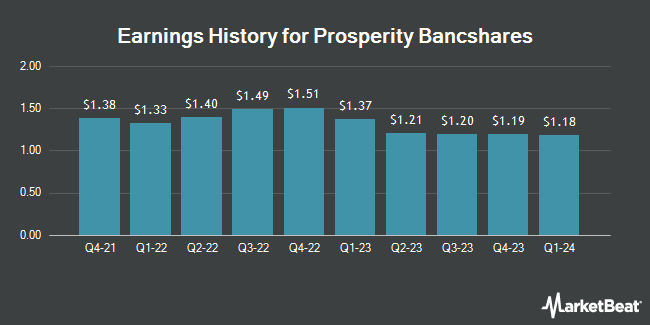

Prosperity Bancshares (NYSE:PB - Get Free Report) is scheduled to release its earnings data before the market opens on Wednesday, October 23rd. Analysts expect Prosperity Bancshares to post earnings of $1.30 per share for the quarter. Persons interested in participating in the company's earnings conference call can do so using this link.

Prosperity Bancshares (NYSE:PB - Get Free Report) last issued its quarterly earnings results on Wednesday, July 24th. The bank reported $1.22 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.20 by $0.02. The company had revenue of $458.95 million for the quarter, compared to the consensus estimate of $290.06 million. Prosperity Bancshares had a return on equity of 6.32% and a net margin of 25.10%. During the same quarter in the prior year, the business posted $1.21 earnings per share. On average, analysts expect Prosperity Bancshares to post $5 EPS for the current fiscal year and $6 EPS for the next fiscal year.

Prosperity Bancshares Stock Up 1.7 %

Shares of Prosperity Bancshares stock traded up $1.21 on Wednesday, reaching $74.14. The company's stock had a trading volume of 612,173 shares, compared to its average volume of 565,315. The company has a market capitalization of $7.11 billion, a P/E ratio of 17.11, a PEG ratio of 1.49 and a beta of 0.89. The stock has a 50-day moving average price of $71.71 and a 200-day moving average price of $66.14. Prosperity Bancshares has a 52-week low of $49.60 and a 52-week high of $74.91.

Analysts Set New Price Targets

Several research firms have issued reports on PB. Barclays increased their price objective on shares of Prosperity Bancshares from $70.00 to $75.00 and gave the company an "equal weight" rating in a report on Friday, September 27th. Morgan Stanley upgraded Prosperity Bancshares from an "equal weight" rating to an "overweight" rating and raised their target price for the company from $75.00 to $86.00 in a research report on Monday, August 5th. DA Davidson downgraded Prosperity Bancshares from a "buy" rating to a "neutral" rating and reduced their price objective for the company from $80.00 to $78.00 in a research note on Tuesday. Stephens raised shares of Prosperity Bancshares from an "equal weight" rating to an "overweight" rating in a research note on Wednesday, June 26th. Finally, StockNews.com cut shares of Prosperity Bancshares from a "hold" rating to a "sell" rating in a research report on Wednesday, August 28th. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating and nine have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $77.27.

View Our Latest Stock Report on PB

About Prosperity Bancshares

(

Get Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Recommended Stories

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.