Ceredex Value Advisors LLC lowered its position in shares of Ovintiv Inc. (NYSE:OVV - Free Report) by 99.9% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 950 shares of the company's stock after selling 716,550 shares during the quarter. Ceredex Value Advisors LLC's holdings in Ovintiv were worth $36,000 as of its most recent SEC filing.

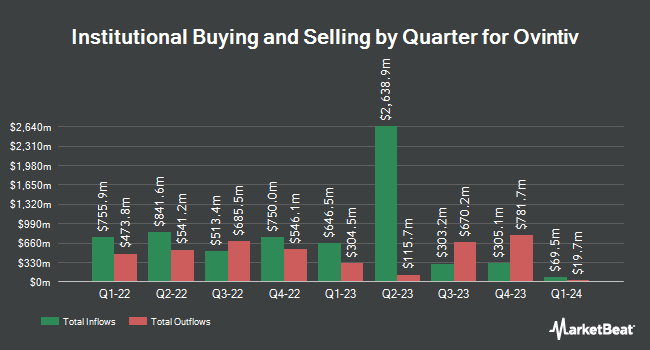

Several other hedge funds have also recently made changes to their positions in the business. AustralianSuper Pty Ltd acquired a new position in shares of Ovintiv during the 3rd quarter valued at $6,375,000. US Bancorp DE increased its stake in Ovintiv by 13.9% in the third quarter. US Bancorp DE now owns 9,890 shares of the company's stock valued at $379,000 after purchasing an additional 1,209 shares in the last quarter. New York State Teachers Retirement System raised its holdings in shares of Ovintiv by 0.7% during the third quarter. New York State Teachers Retirement System now owns 233,819 shares of the company's stock valued at $8,958,000 after purchasing an additional 1,620 shares during the period. Abich Financial Wealth Management LLC bought a new position in shares of Ovintiv during the 3rd quarter worth about $122,000. Finally, Pallas Capital Advisors LLC acquired a new stake in shares of Ovintiv in the 3rd quarter valued at about $237,000. 83.81% of the stock is owned by institutional investors.

Ovintiv Stock Performance

Shares of OVV traded down $0.24 during mid-day trading on Friday, hitting $38.96. The stock had a trading volume of 2,066,902 shares, compared to its average volume of 2,300,671. The firm has a market cap of $10.27 billion, a P/E ratio of 5.50, a PEG ratio of 7.46 and a beta of 2.62. The business has a fifty day moving average price of $40.73 and a 200-day moving average price of $45.12. The company has a debt-to-equity ratio of 0.47, a current ratio of 0.44 and a quick ratio of 0.44. Ovintiv Inc. has a 52 week low of $36.90 and a 52 week high of $55.95.

Wall Street Analysts Forecast Growth

OVV has been the subject of a number of research reports. Wolfe Research began coverage on Ovintiv in a research note on Thursday, July 18th. They issued an "outperform" rating and a $65.00 price objective for the company. UBS Group reduced their price target on shares of Ovintiv from $61.00 to $57.00 and set a "buy" rating for the company in a research report on Wednesday, September 18th. Mizuho lowered their price objective on shares of Ovintiv from $60.00 to $58.00 and set an "outperform" rating on the stock in a report on Wednesday, October 9th. Siebert Williams Shank upgraded shares of Ovintiv to a "strong-buy" rating in a report on Tuesday, October 15th. Finally, Citigroup lowered their target price on shares of Ovintiv from $58.00 to $55.00 and set a "buy" rating on the stock in a report on Monday, October 7th. Five research analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $57.00.

Read Our Latest Stock Analysis on OVV

Ovintiv Company Profile

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

Further Reading

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.