Semanteon Capital Management LP purchased a new position in shares of Ovintiv Inc. (NYSE:OVV - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 29,760 shares of the company's stock, valued at approximately $1,140,000.

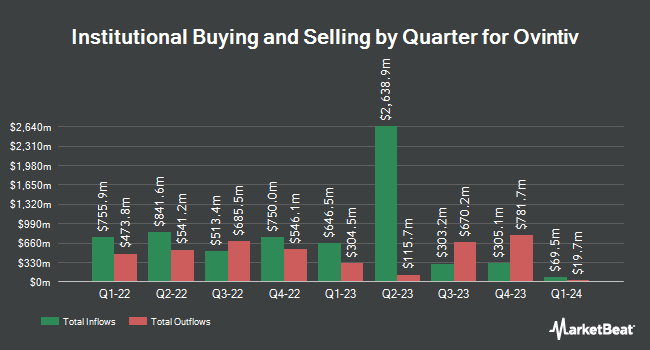

A number of other hedge funds and other institutional investors have also made changes to their positions in the stock. Vanguard Group Inc. increased its holdings in shares of Ovintiv by 3.8% in the 1st quarter. Vanguard Group Inc. now owns 28,055,344 shares of the company's stock valued at $1,456,072,000 after acquiring an additional 1,024,931 shares during the last quarter. Dimensional Fund Advisors LP boosted its holdings in Ovintiv by 3.8% in the second quarter. Dimensional Fund Advisors LP now owns 3,844,632 shares of the company's stock worth $180,194,000 after purchasing an additional 142,296 shares during the period. AQR Capital Management LLC increased its stake in Ovintiv by 114.9% during the second quarter. AQR Capital Management LLC now owns 3,027,292 shares of the company's stock valued at $141,889,000 after purchasing an additional 1,618,556 shares during the last quarter. Assenagon Asset Management S.A. lifted its holdings in Ovintiv by 7,422.1% in the third quarter. Assenagon Asset Management S.A. now owns 1,359,014 shares of the company's stock worth $52,064,000 after acquiring an additional 1,340,947 shares during the last quarter. Finally, Hsbc Holdings PLC grew its holdings in shares of Ovintiv by 6.2% during the second quarter. Hsbc Holdings PLC now owns 976,001 shares of the company's stock valued at $45,778,000 after purchasing an additional 57,182 shares during the last quarter. Institutional investors own 83.81% of the company's stock.

Analysts Set New Price Targets

OVV has been the subject of a number of analyst reports. Evercore ISI reduced their price objective on Ovintiv from $60.00 to $54.00 and set an "outperform" rating for the company in a research report on Monday, September 30th. JPMorgan Chase & Co. lowered their price target on shares of Ovintiv from $60.00 to $51.00 and set an "overweight" rating for the company in a research report on Thursday, September 12th. Morgan Stanley cut their price objective on shares of Ovintiv from $53.00 to $51.00 and set an "equal weight" rating on the stock in a research report on Monday, September 16th. UBS Group dropped their price target on shares of Ovintiv from $61.00 to $57.00 and set a "buy" rating on the stock in a research note on Wednesday, September 18th. Finally, Scotiabank lifted their price target on Ovintiv from $58.00 to $60.00 and gave the company a "sector outperform" rating in a report on Friday, July 12th. Five equities research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $57.00.

Get Our Latest Analysis on Ovintiv

Ovintiv Price Performance

OVV stock traded down $1.25 during trading hours on Monday, hitting $39.14. 2,821,690 shares of the stock traded hands, compared to its average volume of 3,086,073. The stock has a 50-day simple moving average of $41.03 and a 200 day simple moving average of $45.50. The company has a market cap of $10.32 billion, a P/E ratio of 5.52, a P/E/G ratio of 7.81 and a beta of 2.61. Ovintiv Inc. has a one year low of $36.90 and a one year high of $55.95. The company has a current ratio of 0.44, a quick ratio of 0.44 and a debt-to-equity ratio of 0.47.

Ovintiv (NYSE:OVV - Get Free Report) last posted its quarterly earnings data on Tuesday, July 30th. The company reported $1.24 earnings per share for the quarter, beating the consensus estimate of $1.22 by $0.02. Ovintiv had a net margin of 18.56% and a return on equity of 18.28%. The company had revenue of $2.29 billion during the quarter, compared to analyst estimates of $2.53 billion. Equities analysts forecast that Ovintiv Inc. will post 4.83 earnings per share for the current year.

Ovintiv Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Friday, September 13th were issued a $0.30 dividend. The ex-dividend date was Friday, September 13th. This represents a $1.20 annualized dividend and a dividend yield of 3.07%. Ovintiv's dividend payout ratio is currently 16.93%.

About Ovintiv

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

Recommended Stories

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.