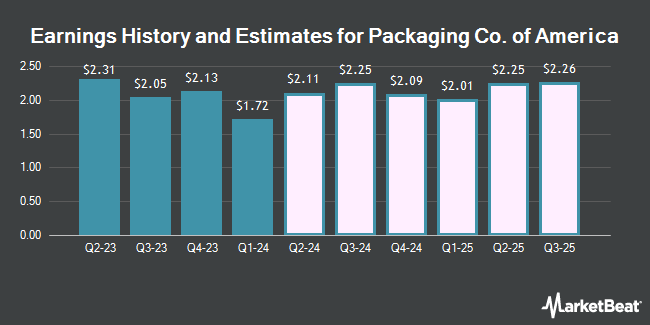

Packaging Co. of America (NYSE:PKG - Free Report) - Equities researchers at Seaport Res Ptn lifted their FY2024 earnings per share (EPS) estimates for shares of Packaging Co. of America in a research note issued on Wednesday, October 23rd. Seaport Res Ptn analyst M. Weintraub now forecasts that the industrial products company will post earnings per share of $9.10 for the year, up from their previous estimate of $8.85. The consensus estimate for Packaging Co. of America's current full-year earnings is $8.77 per share. Seaport Res Ptn also issued estimates for Packaging Co. of America's Q4 2024 earnings at $2.53 EPS and FY2025 earnings at $11.50 EPS.

Packaging Co. of America (NYSE:PKG - Get Free Report) last released its quarterly earnings results on Tuesday, October 22nd. The industrial products company reported $2.65 earnings per share for the quarter, beating the consensus estimate of $2.50 by $0.15. The business had revenue of $2.18 billion during the quarter, compared to analysts' expectations of $2.09 billion. Packaging Co. of America had a return on equity of 19.35% and a net margin of 9.46%. The firm's revenue for the quarter was up 14.9% compared to the same quarter last year. During the same quarter last year, the business posted $2.05 EPS.

Other equities research analysts also recently issued reports about the company. Wells Fargo & Company upped their price objective on Packaging Co. of America from $235.00 to $253.00 and gave the company an "overweight" rating in a research report on Thursday. StockNews.com upgraded Packaging Co. of America from a "hold" rating to a "buy" rating in a research report on Tuesday. Citigroup boosted their price objective on shares of Packaging Co. of America from $199.00 to $221.00 and gave the company a "neutral" rating in a research report on Wednesday, October 2nd. Finally, Truist Financial restated a "buy" rating and issued a $252.00 target price (up previously from $242.00) on shares of Packaging Co. of America in a report on Thursday. Three equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $221.60.

Read Our Latest Report on PKG

Packaging Co. of America Price Performance

Shares of NYSE PKG traded down $1.65 during mid-day trading on Friday, hitting $225.86. 451,765 shares of the company's stock traded hands, compared to its average volume of 598,833. The company has a debt-to-equity ratio of 0.60, a current ratio of 2.43 and a quick ratio of 1.71. Packaging Co. of America has a 1 year low of $148.50 and a 1 year high of $231.30. The company's 50-day moving average is $212.04 and its two-hundred day moving average is $194.18. The company has a market capitalization of $20.28 billion, a P/E ratio of 28.23, a PEG ratio of 4.24 and a beta of 0.77.

Hedge Funds Weigh In On Packaging Co. of America

A number of hedge funds have recently added to or reduced their stakes in the stock. Register Financial Advisors LLC bought a new stake in shares of Packaging Co. of America in the first quarter valued at about $25,000. Asset Dedication LLC raised its holdings in shares of Packaging Co. of America by 200.0% in the 2nd quarter. Asset Dedication LLC now owns 168 shares of the industrial products company's stock valued at $31,000 after purchasing an additional 112 shares in the last quarter. Central Pacific Bank Trust Division purchased a new stake in shares of Packaging Co. of America in the 3rd quarter worth approximately $32,000. Tortoise Investment Management LLC bought a new position in shares of Packaging Co. of America during the second quarter valued at approximately $33,000. Finally, Headlands Technologies LLC purchased a new position in Packaging Co. of America during the first quarter valued at approximately $43,000. 89.78% of the stock is currently owned by institutional investors.

Packaging Co. of America Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, September 16th. Stockholders of record on Tuesday, October 15th were paid a dividend of $1.25 per share. This represents a $5.00 dividend on an annualized basis and a dividend yield of 2.21%. The ex-dividend date was Monday, September 16th. Packaging Co. of America's dividend payout ratio is currently 62.50%.

Packaging Co. of America Company Profile

(

Get Free Report)

Packaging Corporation of America manufactures and sells containerboard and corrugated packaging products in the United States. The company operates through three segments: Packaging, Paper, and Corporate and Other. The Packaging segment offers various containerboard and corrugated packaging products, such as conventional shipping containers used to protect and transport manufactured goods; multi-color boxes and displays that help to merchandise the packaged product in retail locations; and honeycomb protective packaging products, as well as packaging for meat, fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products.

Featured Articles

Before you consider Packaging Co. of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Packaging Co. of America wasn't on the list.

While Packaging Co. of America currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.