Helen Stephens Group LLC purchased a new stake in Prosperity Bancshares, Inc. (NYSE:PB - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund purchased 31,000 shares of the bank's stock, valued at approximately $2,234,000. Prosperity Bancshares accounts for approximately 0.7% of Helen Stephens Group LLC's investment portfolio, making the stock its 23rd biggest position.

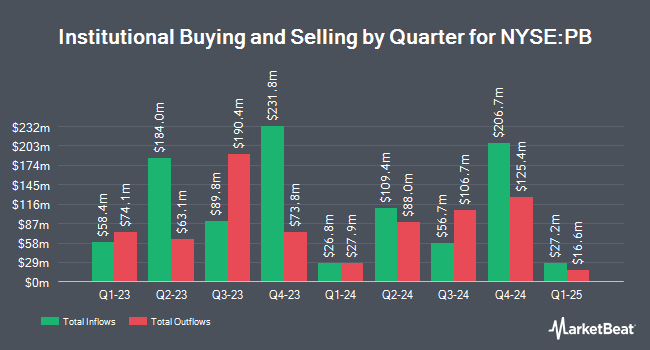

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Vanguard Group Inc. grew its position in shares of Prosperity Bancshares by 0.6% during the 4th quarter. Vanguard Group Inc. now owns 9,693,076 shares of the bank's stock worth $656,512,000 after purchasing an additional 53,844 shares in the last quarter. Victory Capital Management Inc. grew its position in Prosperity Bancshares by 3.0% during the second quarter. Victory Capital Management Inc. now owns 6,359,165 shares of the bank's stock worth $388,799,000 after buying an additional 184,453 shares in the last quarter. Dimensional Fund Advisors LP increased its stake in Prosperity Bancshares by 14.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,287,615 shares of the bank's stock worth $262,141,000 after acquiring an additional 532,241 shares during the period. Bank of New York Mellon Corp raised its holdings in Prosperity Bancshares by 2.1% in the 2nd quarter. Bank of New York Mellon Corp now owns 935,420 shares of the bank's stock valued at $57,192,000 after acquiring an additional 19,224 shares in the last quarter. Finally, Goldman Sachs Group Inc. lifted its position in shares of Prosperity Bancshares by 11.3% during the 4th quarter. Goldman Sachs Group Inc. now owns 884,734 shares of the bank's stock valued at $59,923,000 after acquiring an additional 89,617 shares during the period. 80.69% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on PB shares. Royal Bank of Canada boosted their target price on shares of Prosperity Bancshares from $70.00 to $74.00 and gave the company a "sector perform" rating in a research report on Thursday, July 25th. DA Davidson boosted their price objective on shares of Prosperity Bancshares from $78.00 to $82.00 and gave the company a "buy" rating in a research report on Thursday, July 25th. Stephens upgraded Prosperity Bancshares from an "equal weight" rating to an "overweight" rating in a research note on Wednesday, June 26th. Barclays lifted their price target on Prosperity Bancshares from $70.00 to $75.00 and gave the company an "equal weight" rating in a research note on Friday, September 27th. Finally, Hovde Group upped their price objective on Prosperity Bancshares from $80.50 to $82.50 and gave the stock an "outperform" rating in a research report on Monday, August 26th. One research analyst has rated the stock with a sell rating, three have issued a hold rating and ten have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $77.58.

Get Our Latest Research Report on PB

Prosperity Bancshares Stock Performance

Shares of NYSE:PB traded up $0.77 during midday trading on Wednesday, reaching $71.10. The company's stock had a trading volume of 462,744 shares, compared to its average volume of 567,397. Prosperity Bancshares, Inc. has a fifty-two week low of $49.60 and a fifty-two week high of $74.87. The firm has a 50 day moving average price of $71.56 and a two-hundred day moving average price of $65.87. The firm has a market capitalization of $6.77 billion, a price-to-earnings ratio of 16.32, a PEG ratio of 1.45 and a beta of 0.89.

Prosperity Bancshares (NYSE:PB - Get Free Report) last released its quarterly earnings data on Wednesday, July 24th. The bank reported $1.22 earnings per share for the quarter, beating the consensus estimate of $1.20 by $0.02. The company had revenue of $458.95 million during the quarter, compared to analyst estimates of $290.06 million. Prosperity Bancshares had a net margin of 25.10% and a return on equity of 6.32%. During the same quarter in the previous year, the business posted $1.21 EPS. As a group, research analysts anticipate that Prosperity Bancshares, Inc. will post 5.04 earnings per share for the current year.

Prosperity Bancshares Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, October 1st. Stockholders of record on Friday, September 13th were given a dividend of $0.56 per share. This represents a $2.24 dividend on an annualized basis and a dividend yield of 3.15%. The ex-dividend date was Friday, September 13th. Prosperity Bancshares's payout ratio is 51.61%.

About Prosperity Bancshares

(

Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Featured Articles

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.