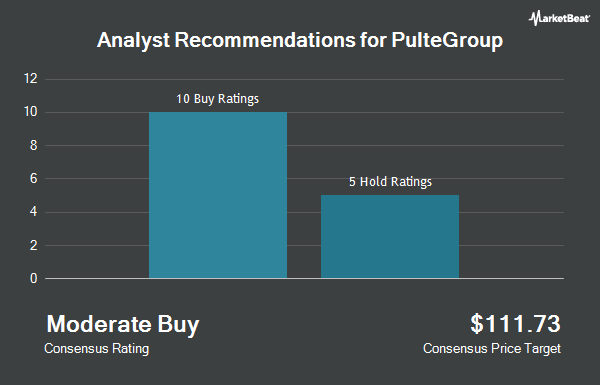

Shares of PulteGroup, Inc. (NYSE:PHM - Get Free Report) have been given an average recommendation of "Moderate Buy" by the sixteen analysts that are covering the company, MarketBeat.com reports. Six analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $145.00.

A number of equities research analysts have issued reports on PHM shares. Royal Bank of Canada lifted their target price on shares of PulteGroup from $113.00 to $120.00 and gave the company a "sector perform" rating in a research note on Wednesday, July 24th. Evercore ISI reduced their price objective on shares of PulteGroup from $198.00 to $195.00 and set an "outperform" rating for the company in a research note on Wednesday, October 23rd. BTIG Research lifted their price objective on shares of PulteGroup from $139.00 to $156.00 and gave the company a "buy" rating in a research note on Wednesday, October 23rd. Wolfe Research lowered shares of PulteGroup from an "outperform" rating to a "peer perform" rating in a research note on Wednesday, August 14th. Finally, Wells Fargo & Company lifted their price objective on shares of PulteGroup from $150.00 to $165.00 and gave the company an "overweight" rating in a research note on Monday, October 7th.

View Our Latest Research Report on PHM

Insider Buying and Selling

In related news, Director Thomas J. Folliard sold 19,000 shares of the firm's stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $131.14, for a total value of $2,491,660.00. Following the completion of the transaction, the director now directly owns 45,230 shares of the company's stock, valued at $5,931,462.20. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. In other PulteGroup news, CFO Robert Oshaughnessy sold 71,007 shares of PulteGroup stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $134.83, for a total transaction of $9,573,873.81. Following the completion of the transaction, the chief financial officer now directly owns 89,323 shares of the company's stock, valued at approximately $12,043,420.09. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Thomas J. Folliard sold 19,000 shares of PulteGroup stock in a transaction on Wednesday, August 28th. The shares were sold at an average price of $131.14, for a total value of $2,491,660.00. Following the transaction, the director now directly owns 45,230 shares of the company's stock, valued at approximately $5,931,462.20. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.75% of the stock is owned by company insiders.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently made changes to their positions in the stock. Ashton Thomas Private Wealth LLC raised its holdings in shares of PulteGroup by 3.0% in the third quarter. Ashton Thomas Private Wealth LLC now owns 3,054 shares of the construction company's stock valued at $438,000 after buying an additional 88 shares during the last quarter. Jupiter Wealth Management LLC raised its holdings in shares of PulteGroup by 6.1% in the third quarter. Jupiter Wealth Management LLC now owns 13,602 shares of the construction company's stock valued at $1,952,000 after buying an additional 780 shares during the last quarter. Tyler Stone Wealth Management raised its holdings in shares of PulteGroup by 115.6% in the third quarter. Tyler Stone Wealth Management now owns 11,534 shares of the construction company's stock valued at $1,655,000 after buying an additional 6,184 shares during the last quarter. Baker Avenue Asset Management LP bought a new position in shares of PulteGroup in the third quarter valued at about $413,000. Finally, Colonial River Investments LLC bought a new position in shares of PulteGroup in the third quarter valued at about $433,000. 89.90% of the stock is owned by institutional investors.

PulteGroup Stock Up 2.9 %

Shares of NYSE:PHM traded up $3.77 during trading on Tuesday, reaching $133.26. 1,536,040 shares of the company traded hands, compared to its average volume of 1,840,212. The firm has a fifty day simple moving average of $137.23 and a 200 day simple moving average of $124.24. The firm has a market cap of $27.33 billion, a P/E ratio of 9.55, a price-to-earnings-growth ratio of 0.52 and a beta of 1.63. PulteGroup has a 1-year low of $80.60 and a 1-year high of $149.47. The company has a quick ratio of 0.73, a current ratio of 0.73 and a debt-to-equity ratio of 0.14.

PulteGroup (NYSE:PHM - Get Free Report) last issued its earnings results on Tuesday, October 22nd. The construction company reported $3.35 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.10 by $0.25. The company had revenue of $4.48 billion during the quarter, compared to analyst estimates of $4.27 billion. PulteGroup had a net margin of 16.64% and a return on equity of 25.30%. The company's revenue for the quarter was up 11.8% on a year-over-year basis. During the same quarter last year, the business posted $2.90 EPS. Analysts anticipate that PulteGroup will post 12.92 earnings per share for the current fiscal year.

PulteGroup Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, October 2nd. Investors of record on Tuesday, September 17th were given a $0.20 dividend. The ex-dividend date of this dividend was Tuesday, September 17th. This represents a $0.80 annualized dividend and a yield of 0.60%. PulteGroup's dividend payout ratio (DPR) is currently 5.90%.

PulteGroup Company Profile

(

Get Free ReportPulteGroup, Inc, through its subsidiaries, primarily engages in the homebuilding business in the United States. It acquires and develops land primarily for residential purposes; and constructs housing on such land. The company also offers various home designs, including single-family detached, townhomes, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, John Wieland Homes and Neighborhoods, and American West brand names.

Featured Articles

Before you consider PulteGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PulteGroup wasn't on the list.

While PulteGroup currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.