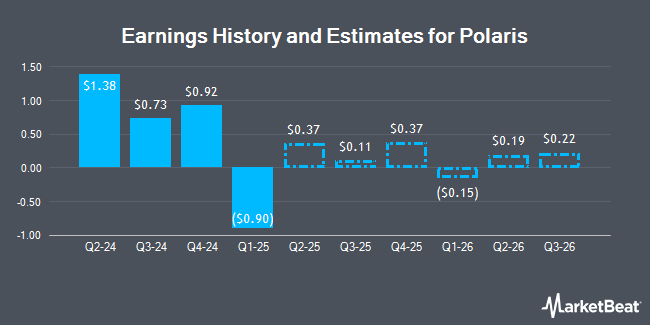

Polaris Inc. (NYSE:PII - Free Report) - Analysts at DA Davidson dropped their FY2024 earnings per share estimates for Polaris in a research note issued to investors on Thursday, October 24th. DA Davidson analyst B. Rolle now forecasts that the company will post earnings per share of $3.15 for the year, down from their prior estimate of $3.50. DA Davidson has a "Buy" rating and a $84.00 price objective on the stock. The consensus estimate for Polaris' current full-year earnings is $3.25 per share. DA Davidson also issued estimates for Polaris' Q4 2024 earnings at $0.81 EPS.

Polaris (NYSE:PII - Get Free Report) last announced its quarterly earnings data on Tuesday, October 22nd. The company reported $0.73 EPS for the quarter, missing the consensus estimate of $0.88 by ($0.15). The company had revenue of $1.72 billion during the quarter, compared to analysts' expectations of $1.77 billion. Polaris had a net margin of 2.64% and a return on equity of 17.92%. The business's revenue for the quarter was down 23.4% compared to the same quarter last year. During the same period in the previous year, the business earned $2.71 earnings per share.

A number of other analysts have also recently commented on PII. KeyCorp lowered their price target on Polaris from $90.00 to $80.00 and set an "overweight" rating for the company in a research report on Wednesday. Bank of America cut their price target on shares of Polaris from $86.00 to $85.00 and set a "neutral" rating on the stock in a report on Wednesday, July 24th. Royal Bank of Canada decreased their price objective on shares of Polaris from $82.00 to $73.00 and set a "sector perform" rating for the company in a research note on Wednesday. Longbow Research reiterated a "neutral" rating on shares of Polaris in a research note on Wednesday, July 24th. Finally, Roth Mkm reduced their target price on shares of Polaris from $92.00 to $79.00 and set a "neutral" rating for the company in a report on Wednesday, July 24th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $87.09.

Check Out Our Latest Report on PII

Polaris Stock Performance

Shares of PII traded up $0.48 during trading hours on Friday, reaching $71.23. 748,138 shares of the company traded hands, compared to its average volume of 731,897. The company has a quick ratio of 0.40, a current ratio of 1.21 and a debt-to-equity ratio of 1.28. The business has a fifty day moving average price of $81.58 and a 200-day moving average price of $81.78. Polaris has a 12-month low of $68.59 and a 12-month high of $100.91. The stock has a market capitalization of $3.97 billion, a P/E ratio of 19.90, a P/E/G ratio of 7.48 and a beta of 1.51.

Polaris Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be given a dividend of $0.66 per share. This represents a $2.64 dividend on an annualized basis and a yield of 3.71%. Polaris's dividend payout ratio is currently 73.74%.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the business. New England Capital Financial Advisors LLC purchased a new position in Polaris in the 1st quarter valued at about $25,000. Bessemer Group Inc. lifted its position in shares of Polaris by 174.1% in the first quarter. Bessemer Group Inc. now owns 370 shares of the company's stock valued at $37,000 after acquiring an additional 235 shares in the last quarter. Blue Trust Inc. boosted its stake in shares of Polaris by 2,431.3% in the third quarter. Blue Trust Inc. now owns 405 shares of the company's stock worth $32,000 after acquiring an additional 389 shares during the last quarter. Signaturefd LLC increased its position in shares of Polaris by 1,931.3% during the second quarter. Signaturefd LLC now owns 650 shares of the company's stock worth $51,000 after purchasing an additional 618 shares in the last quarter. Finally, Abich Financial Wealth Management LLC acquired a new position in Polaris in the 2nd quarter valued at $57,000. Hedge funds and other institutional investors own 88.06% of the company's stock.

Polaris Company Profile

(

Get Free Report)

Polaris Inc designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally. It operates through three segments: Off-Road, On-Road, and Marine. The company offers off-road vehicles (ORVs), including all-terrain vehicles and side-by-side vehicles; military and commercial ORVs; snowmobiles; motorcycles; and moto-roadsters, quadricycles, and boats.

Featured Articles

Before you consider Polaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Polaris wasn't on the list.

While Polaris currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.