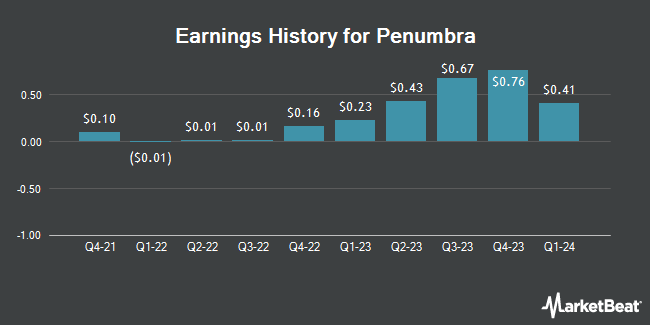

Penumbra (NYSE:PEN - Get Free Report) is set to release its earnings data after the market closes on Wednesday, October 30th. Analysts expect Penumbra to post earnings of $0.69 per share for the quarter. Penumbra has set its FY 2024 guidance at EPS.Persons interested in listening to the company's earnings conference call can do so using this link.

Penumbra (NYSE:PEN - Get Free Report) last released its earnings results on Tuesday, July 30th. The company reported $0.64 EPS for the quarter, topping the consensus estimate of $0.56 by $0.08. Penumbra had a return on equity of 8.39% and a net margin of 1.26%. The business had revenue of $299.40 million during the quarter, compared to analysts' expectations of $298.24 million. During the same quarter last year, the firm posted $0.43 earnings per share. The firm's revenue was up 14.5% on a year-over-year basis. On average, analysts expect Penumbra to post $3 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Penumbra Trading Down 0.9 %

NYSE PEN traded down $1.91 during trading hours on Wednesday, hitting $203.71. 233,880 shares of the company's stock were exchanged, compared to its average volume of 378,407. The stock has a 50-day simple moving average of $197.66 and a 200 day simple moving average of $193.92. Penumbra has a 1-year low of $148.00 and a 1-year high of $277.34. The firm has a market cap of $7.91 billion, a price-to-earnings ratio of 605.21, a PEG ratio of 2.39 and a beta of 0.54. The company has a current ratio of 6.25, a quick ratio of 3.77 and a debt-to-equity ratio of 0.02.

Penumbra announced that its board has approved a stock repurchase program on Tuesday, August 13th that allows the company to buyback $200.00 million in shares. This buyback authorization allows the company to reacquire up to 2.6% of its shares through open market purchases. Shares buyback programs are typically a sign that the company's board of directors believes its stock is undervalued.

Insider Activity

In related news, EVP Johanna Roberts sold 600 shares of Penumbra stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $206.22, for a total transaction of $123,732.00. Following the sale, the executive vice president now directly owns 61,088 shares in the company, valued at approximately $12,597,567.36. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. In related news, CEO Adam Elsesser sold 15,000 shares of the business's stock in a transaction dated Friday, September 20th. The stock was sold at an average price of $197.71, for a total transaction of $2,965,650.00. Following the completion of the transaction, the chief executive officer now directly owns 882,582 shares in the company, valued at $174,495,287.22. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, EVP Johanna Roberts sold 600 shares of the business's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $206.22, for a total value of $123,732.00. Following the transaction, the executive vice president now owns 61,088 shares of the company's stock, valued at approximately $12,597,567.36. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 19,368 shares of company stock worth $3,824,718 over the last 90 days. 5.00% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of brokerages have commented on PEN. Needham & Company LLC reissued a "hold" rating on shares of Penumbra in a research note on Wednesday, July 31st. Stifel Nicolaus began coverage on Penumbra in a research note on Tuesday, September 17th. They issued a "buy" rating and a $238.00 price objective for the company. Truist Financial raised their price objective on Penumbra from $200.00 to $235.00 and gave the company a "buy" rating in a research note on Monday, October 14th. Canaccord Genuity Group raised their price objective on Penumbra from $176.00 to $235.00 and gave the company a "buy" rating in a research note on Wednesday, October 16th. Finally, Piper Sandler reissued an "overweight" rating and issued a $225.00 price objective (up previously from $200.00) on shares of Penumbra in a research note on Friday, October 18th. Five analysts have rated the stock with a hold rating, eight have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, Penumbra has a consensus rating of "Moderate Buy" and a consensus target price of $220.17.

Get Our Latest Analysis on PEN

Penumbra Company Profile

(

Get Free Report)

Penumbra, Inc, together with its subsidiaries, designs, develops, manufactures, and markets medical devices in the United States and internationally. The company offers peripheral products, including the Indigo System for power aspiration of thrombus in the body; Lightning Flash, a mechanical thrombectomy system; Lightning Bolt 7, an arterial thrombectomy system; and CAT RX.

Read More

Before you consider Penumbra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penumbra wasn't on the list.

While Penumbra currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.