Allspring Global Investments Holdings LLC lifted its stake in Prosperity Bancshares, Inc. (NYSE:PB - Free Report) by 21.8% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 272,331 shares of the bank's stock after purchasing an additional 48,719 shares during the quarter. Allspring Global Investments Holdings LLC owned about 0.29% of Prosperity Bancshares worth $19,627,000 at the end of the most recent reporting period.

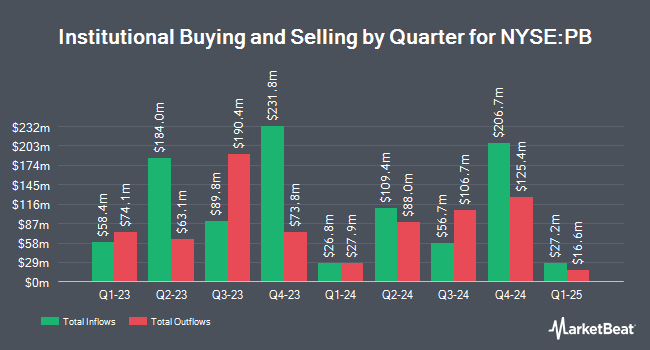

Several other hedge funds and other institutional investors have also recently made changes to their positions in the stock. Dimensional Fund Advisors LP boosted its holdings in Prosperity Bancshares by 14.2% in the 2nd quarter. Dimensional Fund Advisors LP now owns 4,287,615 shares of the bank's stock valued at $262,141,000 after purchasing an additional 532,241 shares during the last quarter. Victory Capital Management Inc. grew its position in Prosperity Bancshares by 3.0% in the second quarter. Victory Capital Management Inc. now owns 6,359,165 shares of the bank's stock worth $388,799,000 after acquiring an additional 184,453 shares during the period. Amarillo National Bank acquired a new stake in Prosperity Bancshares during the second quarter worth $8,520,000. Thrivent Financial for Lutherans raised its position in Prosperity Bancshares by 16.0% in the second quarter. Thrivent Financial for Lutherans now owns 811,772 shares of the bank's stock valued at $49,632,000 after purchasing an additional 112,101 shares during the period. Finally, Vaughan Nelson Investment Management L.P. lifted its stake in shares of Prosperity Bancshares by 14.8% in the 1st quarter. Vaughan Nelson Investment Management L.P. now owns 784,910 shares of the bank's stock valued at $51,631,000 after purchasing an additional 101,230 shares during the last quarter. Institutional investors and hedge funds own 80.69% of the company's stock.

Prosperity Bancshares Trading Down 1.7 %

NYSE:PB traded down $1.27 during mid-day trading on Friday, hitting $72.26. The stock had a trading volume of 516,557 shares, compared to its average volume of 572,250. Prosperity Bancshares, Inc. has a twelve month low of $52.49 and a twelve month high of $75.28. The stock has a 50-day simple moving average of $72.19 and a two-hundred day simple moving average of $66.58. The company has a market capitalization of $6.93 billion, a PE ratio of 16.58, a PEG ratio of 1.52 and a beta of 0.89.

Prosperity Bancshares (NYSE:PB - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The bank reported $1.34 EPS for the quarter, topping analysts' consensus estimates of $1.31 by $0.03. Prosperity Bancshares had a net margin of 25.10% and a return on equity of 6.32%. The firm had revenue of $459.00 million during the quarter, compared to the consensus estimate of $299.83 million. During the same quarter in the previous year, the firm posted $1.20 earnings per share. Sell-side analysts predict that Prosperity Bancshares, Inc. will post 5.03 EPS for the current fiscal year.

Prosperity Bancshares Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Stockholders of record on Friday, December 13th will be given a dividend of $0.58 per share. This represents a $2.32 annualized dividend and a dividend yield of 3.21%. The ex-dividend date of this dividend is Friday, December 13th. This is a positive change from Prosperity Bancshares's previous quarterly dividend of $0.56. Prosperity Bancshares's dividend payout ratio (DPR) is 53.46%.

Wall Street Analyst Weigh In

PB has been the topic of several research analyst reports. Royal Bank of Canada restated a "sector perform" rating and issued a $77.00 price objective on shares of Prosperity Bancshares in a report on Thursday. Wedbush restated an "outperform" rating and issued a $90.00 price objective on shares of Prosperity Bancshares in a report on Thursday. StockNews.com downgraded shares of Prosperity Bancshares from a "hold" rating to a "sell" rating in a report on Wednesday, August 28th. Compass Point boosted their target price on Prosperity Bancshares from $73.00 to $80.00 and gave the company a "buy" rating in a research report on Friday, July 26th. Finally, Hovde Group raised their price target on Prosperity Bancshares from $80.50 to $82.50 and gave the stock an "outperform" rating in a research report on Monday, August 26th. One research analyst has rated the stock with a sell rating, four have given a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $77.58.

Read Our Latest Stock Analysis on Prosperity Bancshares

About Prosperity Bancshares

(

Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

See Also

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.