Ormat Technologies (NYSE:ORA - Get Free Report) will be releasing its earnings data after the market closes on Wednesday, November 6th. Analysts expect Ormat Technologies to post earnings of $0.34 per share for the quarter. Ormat Technologies has set its FY 2024 guidance at EPS.Individual that are interested in participating in the company's earnings conference call can do so using this link.

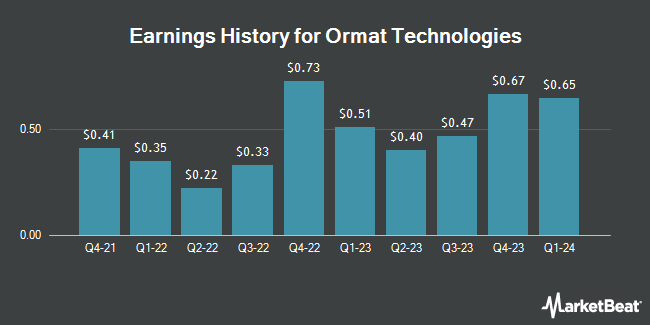

Ormat Technologies (NYSE:ORA - Get Free Report) last announced its quarterly earnings results on Tuesday, August 6th. The energy company reported $0.40 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.37 by $0.03. Ormat Technologies had a net margin of 14.89% and a return on equity of 5.40%. The company had revenue of $212.96 million during the quarter, compared to the consensus estimate of $214.07 million. During the same period in the prior year, the business earned $0.40 earnings per share. The company's revenue for the quarter was up 9.3% compared to the same quarter last year. On average, analysts expect Ormat Technologies to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Ormat Technologies Price Performance

Shares of NYSE ORA traded down $0.84 during mid-day trading on Wednesday, hitting $80.15. 369,662 shares of the stock traded hands, compared to its average volume of 434,556. The company has a market cap of $4.85 billion, a PE ratio of 36.60, a price-to-earnings-growth ratio of 4.12 and a beta of 0.53. Ormat Technologies has a twelve month low of $58.73 and a twelve month high of $82.39. The company has a debt-to-equity ratio of 0.72, a current ratio of 0.97 and a quick ratio of 0.89. The firm has a 50 day simple moving average of $75.81 and a two-hundred day simple moving average of $73.19.

Ormat Technologies Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 3rd. Stockholders of record on Tuesday, August 20th were issued a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a dividend yield of 0.60%. The ex-dividend date of this dividend was Tuesday, August 20th. Ormat Technologies's dividend payout ratio (DPR) is currently 21.92%.

Insider Transactions at Ormat Technologies

In related news, Director Byron G. Wong sold 1,266 shares of the company's stock in a transaction dated Friday, September 20th. The stock was sold at an average price of $74.98, for a total transaction of $94,924.68. Following the sale, the director now owns 6,906 shares in the company, valued at $517,811.88. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. In related news, Director Byron G. Wong sold 1,266 shares of the stock in a transaction on Friday, September 20th. The shares were sold at an average price of $74.98, for a total transaction of $94,924.68. Following the transaction, the director now directly owns 6,906 shares of the company's stock, valued at $517,811.88. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Dafna Sharir sold 433 shares of Ormat Technologies stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $74.91, for a total transaction of $32,436.03. Following the completion of the sale, the director now directly owns 3,561 shares of the company's stock, valued at approximately $266,754.51. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 0.46% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have issued reports on ORA. JPMorgan Chase & Co. upped their price target on shares of Ormat Technologies from $69.00 to $75.00 and gave the company a "neutral" rating in a research report on Tuesday, July 16th. Oppenheimer upped their price target on Ormat Technologies from $85.00 to $86.00 and gave the company an "outperform" rating in a research report on Thursday, August 8th. Finally, Roth Mkm reissued a "buy" rating and issued a $80.00 price target on shares of Ormat Technologies in a research note on Monday, August 12th. Three investment analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $81.67.

Get Our Latest Stock Analysis on ORA

Ormat Technologies Company Profile

(

Get Free Report)

Ormat Technologies, Inc engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, and internationally. It operates in three segments: Electricity, Product, and Energy Storage. The Electricity segment develops, builds, owns, and operates geothermal, solar photovoltaic, and recovered energy-based power plants; and sells electricity.

Read More

Before you consider Ormat Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ormat Technologies wasn't on the list.

While Ormat Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.