Millennium Management LLC lessened its position in Prosperity Bancshares, Inc. (NYSE:PB - Free Report) by 90.0% in the 2nd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 115,085 shares of the bank's stock after selling 1,037,862 shares during the period. Millennium Management LLC owned approximately 0.12% of Prosperity Bancshares worth $7,036,000 as of its most recent filing with the SEC.

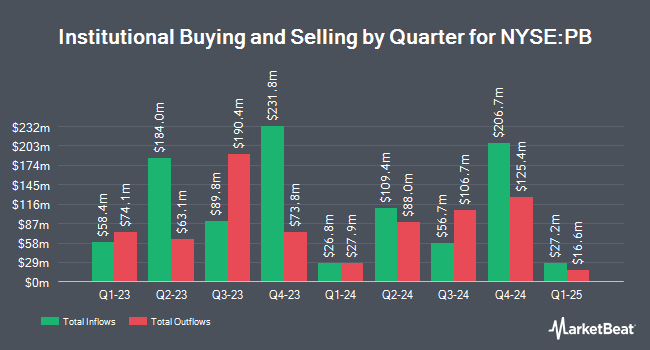

Several other large investors have also recently bought and sold shares of PB. Goldman Sachs Group Inc. boosted its holdings in Prosperity Bancshares by 11.3% during the fourth quarter. Goldman Sachs Group Inc. now owns 884,734 shares of the bank's stock worth $59,923,000 after purchasing an additional 89,617 shares during the last quarter. Kingsview Wealth Management LLC acquired a new stake in Prosperity Bancshares in the first quarter valued at $2,343,000. Amica Mutual Insurance Co. lifted its stake in Prosperity Bancshares by 41.9% in the second quarter. Amica Mutual Insurance Co. now owns 157,770 shares of the bank's stock valued at $9,646,000 after acquiring an additional 46,593 shares during the last quarter. Vaughan Nelson Investment Management L.P. lifted its stake in Prosperity Bancshares by 14.8% in the first quarter. Vaughan Nelson Investment Management L.P. now owns 784,910 shares of the bank's stock valued at $51,631,000 after acquiring an additional 101,230 shares during the last quarter. Finally, Harbor Capital Advisors Inc. lifted its stake in Prosperity Bancshares by 394.8% in the second quarter. Harbor Capital Advisors Inc. now owns 11,465 shares of the bank's stock valued at $701,000 after acquiring an additional 9,148 shares during the last quarter. Institutional investors own 80.69% of the company's stock.

Prosperity Bancshares Trading Down 0.4 %

NYSE:PB traded down $0.28 during mid-day trading on Thursday, hitting $70.81. 385,296 shares of the company's stock were exchanged, compared to its average volume of 566,468. The company has a 50 day simple moving average of $71.53 and a 200-day simple moving average of $65.91. Prosperity Bancshares, Inc. has a fifty-two week low of $49.60 and a fifty-two week high of $74.87. The firm has a market capitalization of $6.79 billion, a P/E ratio of 16.37, a PEG ratio of 1.45 and a beta of 0.89.

Prosperity Bancshares (NYSE:PB - Get Free Report) last issued its quarterly earnings results on Wednesday, July 24th. The bank reported $1.22 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.20 by $0.02. The firm had revenue of $458.95 million for the quarter, compared to the consensus estimate of $290.06 million. Prosperity Bancshares had a net margin of 25.10% and a return on equity of 6.32%. During the same quarter in the previous year, the company earned $1.21 EPS. As a group, analysts expect that Prosperity Bancshares, Inc. will post 5.04 earnings per share for the current year.

Prosperity Bancshares Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, October 1st. Shareholders of record on Friday, September 13th were paid a dividend of $0.56 per share. The ex-dividend date was Friday, September 13th. This represents a $2.24 dividend on an annualized basis and a yield of 3.16%. Prosperity Bancshares's dividend payout ratio (DPR) is presently 51.61%.

Wall Street Analyst Weigh In

A number of brokerages have commented on PB. StockNews.com cut shares of Prosperity Bancshares from a "hold" rating to a "sell" rating in a research note on Wednesday, August 28th. Barclays raised their price target on shares of Prosperity Bancshares from $70.00 to $75.00 and gave the stock an "equal weight" rating in a research report on Friday, September 27th. Stephens raised shares of Prosperity Bancshares from an "equal weight" rating to an "overweight" rating in a report on Wednesday, June 26th. Hovde Group raised their target price on shares of Prosperity Bancshares from $80.50 to $82.50 and gave the company an "outperform" rating in a report on Monday, August 26th. Finally, Compass Point raised their target price on shares of Prosperity Bancshares from $73.00 to $80.00 and gave the company a "buy" rating in a report on Friday, July 26th. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating and ten have issued a buy rating to the stock. According to data from MarketBeat, Prosperity Bancshares currently has a consensus rating of "Moderate Buy" and a consensus price target of $77.58.

View Our Latest Stock Analysis on Prosperity Bancshares

Prosperity Bancshares Company Profile

(

Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Read More

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.