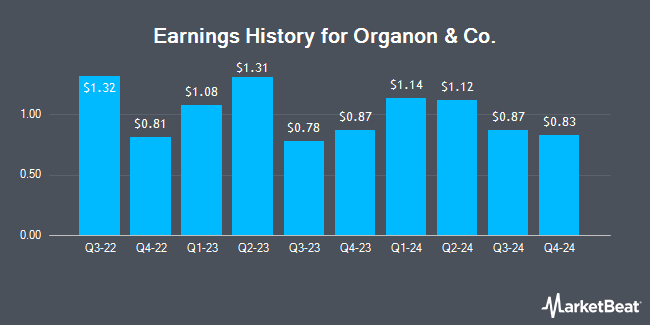

Organon & Co. (NYSE:OGN - Get Free Report) will be posting its quarterly earnings results before the market opens on Thursday, October 31st. Analysts expect Organon & Co. to post earnings of $0.94 per share for the quarter. Organon & Co. has set its FY 2024 guidance at EPS.Individual that are interested in registering for the company's earnings conference call can do so using this link.

Organon & Co. (NYSE:OGN - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The company reported $1.12 earnings per share for the quarter, topping analysts' consensus estimates of $1.08 by $0.04. The company had revenue of $1.61 billion during the quarter, compared to analysts' expectations of $1.61 billion. Organon & Co. had a negative return on equity of 840.29% and a net margin of 15.76%. The firm's revenue for the quarter was down .1% on a year-over-year basis. During the same period last year, the firm earned $1.31 EPS. On average, analysts expect Organon & Co. to post $4 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Organon & Co. Price Performance

Shares of OGN traded up $0.01 during trading hours on Thursday, reaching $17.22. The company had a trading volume of 1,990,517 shares, compared to its average volume of 2,166,577. The firm has a 50 day simple moving average of $19.83 and a 200-day simple moving average of $20.12. Organon & Co. has a 12-month low of $10.84 and a 12-month high of $23.10. The company has a current ratio of 1.64, a quick ratio of 1.17 and a debt-to-equity ratio of 60.05. The company has a market capitalization of $4.43 billion, a price-to-earnings ratio of 4.43, a PEG ratio of 0.78 and a beta of 0.84.

Organon & Co. Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, September 12th. Stockholders of record on Friday, August 16th were issued a $0.28 dividend. The ex-dividend date of this dividend was Friday, August 16th. This represents a $1.12 dividend on an annualized basis and a dividend yield of 6.50%. Organon & Co.'s dividend payout ratio (DPR) is 28.79%.

Analyst Upgrades and Downgrades

OGN has been the topic of several research analyst reports. Evercore ISI raised shares of Organon & Co. to a "strong-buy" rating in a research report on Wednesday, September 18th. JPMorgan Chase & Co. cut Organon & Co. from a "neutral" rating to an "underweight" rating and increased their target price for the company from $18.00 to $20.00 in a research note on Friday, September 6th.

Check Out Our Latest Research Report on Organon & Co.

About Organon & Co.

(

Get Free Report)

Organon & Co develops and delivers health solutions through a portfolio of prescription therapies and medical devices within women's health in the United States and internationally. Its women's health portfolio comprises contraception and fertility brands, such as Nexplanon, a long-acting reversible contraceptive; NuvaRing, a monthly vaginal contraceptive ring; Cerazette, a daily pill used to prevent pregnancy; Marvelon, progestin and estrogen used as daily pills to prevent pregnancy; Follistim AQ, used to promote the development of multiple ovarian follicles in assisted reproduction technology procedures; Elonva, an ovarian follicle stimulant; Ganirelix Acetate Injection, an injectable antagonist; and Jada, for abnormal postpartum uterine bleeding or hemorrhage.

Featured Articles

Before you consider Organon & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Organon & Co. wasn't on the list.

While Organon & Co. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.