New York State Common Retirement Fund lessened its holdings in shares of Paycom Software, Inc. (NYSE:PAYC - Free Report) by 24.7% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 172,887 shares of the software maker's stock after selling 56,622 shares during the quarter. New York State Common Retirement Fund owned approximately 0.30% of Paycom Software worth $28,798,000 at the end of the most recent quarter.

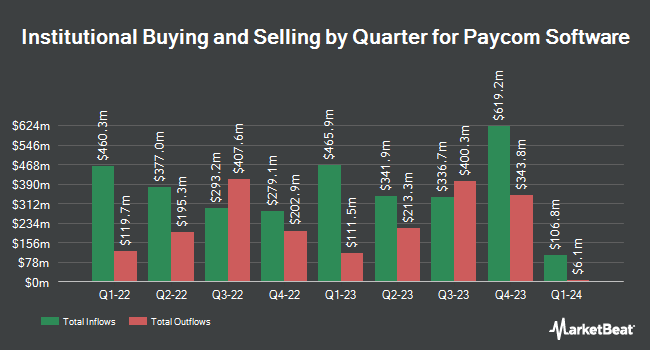

Several other hedge funds and other institutional investors have also recently modified their holdings of PAYC. Van ECK Associates Corp raised its position in Paycom Software by 6.9% in the first quarter. Van ECK Associates Corp now owns 9,035 shares of the software maker's stock valued at $1,798,000 after purchasing an additional 581 shares during the period. Norden Group LLC boosted its position in Paycom Software by 13.6% in the 1st quarter. Norden Group LLC now owns 3,220 shares of the software maker's stock valued at $641,000 after buying an additional 385 shares during the period. Private Advisor Group LLC grew its stake in shares of Paycom Software by 10.9% in the first quarter. Private Advisor Group LLC now owns 2,796 shares of the software maker's stock worth $556,000 after acquiring an additional 274 shares in the last quarter. Diversify Advisory Services LLC purchased a new stake in shares of Paycom Software during the first quarter worth $256,000. Finally, Janney Montgomery Scott LLC boosted its holdings in Paycom Software by 17.7% in the first quarter. Janney Montgomery Scott LLC now owns 59,242 shares of the software maker's stock valued at $11,790,000 after purchasing an additional 8,927 shares during the period. 87.77% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several brokerages have recently issued reports on PAYC. TD Cowen upped their target price on shares of Paycom Software from $171.00 to $188.00 and gave the company a "hold" rating in a report on Monday, September 23rd. Needham & Company LLC reissued a "hold" rating on shares of Paycom Software in a research report on Thursday, August 1st. StockNews.com downgraded Paycom Software from a "buy" rating to a "hold" rating in a report on Monday, July 15th. BMO Capital Markets upped their price target on shares of Paycom Software from $183.00 to $197.00 and gave the company a "market perform" rating in a research report on Thursday. Finally, Barclays lifted their price objective on shares of Paycom Software from $172.00 to $181.00 and gave the company an "equal weight" rating in a research note on Thursday. Twelve research analysts have rated the stock with a hold rating and one has given a buy rating to the stock. Based on data from MarketBeat, Paycom Software currently has an average rating of "Hold" and an average price target of $193.67.

Read Our Latest Analysis on Paycom Software

Paycom Software Trading Up 0.4 %

NYSE:PAYC traded up $0.81 during trading hours on Monday, hitting $211.46. The stock had a trading volume of 810,754 shares, compared to its average volume of 818,635. The company has a market cap of $12.14 billion, a PE ratio of 25.51, a price-to-earnings-growth ratio of 2.97 and a beta of 1.13. The business has a 50 day simple moving average of $167.57 and a two-hundred day simple moving average of $163.00. Paycom Software, Inc. has a 1-year low of $139.50 and a 1-year high of $222.30.

Paycom Software Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 9th. Investors of record on Monday, November 25th will be issued a $0.375 dividend. This represents a $1.50 annualized dividend and a dividend yield of 0.71%. The ex-dividend date of this dividend is Monday, November 25th. Paycom Software's dividend payout ratio (DPR) is 18.05%.

Insider Activity at Paycom Software

In other Paycom Software news, insider Bradley Scott Smith sold 1,524 shares of the company's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $157.62, for a total value of $240,212.88. Following the completion of the transaction, the insider now owns 14,769 shares in the company, valued at approximately $2,327,889.78. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In related news, insider Bradley Scott Smith sold 1,524 shares of the company's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $157.62, for a total value of $240,212.88. Following the completion of the sale, the insider now owns 14,769 shares of the company's stock, valued at $2,327,889.78. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CEO Chad R. Richison sold 1,950 shares of the business's stock in a transaction dated Friday, November 1st. The stock was sold at an average price of $209.62, for a total transaction of $408,759.00. Following the sale, the chief executive officer now owns 2,747,010 shares in the company, valued at $575,828,236.20. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 71,906 shares of company stock worth $11,827,441 in the last 90 days. 14.50% of the stock is currently owned by company insiders.

About Paycom Software

(

Free Report)

Paycom Software, Inc provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States. It offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.

Featured Stories

Before you consider Paycom Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycom Software wasn't on the list.

While Paycom Software currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.