The company's stock had a trading volume of 1,111,988 shares, compared to its average volume of 1,348,677. Novartis AG has a twelve month low of $92.35 and a twelve month high of $120.92. The company has a market cap of $223.49 billion, a price-to-earnings ratio of 12.75, a PEG ratio of 1.59 and a beta of 0.57. The company has a debt-to-equity ratio of 0.55, a quick ratio of 0.72 and a current ratio of 1.11. The business's fifty day moving average price is $115.94 and its 200 day moving average price is $109.01.

Novartis (NYSE:NVS - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The company reported $2.06 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.94 by $0.12. Novartis had a net margin of 35.96% and a return on equity of 34.80%. The business had revenue of $12.82 billion for the quarter, compared to the consensus estimate of $12.62 billion. During the same quarter in the prior year, the company earned $1.74 EPS. Equities analysts expect that Novartis AG will post 7.56 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several research analysts recently issued reports on NVS shares. The Goldman Sachs Group reissued a "neutral" rating and issued a $121.00 price target (up previously from $119.00) on shares of Novartis in a research report on Thursday, September 5th. Jefferies Financial Group lowered Novartis from a "buy" rating to a "hold" rating in a research note on Tuesday, September 3rd. Bank of America lowered Novartis from a "buy" rating to a "neutral" rating and dropped their price objective for the stock from $135.00 to $130.00 in a research note on Wednesday, September 11th. BMO Capital Markets lifted their price objective on Novartis from $118.00 to $120.00 and gave the company a "market perform" rating in a report on Wednesday. Finally, Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating on shares of Novartis in a report on Friday, July 19th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $121.50.

Check Out Our Latest Report on Novartis

Novartis Company Profile

(

Free Report)

Novartis AG engages in the research, development, manufacture, and marketing of healthcare products in Switzerland and internationally. The company offers prescription medicines for patients and physicians. It focuses on therapeutic areas, such as cardiovascular, renal and metabolic, immunology, neuroscience, and oncology, as well as ophthalmology and hematology.

See Also

Before you consider Novartis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novartis wasn't on the list.

While Novartis currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.