NorthWestern Energy Group (NYSE:NWE - Get Free Report) had its price objective raised by analysts at JPMorgan Chase & Co. from $56.00 to $60.00 in a report issued on Monday, Benzinga reports. The firm presently has a "neutral" rating on the stock. JPMorgan Chase & Co.'s price target would suggest a potential upside of 8.46% from the company's current price.

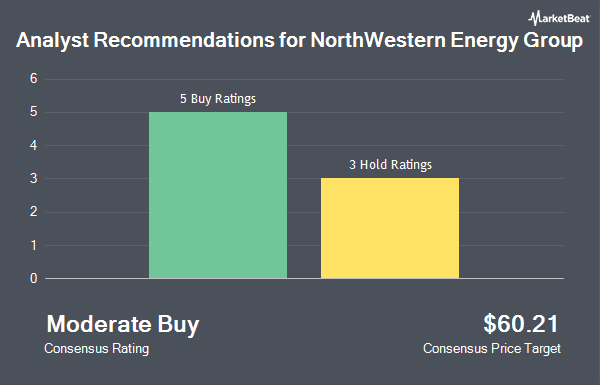

A number of other equities analysts have also recently weighed in on NWE. Barclays raised their price objective on NorthWestern Energy Group from $50.00 to $53.00 and gave the company an "underweight" rating in a report on Tuesday, August 6th. StockNews.com cut shares of NorthWestern Energy Group from a "buy" rating to a "hold" rating in a research report on Tuesday, October 8th. Mizuho upped their target price on NorthWestern Energy Group from $52.00 to $56.00 and gave the company a "neutral" rating in a report on Wednesday, October 9th. Wells Fargo & Company lifted their price objective on NorthWestern Energy Group from $58.00 to $61.00 and gave the company an "overweight" rating in a research report on Wednesday, October 16th. Finally, Bank of America started coverage on NorthWestern Energy Group in a report on Thursday, September 12th. They issued a "buy" rating and a $65.00 price objective for the company. One investment analyst has rated the stock with a sell rating, six have issued a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat, NorthWestern Energy Group presently has a consensus rating of "Hold" and an average price target of $56.14.

Get Our Latest Research Report on NorthWestern Energy Group

NorthWestern Energy Group Price Performance

NYSE NWE traded down $1.15 on Monday, hitting $55.32. The stock had a trading volume of 461,114 shares, compared to its average volume of 331,704. The company has a market capitalization of $3.39 billion, a price-to-earnings ratio of 17.16, a price-to-earnings-growth ratio of 2.56 and a beta of 0.46. The company has a debt-to-equity ratio of 0.92, a quick ratio of 0.36 and a current ratio of 0.52. The firm has a 50-day moving average of $55.06 and a 200-day moving average of $52.35. NorthWestern Energy Group has a 52-week low of $46.15 and a 52-week high of $57.48.

NorthWestern Energy Group (NYSE:NWE - Get Free Report) last posted its quarterly earnings data on Tuesday, July 30th. The company reported $0.53 earnings per share for the quarter, beating the consensus estimate of $0.48 by $0.05. NorthWestern Energy Group had a net margin of 14.21% and a return on equity of 7.65%. The firm had revenue of $319.90 million for the quarter, compared to analysts' expectations of $310.40 million. During the same quarter last year, the company posted $0.35 EPS. The business's quarterly revenue was up 10.1% on a year-over-year basis. Equities analysts expect that NorthWestern Energy Group will post 3.54 EPS for the current year.

Insider Activity at NorthWestern Energy Group

In other NorthWestern Energy Group news, Director Britt E. Ide sold 688 shares of the stock in a transaction that occurred on Thursday, August 8th. The shares were sold at an average price of $51.92, for a total value of $35,720.96. Following the transaction, the director now directly owns 10,778 shares in the company, valued at approximately $559,593.76. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 0.94% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On NorthWestern Energy Group

Large investors have recently made changes to their positions in the business. BNP Paribas Financial Markets grew its holdings in NorthWestern Energy Group by 128.8% during the 1st quarter. BNP Paribas Financial Markets now owns 63,292 shares of the company's stock valued at $3,223,000 after buying an additional 35,628 shares in the last quarter. Russell Investments Group Ltd. grew its position in NorthWestern Energy Group by 429.0% in the first quarter. Russell Investments Group Ltd. now owns 105,103 shares of the company's stock worth $5,353,000 after acquiring an additional 85,235 shares in the last quarter. Cetera Investment Advisers increased its stake in NorthWestern Energy Group by 49.0% during the first quarter. Cetera Investment Advisers now owns 30,963 shares of the company's stock worth $1,577,000 after acquiring an additional 10,185 shares during the last quarter. Vanguard Group Inc. raised its position in NorthWestern Energy Group by 2.8% during the fourth quarter. Vanguard Group Inc. now owns 6,780,298 shares of the company's stock valued at $345,049,000 after purchasing an additional 187,619 shares during the period. Finally, Susquehanna Fundamental Investments LLC purchased a new position in shares of NorthWestern Energy Group in the 1st quarter worth approximately $2,862,000. 96.07% of the stock is currently owned by hedge funds and other institutional investors.

About NorthWestern Energy Group

(

Get Free Report)

NorthWestern Energy Group, Inc provides electricity and natural gas to residential, commercial, and various industrial customers. It generates, purchases, transmits, and distributes electricity; and produces, purchases, stores, transmits, and distributes natural gas, as well as owns municipal franchises to provide natural gas service in the communities.

Featured Articles

Before you consider NorthWestern Energy Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NorthWestern Energy Group wasn't on the list.

While NorthWestern Energy Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.