ON24 (NYSE:ONTF - Get Free Report) will be posting its quarterly earnings results after the market closes on Thursday, November 7th. Analysts expect ON24 to post earnings of $0.01 per share for the quarter. ON24 has set its FY 2024 guidance at 0.050-0.080 EPS and its Q3 2024 guidance at -0.010-0.010 EPS.Individual that are interested in registering for the company's earnings conference call can do so using this link.

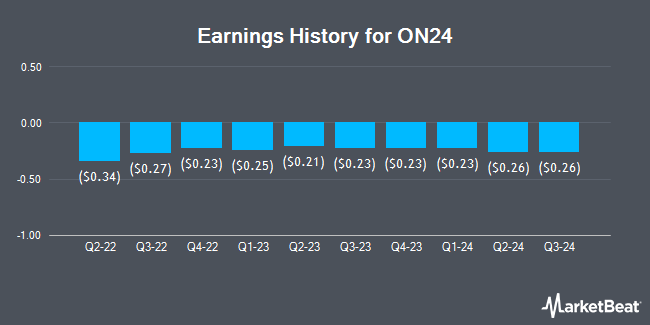

ON24 (NYSE:ONTF - Get Free Report) last released its quarterly earnings results on Tuesday, August 6th. The company reported ($0.26) EPS for the quarter, missing analysts' consensus estimates of ($0.16) by ($0.10). The company had revenue of $37.35 million for the quarter, compared to the consensus estimate of $36.31 million. ON24 had a negative return on equity of 21.81% and a negative net margin of 28.14%. On average, analysts expect ON24 to post $-1 EPS for the current fiscal year and $0 EPS for the next fiscal year.

ON24 Price Performance

Shares of NYSE ONTF traded down $0.38 during mid-day trading on Thursday, reaching $6.05. 68,122 shares of the company traded hands, compared to its average volume of 177,142. ON24 has a fifty-two week low of $5.37 and a fifty-two week high of $8.35. The firm has a market cap of $251.25 million, a PE ratio of -5.93 and a beta of 0.47. The stock has a fifty day simple moving average of $6.20 and a 200-day simple moving average of $6.19.

Analyst Upgrades and Downgrades

ONTF has been the topic of several research analyst reports. Needham & Company LLC reiterated a "hold" rating on shares of ON24 in a research report on Wednesday, August 7th. JPMorgan Chase & Co. lowered their target price on ON24 from $8.00 to $7.00 and set a "neutral" rating on the stock in a report on Wednesday, August 7th.

View Our Latest Report on ONTF

Insider Activity

In other ON24 news, CRO James Blackie sold 4,376 shares of the company's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $6.35, for a total transaction of $27,787.60. Following the completion of the sale, the executive now directly owns 437,161 shares of the company's stock, valued at approximately $2,775,972.35. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, insider Sharat Sharan sold 17,750 shares of ON24 stock in a transaction on Monday, September 30th. The stock was sold at an average price of $6.13, for a total transaction of $108,807.50. Following the transaction, the insider now owns 3,069,728 shares in the company, valued at approximately $18,817,432.64. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CRO James Blackie sold 4,376 shares of the company's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $6.35, for a total value of $27,787.60. Following the transaction, the executive now directly owns 437,161 shares in the company, valued at $2,775,972.35. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 124,300 shares of company stock worth $768,498. Insiders own 32.30% of the company's stock.

ON24 Company Profile

(

Get Free Report)

ON24, Inc provides a cloud-based intelligent engagement platform that enables businesses to convert customer engagement into revenue through interactive webinar, virtual event, and multimedia content experiences worldwide. The company provides ON24 Elite, for live and interactive webinar experience; ON24 Breakouts, for live breakout room experience that facilitates networking, collaboration, and interactivity between users; ON24 Forums, for live and interactive experience, which facilitates video-to-video interaction between presenters and audiences; ON24 Go Live, for live and interactive video event experience that enables presenters and attendees to engage face-to-face in real-time; and ON24 Virtual Confrence, for live and large scale managed virtual event experience.

See Also

Before you consider ON24, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON24 wasn't on the list.

While ON24 currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.