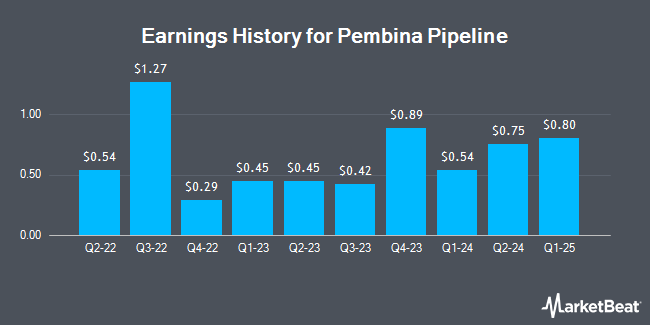

Pembina Pipeline (NYSE:PBA - Get Free Report) TSE: PPL will announce its earnings results after the market closes on Tuesday, November 5th. Analysts expect the company to announce earnings of $0.58 per share for the quarter. Investors that wish to register for the company's conference call can do so using this link.

Pembina Pipeline (NYSE:PBA - Get Free Report) TSE: PPL last announced its quarterly earnings data on Thursday, August 8th. The pipeline company reported $0.75 EPS for the quarter, beating the consensus estimate of $0.54 by $0.21. Pembina Pipeline had a net margin of 23.50% and a return on equity of 13.68%. The firm had revenue of $1.36 billion during the quarter, compared to analysts' expectations of $1.44 billion. During the same quarter last year, the business earned $0.45 earnings per share. The business's revenue for the quarter was up 30.5% compared to the same quarter last year. On average, analysts expect Pembina Pipeline to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Pembina Pipeline Price Performance

Shares of NYSE PBA traded down $0.28 during midday trading on Tuesday, hitting $41.85. The company had a trading volume of 740,335 shares, compared to its average volume of 1,124,144. The company has a quick ratio of 0.55, a current ratio of 0.68 and a debt-to-equity ratio of 0.77. Pembina Pipeline has a twelve month low of $30.41 and a twelve month high of $43.44. The business has a 50-day simple moving average of $41.36 and a two-hundred day simple moving average of $38.52. The firm has a market capitalization of $24.29 billion, a price-to-earnings ratio of 17.44, a price-to-earnings-growth ratio of 5.94 and a beta of 1.25.

Pembina Pipeline Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Monday, September 16th were given a dividend of $0.50 per share. The ex-dividend date of this dividend was Monday, September 16th. This represents a $2.00 dividend on an annualized basis and a yield of 4.78%. Pembina Pipeline's dividend payout ratio (DPR) is 85.00%.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on PBA. Raymond James began coverage on shares of Pembina Pipeline in a research report on Friday, October 11th. They set an "outperform" rating on the stock. UBS Group began coverage on shares of Pembina Pipeline in a research report on Wednesday, September 11th. They set a "neutral" rating on the stock. Finally, Citigroup lifted their price target on shares of Pembina Pipeline from $53.00 to $56.00 and gave the company a "neutral" rating in a research report on Wednesday, August 28th. Four analysts have rated the stock with a hold rating and one has issued a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $56.50.

Get Our Latest Stock Report on PBA

About Pembina Pipeline

(

Get Free Report)

Pembina Pipeline Corporation provides energy transportation and midstream services. It operates through three segments: Pipelines, Facilities, and Marketing & New Ventures. The Pipelines segment operates conventional, oil sands and heavy oil, and transmission assets with a transportation capacity of 2.9 millions of barrels of oil equivalent per day, the ground storage capacity of 10 millions of barrels, and rail terminalling capacity of approximately 105 thousands of barrels of oil equivalent per day serving markets and basins across North America.

Further Reading

Before you consider Pembina Pipeline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pembina Pipeline wasn't on the list.

While Pembina Pipeline currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.