Principal Financial Group (NYSE:PFG - Get Free Report) had its target price raised by equities research analysts at Barclays from $75.00 to $77.00 in a research report issued on Friday, Benzinga reports. The firm presently has an "underweight" rating on the stock. Barclays's price target would suggest a potential downside of 8.02% from the company's current price.

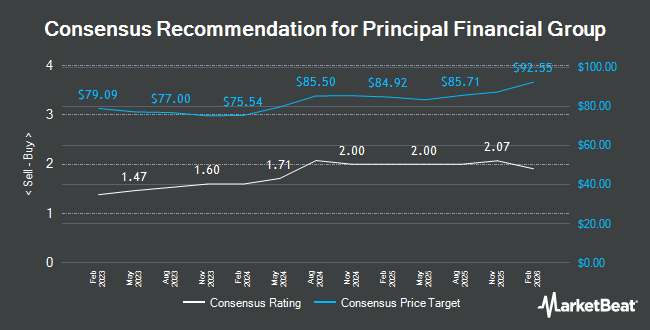

Other research analysts also recently issued research reports about the stock. Bank of America dropped their price objective on shares of Principal Financial Group from $94.00 to $91.00 and set a "neutral" rating on the stock in a report on Thursday, October 10th. Piper Sandler boosted their price objective on shares of Principal Financial Group from $85.00 to $90.00 and gave the stock a "neutral" rating in a report on Wednesday, October 2nd. Citigroup boosted their price objective on shares of Principal Financial Group from $68.00 to $70.00 and gave the stock a "sell" rating in a report on Tuesday, July 23rd. Wells Fargo & Company boosted their price objective on shares of Principal Financial Group from $85.00 to $86.00 and gave the stock an "equal weight" rating in a report on Thursday, October 10th. Finally, Morgan Stanley dropped their price objective on shares of Principal Financial Group from $85.00 to $83.00 and set an "equal weight" rating on the stock in a report on Monday, August 19th. Two equities research analysts have rated the stock with a sell rating, nine have issued a hold rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of $85.58.

Check Out Our Latest Report on Principal Financial Group

Principal Financial Group Stock Performance

PFG traded down $5.94 during trading on Friday, hitting $83.71. The stock had a trading volume of 4,194,593 shares, compared to its average volume of 1,131,609. The firm has a market cap of $19.62 billion, a PE ratio of 15.85, a P/E/G ratio of 0.95 and a beta of 1.19. Principal Financial Group has a 12 month low of $66.71 and a 12 month high of $91.97. The company has a current ratio of 0.29, a quick ratio of 0.29 and a debt-to-equity ratio of 0.36. The company has a 50 day simple moving average of $83.87 and a 200-day simple moving average of $81.73.

Principal Financial Group (NYSE:PFG - Get Free Report) last announced its earnings results on Thursday, July 25th. The company reported $1.63 EPS for the quarter, missing the consensus estimate of $1.87 by ($0.24). The firm had revenue of $4.31 billion during the quarter, compared to the consensus estimate of $3.78 billion. Principal Financial Group had a return on equity of 14.92% and a net margin of 8.05%. During the same quarter last year, the business earned $1.53 EPS. Analysts expect that Principal Financial Group will post 7.31 EPS for the current year.

Hedge Funds Weigh In On Principal Financial Group

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Pinnacle Associates Ltd. lifted its position in shares of Principal Financial Group by 11.4% during the third quarter. Pinnacle Associates Ltd. now owns 9,659 shares of the company's stock worth $760,000 after purchasing an additional 988 shares in the last quarter. First Trust Direct Indexing L.P. lifted its position in shares of Principal Financial Group by 2.5% during the third quarter. First Trust Direct Indexing L.P. now owns 6,479 shares of the company's stock worth $557,000 after purchasing an additional 159 shares in the last quarter. GW Henssler & Associates Ltd. lifted its position in shares of Principal Financial Group by 0.6% during the third quarter. GW Henssler & Associates Ltd. now owns 203,522 shares of the company's stock worth $17,483,000 after purchasing an additional 1,197 shares in the last quarter. Farmers & Merchants Investments Inc. lifted its position in shares of Principal Financial Group by 22.6% during the third quarter. Farmers & Merchants Investments Inc. now owns 4,530 shares of the company's stock worth $389,000 after purchasing an additional 834 shares in the last quarter. Finally, Hunter Associates Investment Management LLC acquired a new position in shares of Principal Financial Group during the third quarter worth approximately $207,000. 75.08% of the stock is currently owned by institutional investors and hedge funds.

About Principal Financial Group

(

Get Free Report)

Principal Financial Group, Inc provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide. The company operates through Retirement and Income Solutions, Principal Asset Management, and Benefits and Protection segments. The Retirement and Income Solutions segment provides retirement, and related financial products and services.

See Also

Before you consider Principal Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Principal Financial Group wasn't on the list.

While Principal Financial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.