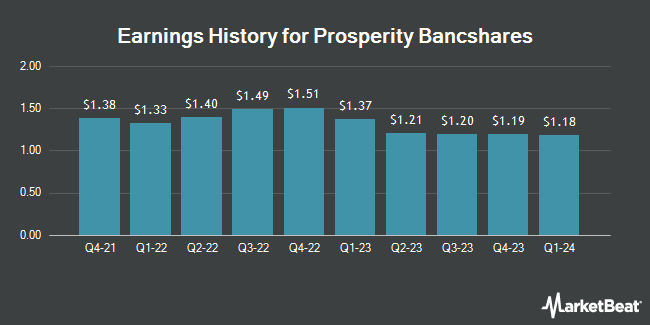

Prosperity Bancshares (NYSE:PB - Get Free Report) issued its quarterly earnings results on Wednesday. The bank reported $1.34 EPS for the quarter, beating analysts' consensus estimates of $1.31 by $0.03, Briefing.com reports. Prosperity Bancshares had a return on equity of 6.32% and a net margin of 25.10%. During the same period last year, the business earned $1.20 EPS.

Prosperity Bancshares Trading Up 0.3 %

PB stock traded up $0.21 during mid-day trading on Thursday, hitting $73.53. 801,758 shares of the company were exchanged, compared to its average volume of 572,442. Prosperity Bancshares has a 1-year low of $49.82 and a 1-year high of $75.28. The business has a 50 day simple moving average of $72.19 and a 200-day simple moving average of $66.58. The stock has a market capitalization of $7.00 billion, a PE ratio of 16.09, a price-to-earnings-growth ratio of 1.52 and a beta of 0.89.

Prosperity Bancshares Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, December 13th will be issued a $0.58 dividend. This is a boost from Prosperity Bancshares's previous quarterly dividend of $0.56. This represents a $2.32 annualized dividend and a yield of 3.16%. The ex-dividend date of this dividend is Friday, December 13th. Prosperity Bancshares's dividend payout ratio is currently 49.02%.

Wall Street Analysts Forecast Growth

Several equities analysts have recently weighed in on PB shares. Morgan Stanley raised shares of Prosperity Bancshares from an "equal weight" rating to an "overweight" rating and raised their price target for the stock from $75.00 to $86.00 in a research note on Monday, August 5th. Wedbush reiterated an "outperform" rating and issued a $90.00 price target on shares of Prosperity Bancshares in a research note on Thursday. Royal Bank of Canada restated a "sector perform" rating and issued a $77.00 price objective on shares of Prosperity Bancshares in a report on Thursday. Compass Point lifted their target price on Prosperity Bancshares from $73.00 to $80.00 and gave the company a "buy" rating in a research report on Friday, July 26th. Finally, Barclays increased their price target on Prosperity Bancshares from $75.00 to $76.00 and gave the company an "equal weight" rating in a research report on Thursday. One research analyst has rated the stock with a sell rating, four have issued a hold rating and nine have given a buy rating to the stock. According to data from MarketBeat.com, Prosperity Bancshares has an average rating of "Moderate Buy" and an average target price of $77.58.

Read Our Latest Research Report on PB

About Prosperity Bancshares

(

Get Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Featured Articles

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.