First National Bank of Mount Dora Trust Investment Services lessened its stake in Public Service Enterprise Group Incorporated (NYSE:PEG - Free Report) by 16.1% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 86,783 shares of the utilities provider's stock after selling 16,636 shares during the quarter. Public Service Enterprise Group comprises about 1.8% of First National Bank of Mount Dora Trust Investment Services' holdings, making the stock its 16th largest holding. First National Bank of Mount Dora Trust Investment Services' holdings in Public Service Enterprise Group were worth $7,742,000 as of its most recent filing with the SEC.

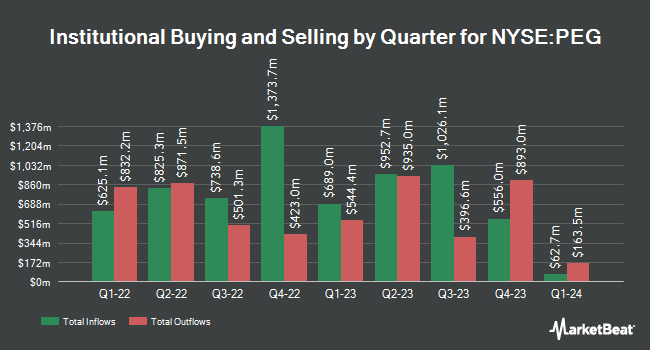

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Raymond James & Associates increased its stake in Public Service Enterprise Group by 30.1% during the third quarter. Raymond James & Associates now owns 2,869,113 shares of the utilities provider's stock worth $255,954,000 after acquiring an additional 663,012 shares during the last quarter. Hamlin Capital Management LLC increased its stake in Public Service Enterprise Group by 7.2% during the third quarter. Hamlin Capital Management LLC now owns 2,427,336 shares of the utilities provider's stock worth $216,543,000 after acquiring an additional 162,731 shares during the last quarter. Hsbc Holdings PLC boosted its position in shares of Public Service Enterprise Group by 43.2% during the second quarter. Hsbc Holdings PLC now owns 2,426,170 shares of the utilities provider's stock worth $178,763,000 after buying an additional 732,443 shares during the period. abrdn plc boosted its position in shares of Public Service Enterprise Group by 10.2% during the third quarter. abrdn plc now owns 1,792,186 shares of the utilities provider's stock worth $159,074,000 after buying an additional 165,995 shares during the period. Finally, Dimensional Fund Advisors LP boosted its holdings in Public Service Enterprise Group by 10.4% in the second quarter. Dimensional Fund Advisors LP now owns 1,734,257 shares of the utilities provider's stock valued at $127,809,000 after purchasing an additional 163,333 shares during the period. Institutional investors and hedge funds own 73.34% of the company's stock.

Public Service Enterprise Group Trading Down 6.2 %

PEG traded down $5.44 during mid-day trading on Monday, hitting $81.87. The stock had a trading volume of 5,437,857 shares, compared to its average volume of 2,792,866. Public Service Enterprise Group Incorporated has a 1-year low of $56.85 and a 1-year high of $92.20. The stock's fifty day simple moving average is $86.49 and its 200-day simple moving average is $78.86. The firm has a market capitalization of $40.78 billion, a price-to-earnings ratio of 24.81, a price-to-earnings-growth ratio of 2.94 and a beta of 0.61. The company has a debt-to-equity ratio of 1.16, a current ratio of 0.65 and a quick ratio of 0.46.

Insider Buying and Selling

In other news, EVP Tamara Louise Linde sold 9,564 shares of the stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $90.61, for a total value of $866,594.04. Following the completion of the sale, the executive vice president now owns 48,397 shares of the company's stock, valued at approximately $4,385,252.17. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. In other Public Service Enterprise Group news, EVP Tamara Louise Linde sold 9,564 shares of the stock in a transaction on Wednesday, October 9th. The stock was sold at an average price of $90.61, for a total transaction of $866,594.04. Following the transaction, the executive vice president now owns 48,397 shares in the company, valued at $4,385,252.17. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Ralph A. Larossa sold 1,378 shares of the stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $90.20, for a total value of $124,295.60. Following the transaction, the chief executive officer now owns 147,514 shares in the company, valued at $13,305,762.80. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 41,010 shares of company stock valued at $3,397,855. 0.57% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

A number of analysts have weighed in on PEG shares. Barclays raised their price target on Public Service Enterprise Group from $80.00 to $98.00 and gave the company an "overweight" rating in a research note on Monday, October 7th. Bank of America lifted their price objective on Public Service Enterprise Group from $84.00 to $88.00 and gave the company a "buy" rating in a report on Thursday, August 29th. Wells Fargo & Company lifted their price objective on Public Service Enterprise Group from $85.00 to $100.00 and gave the company an "overweight" rating in a report on Wednesday, October 16th. Evercore ISI upped their target price on Public Service Enterprise Group from $92.00 to $95.00 and gave the company an "outperform" rating in a research note on Tuesday, October 8th. Finally, LADENBURG THALM/SH SH upgraded Public Service Enterprise Group from a "hold" rating to a "strong-buy" rating in a report on Monday, August 5th. Four investment analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $87.46.

View Our Latest Stock Analysis on Public Service Enterprise Group

Public Service Enterprise Group Company Profile

(

Free Report)

Public Service Enterprise Group Incorporated, through its subsidiaries, operates in electric and gas utility business in the United States. It operates through PSE&G and PSEG Power segments. The PSE&G segment transmits electricity; distributes electricity and natural gas to residential, commercial, and industrial customers; and appliance services and repairs to customers through its service territory, as well as invests in solar generation projects, and energy efficiency and related programs.

Recommended Stories

Before you consider Public Service Enterprise Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Public Service Enterprise Group wasn't on the list.

While Public Service Enterprise Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.