Highland Capital Management LLC raised its stake in Olin Co. (NYSE:OLN - Free Report) by 22.7% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 97,739 shares of the specialty chemicals company's stock after acquiring an additional 18,110 shares during the quarter. Highland Capital Management LLC owned approximately 0.08% of Olin worth $4,690,000 as of its most recent SEC filing.

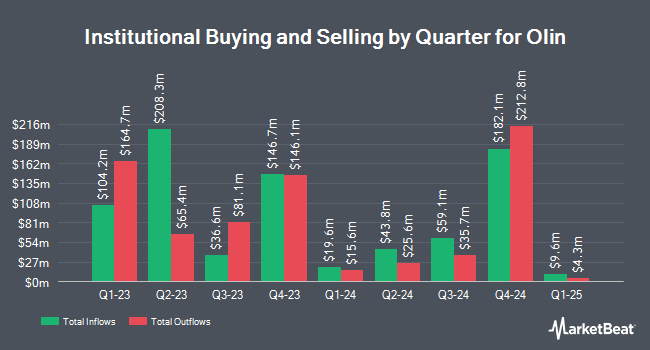

A number of other hedge funds also recently made changes to their positions in the stock. Oak Thistle LLC acquired a new stake in Olin in the first quarter valued at $547,000. FORA Capital LLC raised its position in shares of Olin by 47.4% during the first quarter. FORA Capital LLC now owns 14,149 shares of the specialty chemicals company's stock worth $832,000 after acquiring an additional 4,552 shares during the last quarter. Empowered Funds LLC lifted its stake in shares of Olin by 42.3% in the first quarter. Empowered Funds LLC now owns 48,020 shares of the specialty chemicals company's stock worth $2,824,000 after acquiring an additional 14,279 shares during the period. Swiss National Bank boosted its holdings in Olin by 2.7% in the first quarter. Swiss National Bank now owns 241,932 shares of the specialty chemicals company's stock valued at $14,226,000 after acquiring an additional 6,300 shares during the last quarter. Finally, Meeder Asset Management Inc. acquired a new stake in Olin during the 1st quarter valued at approximately $167,000. 88.67% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of research analysts have recently issued reports on the stock. JPMorgan Chase & Co. upgraded shares of Olin from a "neutral" rating to an "overweight" rating and set a $55.00 price target on the stock in a research report on Monday, July 29th. Bank of America cut shares of Olin from a "buy" rating to a "neutral" rating and cut their price target for the company from $62.00 to $51.00 in a research report on Monday, July 29th. Royal Bank of Canada lowered their price objective on Olin from $61.00 to $52.00 and set an "outperform" rating for the company in a research report on Monday, July 29th. Mizuho started coverage on Olin in a research report on Thursday, August 8th. They set a "neutral" rating and a $45.00 target price on the stock. Finally, Piper Sandler lowered their target price on Olin from $75.00 to $57.00 and set an "overweight" rating for the company in a report on Tuesday, July 30th. One research analyst has rated the stock with a sell rating, eight have given a hold rating and six have given a buy rating to the company. According to MarketBeat, Olin currently has an average rating of "Hold" and a consensus target price of $52.40.

Read Our Latest Analysis on Olin

Olin Stock Performance

NYSE:OLN traded down $3.61 during trading hours on Friday, reaching $41.43. The stock had a trading volume of 4,433,972 shares, compared to its average volume of 1,159,959. The stock has a market cap of $4.95 billion, a P/E ratio of 14.90, a price-to-earnings-growth ratio of 1.12 and a beta of 1.41. The stock has a 50 day simple moving average of $44.78 and a 200 day simple moving average of $48.13. The company has a debt-to-equity ratio of 1.29, a quick ratio of 0.82 and a current ratio of 1.43. Olin Co. has a 12-month low of $39.47 and a 12-month high of $60.60.

Olin (NYSE:OLN - Get Free Report) last released its quarterly earnings data on Thursday, July 25th. The specialty chemicals company reported $0.62 EPS for the quarter, missing the consensus estimate of $0.70 by ($0.08). The business had revenue of $1.64 billion during the quarter, compared to the consensus estimate of $1.71 billion. Olin had a return on equity of 11.73% and a net margin of 4.26%. The firm's quarterly revenue was down 3.5% on a year-over-year basis. During the same period last year, the business posted $1.13 earnings per share. On average, research analysts forecast that Olin Co. will post 1.58 EPS for the current fiscal year.

Olin Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Thursday, November 14th will be paid a $0.20 dividend. This represents a $0.80 annualized dividend and a yield of 1.93%. The ex-dividend date is Thursday, November 14th. Olin's dividend payout ratio is presently 28.78%.

Olin Profile

(

Free Report)

Olin Corporation manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada. It operates through three segments: Chlor Alkali Products and Vinyls; Epoxy; and Winchester. The Chlor Alkali Products and Vinyls segment offers chlorine and caustic soda, ethylene dichloride and vinyl chloride monomers, methyl chloride, methylene chloride, chloroform, carbon tetrachloride, perchloroethylene, hydrochloric acid, hydrogen, bleach products, potassium hydroxide, and chlorinated organics intermediates and solvents.

Featured Articles

Before you consider Olin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Olin wasn't on the list.

While Olin currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.