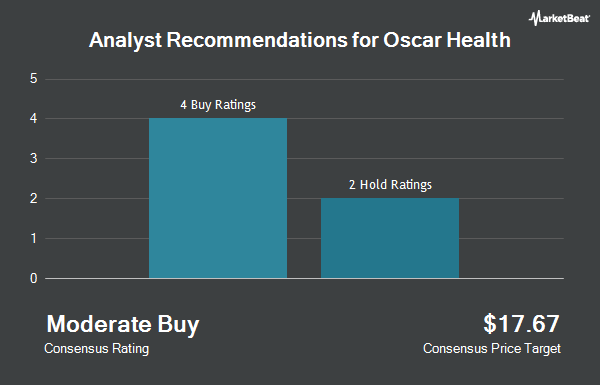

Oscar Health, Inc. (NYSE:OSCR - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the eight brokerages that are presently covering the company, MarketBeat Ratings reports. Three analysts have rated the stock with a hold rating, four have issued a buy rating and one has issued a strong buy rating on the company. The average twelve-month target price among analysts that have updated their coverage on the stock in the last year is $24.00.

A number of equities analysts have commented on the stock. Piper Sandler restated an "overweight" rating and issued a $28.00 target price on shares of Oscar Health in a research note on Tuesday, September 10th. UBS Group assumed coverage on shares of Oscar Health in a research note on Monday, October 7th. They issued a "neutral" rating and a $23.00 target price on the stock.

View Our Latest Stock Analysis on OSCR

Insider Transactions at Oscar Health

In related news, EVP Alessandrea C. Quane sold 16,793 shares of the stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $17.06, for a total transaction of $286,488.58. Following the completion of the sale, the executive vice president now owns 392,607 shares of the company's stock, valued at $6,697,875.42. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In other Oscar Health news, insider Mario Schlosser sold 3,198 shares of the firm's stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $17.99, for a total value of $57,532.02. Following the completion of the sale, the insider now directly owns 76,982 shares in the company, valued at $1,384,906.18. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP Alessandrea C. Quane sold 16,793 shares of the firm's stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $17.06, for a total transaction of $286,488.58. Following the completion of the sale, the executive vice president now owns 392,607 shares of the company's stock, valued at approximately $6,697,875.42. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 169,569 shares of company stock valued at $3,007,069. Company insiders own 25.11% of the company's stock.

Institutional Investors Weigh In On Oscar Health

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Wealth Enhancement Advisory Services LLC lifted its stake in shares of Oscar Health by 7.5% during the third quarter. Wealth Enhancement Advisory Services LLC now owns 12,028 shares of the company's stock worth $255,000 after buying an additional 844 shares during the period. American International Group Inc. raised its holdings in shares of Oscar Health by 1.3% during the first quarter. American International Group Inc. now owns 79,411 shares of the company's stock worth $1,181,000 after purchasing an additional 1,009 shares during the last quarter. Summit Trail Advisors LLC raised its holdings in shares of Oscar Health by 5.4% during the second quarter. Summit Trail Advisors LLC now owns 20,820 shares of the company's stock worth $329,000 after purchasing an additional 1,065 shares during the last quarter. Arizona State Retirement System raised its holdings in shares of Oscar Health by 3.7% during the second quarter. Arizona State Retirement System now owns 38,059 shares of the company's stock worth $602,000 after purchasing an additional 1,351 shares during the last quarter. Finally, Amalgamated Bank increased its holdings in Oscar Health by 27.7% in the second quarter. Amalgamated Bank now owns 6,727 shares of the company's stock valued at $106,000 after buying an additional 1,458 shares in the last quarter. 75.70% of the stock is currently owned by institutional investors and hedge funds.

Oscar Health Trading Up 3.8 %

NYSE:OSCR traded up $0.58 during mid-day trading on Tuesday, hitting $15.93. 2,472,037 shares of the stock traded hands, compared to its average volume of 3,203,904. The stock has a market capitalization of $3.85 billion, a price-to-earnings ratio of -118.07, a PEG ratio of 32.07 and a beta of 1.62. Oscar Health has a 52 week low of $4.72 and a 52 week high of $23.79. The firm's 50 day moving average is $18.76 and its two-hundred day moving average is $18.37. The company has a quick ratio of 0.91, a current ratio of 0.91 and a debt-to-equity ratio of 0.26.

Oscar Health (NYSE:OSCR - Get Free Report) last issued its quarterly earnings results on Wednesday, August 7th. The company reported $0.20 EPS for the quarter, beating the consensus estimate of $0.16 by $0.04. The company had revenue of $2.20 billion for the quarter, compared to the consensus estimate of $2.13 billion. Oscar Health had a net margin of 0.25% and a return on equity of 1.86%. The firm's revenue was up 44.6% compared to the same quarter last year. During the same period in the prior year, the firm posted ($0.07) EPS. On average, equities research analysts predict that Oscar Health will post 0.01 earnings per share for the current year.

Oscar Health Company Profile

(

Get Free ReportOscar Health, Inc operates as a health insurance in the United States. The company offers health plans in individual and small group markets, as well as +Oscar, a technology driven platform that help providers and payors directly enable their shift to value-based care. It also provides reinsurance products.

Read More

Before you consider Oscar Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oscar Health wasn't on the list.

While Oscar Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.