Raymond James & Associates trimmed its holdings in shares of Envista Holdings Co. (NYSE:NVST - Free Report) by 59.0% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 422,775 shares of the company's stock after selling 609,575 shares during the period. Raymond James & Associates owned about 0.25% of Envista worth $8,354,000 at the end of the most recent quarter.

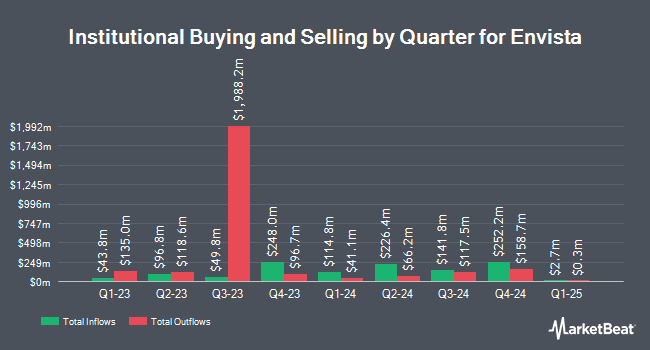

A number of other large investors also recently modified their holdings of the business. State of Michigan Retirement System lifted its stake in Envista by 2.4% in the 1st quarter. State of Michigan Retirement System now owns 42,163 shares of the company's stock valued at $901,000 after purchasing an additional 1,000 shares during the last quarter. Capstone Investment Advisors LLC lifted its stake in Envista by 51.3% in the 1st quarter. Capstone Investment Advisors LLC now owns 64,779 shares of the company's stock valued at $1,385,000 after purchasing an additional 21,950 shares during the last quarter. FORA Capital LLC lifted its stake in Envista by 11.1% in the 1st quarter. FORA Capital LLC now owns 52,198 shares of the company's stock valued at $1,116,000 after purchasing an additional 5,205 shares during the last quarter. Mutual of America Capital Management LLC lifted its stake in Envista by 1.0% in the 1st quarter. Mutual of America Capital Management LLC now owns 196,022 shares of the company's stock valued at $4,191,000 after purchasing an additional 1,967 shares during the last quarter. Finally, Central Pacific Bank Trust Division acquired a new stake in Envista in the 1st quarter valued at about $479,000.

Insider Activity at Envista

In other news, CFO Eric D. Hammes acquired 24,532 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The shares were acquired at an average cost of $16.33 per share, with a total value of $400,607.56. Following the completion of the purchase, the chief financial officer now directly owns 24,532 shares of the company's stock, valued at $400,607.56. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 1.30% of the stock is currently owned by insiders.

Envista Stock Performance

Shares of NVST traded up $0.44 during mid-day trading on Wednesday, hitting $19.23. 4,085,774 shares of the company's stock were exchanged, compared to its average volume of 2,415,143. The stock's 50-day simple moving average is $18.51 and its 200-day simple moving average is $18.04. The firm has a market cap of $3.31 billion, a price-to-earnings ratio of -2.50 and a beta of 1.32. The company has a quick ratio of 1.90, a current ratio of 2.22 and a debt-to-equity ratio of 0.47. Envista Holdings Co. has a 52 week low of $15.15 and a 52 week high of $25.64.

Envista (NYSE:NVST - Get Free Report) last announced its quarterly earnings data on Wednesday, August 7th. The company reported $0.11 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.27 by ($0.16). The firm had revenue of $633.10 million during the quarter, compared to the consensus estimate of $646.88 million. Envista had a negative net margin of 52.25% and a positive return on equity of 4.86%. The business's revenue was down 4.4% compared to the same quarter last year. During the same period last year, the business earned $0.43 earnings per share. On average, equities research analysts expect that Envista Holdings Co. will post 0.69 EPS for the current year.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on NVST shares. Evercore ISI raised their target price on shares of Envista from $18.00 to $23.00 and gave the company an "outperform" rating in a research note on Monday, September 23rd. Bank of America lowered their price target on shares of Envista from $22.00 to $19.00 and set a "buy" rating on the stock in a report on Thursday, August 8th. Wells Fargo & Company started coverage on shares of Envista in a report on Tuesday, October 8th. They issued an "equal weight" rating and a $20.00 price target on the stock. JPMorgan Chase & Co. cut shares of Envista from an "overweight" rating to a "neutral" rating and lowered their price target for the company from $23.00 to $16.00 in a report on Thursday, August 8th. Finally, Stifel Nicolaus increased their price target on shares of Envista from $18.00 to $21.00 and gave the company a "buy" rating in a report on Wednesday, October 23rd. Three analysts have rated the stock with a sell rating, nine have issued a hold rating and three have given a buy rating to the company's stock. According to MarketBeat, Envista has an average rating of "Hold" and a consensus target price of $19.88.

Get Our Latest Stock Analysis on NVST

About Envista

(

Free Report)

Envista Holdings Corporation, together with its subsidiaries, develops, manufactures, markets, and sells dental products in the United States, China, and internationally. The company operates in two segments, Specialty Products & Technologies, and Equipment & Consumables. The Specialty Products & Technologies segment offers dental implant systems, guided surgery systems, biomaterials, and prefabricated and custom-built prosthetics to oral surgeons, prosthodontists and periodontists, and general dentist; and brackets and wires, tubes and bands, archwires, clear aligners, digital orthodontic treatments, retainers, and other orthodontic laboratory products.

Further Reading

Before you consider Envista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Envista wasn't on the list.

While Envista currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.