Harbor Capital Advisors Inc. increased its stake in shares of OGE Energy Corp. (NYSE:OGE - Free Report) by 200.8% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 52,162 shares of the utilities provider's stock after acquiring an additional 34,823 shares during the quarter. Harbor Capital Advisors Inc.'s holdings in OGE Energy were worth $2,140,000 at the end of the most recent quarter.

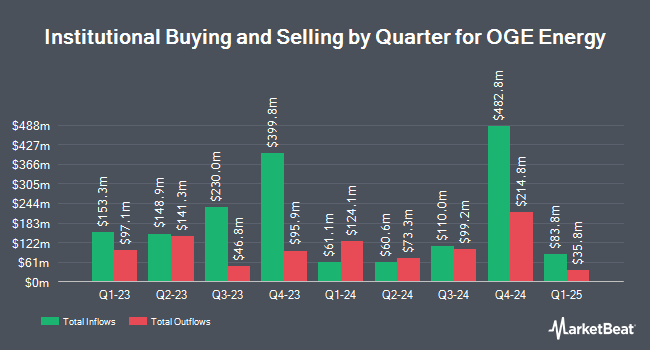

Other large investors have also recently made changes to their positions in the company. V Square Quantitative Management LLC bought a new stake in shares of OGE Energy during the 3rd quarter worth $30,000. Thurston Springer Miller Herd & Titak Inc. purchased a new stake in OGE Energy during the 2nd quarter valued at $35,000. Kimelman & Baird LLC purchased a new position in shares of OGE Energy in the 2nd quarter worth $38,000. Allspring Global Investments Holdings LLC boosted its stake in shares of OGE Energy by 23.1% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 1,483 shares of the utilities provider's stock worth $53,000 after buying an additional 278 shares during the last quarter. Finally, Fortitude Family Office LLC bought a new position in OGE Energy in the 3rd quarter worth $63,000. 71.84% of the stock is owned by institutional investors.

OGE Energy Stock Up 3.0 %

OGE stock traded up $1.19 during trading on Tuesday, reaching $41.03. The stock had a trading volume of 1,572,153 shares, compared to its average volume of 1,290,736. The company has a market capitalization of $8.24 billion, a P/E ratio of 20.11, a PEG ratio of 3.53 and a beta of 0.74. The firm has a fifty day moving average price of $40.35 and a 200 day moving average price of $37.95. The company has a current ratio of 0.71, a quick ratio of 0.36 and a debt-to-equity ratio of 1.08. OGE Energy Corp. has a 1-year low of $32.06 and a 1-year high of $41.48.

OGE Energy (NYSE:OGE - Get Free Report) last released its quarterly earnings data on Wednesday, August 7th. The utilities provider reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.46 by $0.05. OGE Energy had a net margin of 14.83% and a return on equity of 9.15%. The firm had revenue of $662.60 million for the quarter, compared to analyst estimates of $837.51 million. During the same quarter in the prior year, the business earned $0.44 EPS. The company's revenue for the quarter was up 9.5% compared to the same quarter last year. On average, equities analysts anticipate that OGE Energy Corp. will post 2.14 earnings per share for the current year.

OGE Energy Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, October 25th. Investors of record on Monday, October 7th were paid a dividend of $0.4213 per share. This is a positive change from OGE Energy's previous quarterly dividend of $0.42. The ex-dividend date was Monday, October 7th. This represents a $1.69 annualized dividend and a yield of 4.11%. OGE Energy's dividend payout ratio (DPR) is presently 82.35%.

Analyst Upgrades and Downgrades

Several research analysts recently commented on OGE shares. Jefferies Financial Group assumed coverage on OGE Energy in a research report on Thursday, September 19th. They issued a "buy" rating and a $46.00 price target for the company. Barclays upped their price target on OGE Energy from $39.00 to $42.00 and gave the stock an "equal weight" rating in a research report on Monday, October 21st. Finally, Evercore ISI boosted their price objective on shares of OGE Energy from $36.00 to $40.00 and gave the company an "in-line" rating in a report on Thursday, August 8th. Six equities research analysts have rated the stock with a hold rating and one has issued a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $39.40.

Check Out Our Latest Stock Report on OGE Energy

About OGE Energy

(

Free Report)

OGE Energy Corp., together with its subsidiaries, operates as an energy services provider in the United States. The company generates, transmits, distributes, and sells electric energy. In addition, it provides retail electric service to approximately 896,000 customers, which covers a service area of approximately 30,000 square miles in Oklahoma and western Arkansas; and owns and operates coal-fired, natural gas-fired, wind-powered, and solar-powered generating assets.

Recommended Stories

Before you consider OGE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OGE Energy wasn't on the list.

While OGE Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.