Penumbra (NYSE:PEN - Get Free Report)'s stock had its "hold" rating restated by investment analysts at Needham & Company LLC in a report issued on Friday, Benzinga reports.

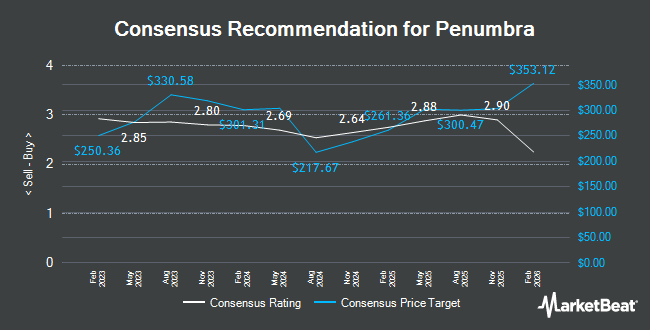

PEN has been the subject of a number of other reports. Stifel Nicolaus started coverage on Penumbra in a report on Tuesday, September 17th. They set a "buy" rating and a $238.00 price target for the company. Citigroup increased their price target on shares of Penumbra from $178.00 to $200.00 and gave the company a "neutral" rating in a report on Thursday, August 22nd. Royal Bank of Canada boosted their price objective on shares of Penumbra from $205.00 to $222.00 and gave the stock an "outperform" rating in a report on Tuesday, October 8th. Robert W. Baird cut their price objective on shares of Penumbra from $231.00 to $180.00 and set an "outperform" rating for the company in a research report on Wednesday, July 31st. Finally, Piper Sandler reissued an "overweight" rating and set a $225.00 target price (up from $200.00) on shares of Penumbra in a research report on Friday, October 18th. Five research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $220.17.

View Our Latest Analysis on PEN

Penumbra Stock Performance

NYSE:PEN traded down $1.84 during midday trading on Friday, reaching $204.71. The stock had a trading volume of 244,600 shares, compared to its average volume of 377,529. The stock has a market capitalization of $7.95 billion, a P/E ratio of 602.09, a PEG ratio of 2.35 and a beta of 0.54. Penumbra has a 1-year low of $148.00 and a 1-year high of $277.34. The company has a debt-to-equity ratio of 0.02, a current ratio of 6.25 and a quick ratio of 3.77. The firm's fifty day simple moving average is $198.41 and its 200-day simple moving average is $194.08.

Penumbra (NYSE:PEN - Get Free Report) last issued its quarterly earnings results on Tuesday, July 30th. The company reported $0.64 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.56 by $0.08. Penumbra had a return on equity of 8.39% and a net margin of 1.26%. The company had revenue of $299.40 million for the quarter, compared to the consensus estimate of $298.24 million. During the same period last year, the business posted $0.43 earnings per share. The firm's revenue was up 14.5% compared to the same quarter last year. On average, equities research analysts forecast that Penumbra will post 2.58 EPS for the current fiscal year.

Penumbra announced that its Board of Directors has initiated a share repurchase program on Tuesday, August 13th that permits the company to buyback $200.00 million in shares. This buyback authorization permits the company to buy up to 2.6% of its stock through open market purchases. Stock buyback programs are generally a sign that the company's leadership believes its stock is undervalued.

Insider Buying and Selling at Penumbra

In other Penumbra news, CEO Adam Elsesser sold 1,620 shares of the business's stock in a transaction dated Thursday, August 22nd. The shares were sold at an average price of $200.00, for a total value of $324,000.00. Following the completion of the transaction, the chief executive officer now directly owns 925,962 shares of the company's stock, valued at approximately $185,192,400. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. In related news, EVP Johanna Roberts sold 600 shares of Penumbra stock in a transaction dated Tuesday, August 13th. The stock was sold at an average price of $175.98, for a total value of $105,588.00. Following the completion of the sale, the executive vice president now directly owns 61,688 shares in the company, valued at $10,855,854.24. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Adam Elsesser sold 1,620 shares of the company's stock in a transaction dated Thursday, August 22nd. The shares were sold at an average price of $200.00, for a total transaction of $324,000.00. Following the transaction, the chief executive officer now owns 925,962 shares in the company, valued at approximately $185,192,400. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 34,368 shares of company stock worth $6,893,118. 5.00% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Penumbra

Several institutional investors have recently modified their holdings of the business. Vanguard Group Inc. grew its holdings in Penumbra by 0.9% during the 1st quarter. Vanguard Group Inc. now owns 3,690,660 shares of the company's stock worth $823,681,000 after acquiring an additional 32,557 shares during the period. First Hawaiian Bank acquired a new position in Penumbra in the second quarter valued at about $1,597,000. Jennison Associates LLC boosted its holdings in Penumbra by 192.1% during the first quarter. Jennison Associates LLC now owns 87,139 shares of the company's stock worth $19,448,000 after buying an additional 57,310 shares during the last quarter. Tidal Investments LLC grew its position in shares of Penumbra by 276.9% during the 1st quarter. Tidal Investments LLC now owns 4,971 shares of the company's stock worth $1,109,000 after buying an additional 3,652 shares during the period. Finally, Blair William & Co. IL increased its stake in shares of Penumbra by 24.3% in the 1st quarter. Blair William & Co. IL now owns 16,674 shares of the company's stock valued at $3,721,000 after acquiring an additional 3,257 shares during the last quarter. Institutional investors and hedge funds own 88.88% of the company's stock.

About Penumbra

(

Get Free Report)

Penumbra, Inc, together with its subsidiaries, designs, develops, manufactures, and markets medical devices in the United States and internationally. The company offers peripheral products, including the Indigo System for power aspiration of thrombus in the body; Lightning Flash, a mechanical thrombectomy system; Lightning Bolt 7, an arterial thrombectomy system; and CAT RX.

Further Reading

Before you consider Penumbra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penumbra wasn't on the list.

While Penumbra currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report