Wolfe Research cut shares of OUTFRONT Media (NYSE:OUT - Free Report) from an outperform rating to a peer perform rating in a research note issued to investors on Thursday morning, MarketBeat reports.

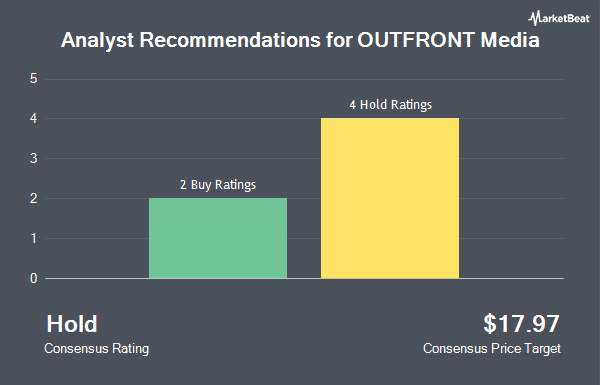

Several other research firms also recently issued reports on OUT. TD Cowen assumed coverage on OUTFRONT Media in a report on Tuesday, July 16th. They set a "hold" rating and a $16.00 price objective on the stock. Barrington Research boosted their price target on shares of OUTFRONT Media from $17.00 to $18.00 and gave the company an "outperform" rating in a report on Tuesday, August 13th. StockNews.com upgraded shares of OUTFRONT Media from a "hold" rating to a "buy" rating in a research report on Saturday, October 19th. JPMorgan Chase & Co. lifted their price objective on shares of OUTFRONT Media from $17.00 to $18.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 31st. Finally, Wells Fargo & Company started coverage on shares of OUTFRONT Media in a research note on Thursday, September 19th. They set an "overweight" rating and a $22.00 target price on the stock. Three investment analysts have rated the stock with a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat.com, OUTFRONT Media presently has a consensus rating of "Moderate Buy" and a consensus target price of $18.50.

Read Our Latest Stock Analysis on OUT

OUTFRONT Media Price Performance

OUTFRONT Media stock traded down $0.26 during mid-day trading on Thursday, hitting $18.58. The company's stock had a trading volume of 1,178,672 shares, compared to its average volume of 1,727,562. The stock has a market capitalization of $3.08 billion, a P/E ratio of -6.98, a P/E/G ratio of 1.20 and a beta of 1.94. OUTFRONT Media has a twelve month low of $9.39 and a twelve month high of $19.33. The stock's fifty day moving average price is $17.61 and its two-hundred day moving average price is $15.84. The company has a quick ratio of 0.67, a current ratio of 0.67 and a debt-to-equity ratio of 3.71.

OUTFRONT Media (NYSE:OUT - Get Free Report) last issued its earnings results on Tuesday, August 6th. The financial services provider reported $1.01 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.41 by $0.60. OUTFRONT Media had a return on equity of 37.83% and a net margin of 12.32%. The business had revenue of $477.30 million for the quarter, compared to analysts' expectations of $482.27 million. During the same period in the previous year, the firm posted $0.47 EPS. The company's quarterly revenue was up 1.8% on a year-over-year basis. Research analysts forecast that OUTFRONT Media will post 1.53 earnings per share for the current year.

OUTFRONT Media Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, September 27th. Investors of record on Friday, September 6th were given a dividend of $0.30 per share. This represents a $1.20 dividend on an annualized basis and a yield of 6.46%. The ex-dividend date was Friday, September 6th. OUTFRONT Media's payout ratio is presently -45.11%.

Institutional Investors Weigh In On OUTFRONT Media

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. DigitalBridge Group Inc. grew its holdings in shares of OUTFRONT Media by 11.7% during the 2nd quarter. DigitalBridge Group Inc. now owns 3,126,062 shares of the financial services provider's stock valued at $44,703,000 after acquiring an additional 327,125 shares in the last quarter. Lasalle Investment Management Securities LLC increased its position in OUTFRONT Media by 17.3% in the 1st quarter. Lasalle Investment Management Securities LLC now owns 2,842,935 shares of the financial services provider's stock worth $47,733,000 after purchasing an additional 419,706 shares during the last quarter. Sumitomo Mitsui Trust Holdings Inc. raised its stake in shares of OUTFRONT Media by 10.9% during the 2nd quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 2,137,548 shares of the financial services provider's stock worth $30,567,000 after purchasing an additional 210,208 shares in the last quarter. DAVENPORT & Co LLC raised its stake in shares of OUTFRONT Media by 145.8% during the 1st quarter. DAVENPORT & Co LLC now owns 1,720,884 shares of the financial services provider's stock worth $28,825,000 after purchasing an additional 1,020,719 shares in the last quarter. Finally, Land & Buildings Investment Management LLC acquired a new stake in shares of OUTFRONT Media during the 2nd quarter valued at about $22,724,000.

OUTFRONT Media Company Profile

(

Get Free Report)

OUTFRONT leverages the power of technology, location, and creativity to connect brands with consumers outside of their homes through one of the largest and most diverse sets of billboard, transit, and mobile assets in North America. Through its technology platform, OUTFRONT will fundamentally change the ways advertisers engage audiences on-the-go.

Further Reading

Before you consider OUTFRONT Media, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OUTFRONT Media wasn't on the list.

While OUTFRONT Media currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.