Planet Fitness (NYSE:PLNT - Free Report) had its price objective lifted by Morgan Stanley from $84.00 to $89.00 in a research note issued to investors on Tuesday morning, Benzinga reports. They currently have an overweight rating on the stock.

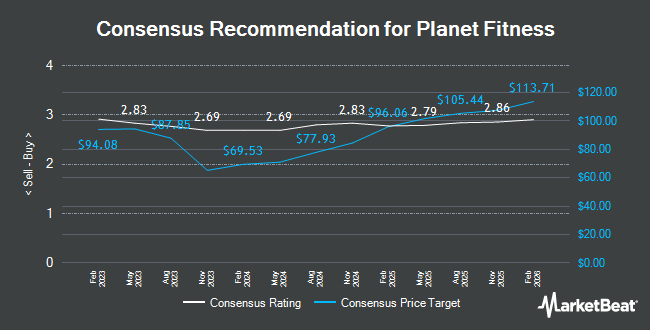

PLNT has been the subject of a number of other research reports. Deutsche Bank Aktiengesellschaft assumed coverage on shares of Planet Fitness in a research note on Friday, September 27th. They issued a "hold" rating and a $71.00 price objective for the company. BNP Paribas raised Planet Fitness from a "neutral" rating to an "outperform" rating and set a $97.00 price target on the stock in a research report on Thursday, September 5th. Bank of America upped their price target on Planet Fitness from $95.00 to $100.00 and gave the stock a "buy" rating in a research report on Friday, September 6th. Roth Mkm upped their price target on Planet Fitness from $73.00 to $88.00 and gave the stock a "buy" rating in a research report on Wednesday, August 7th. Finally, Piper Sandler upped their price target on Planet Fitness from $80.00 to $89.00 and gave the stock an "overweight" rating in a research report on Thursday, July 11th. Four investment analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $85.93.

View Our Latest Stock Report on Planet Fitness

Planet Fitness Trading Down 1.4 %

Shares of Planet Fitness stock traded down $1.11 on Tuesday, hitting $80.14. 838,906 shares of the company traded hands, compared to its average volume of 1,541,512. The stock's 50 day moving average price is $81.34 and its 200-day moving average price is $73.52. Planet Fitness has a 52 week low of $53.31 and a 52 week high of $85.08. The company has a market cap of $7.07 billion, a PE ratio of 45.81, a PEG ratio of 2.74 and a beta of 1.49.

Planet Fitness (NYSE:PLNT - Get Free Report) last posted its quarterly earnings results on Tuesday, August 6th. The company reported $0.71 earnings per share for the quarter, beating the consensus estimate of $0.66 by $0.05. Planet Fitness had a net margin of 14.16% and a negative return on equity of 121.99%. The firm had revenue of $300.94 million during the quarter, compared to the consensus estimate of $290.17 million. During the same quarter in the previous year, the firm posted $0.65 earnings per share. The company's revenue was up 5.1% on a year-over-year basis. As a group, research analysts anticipate that Planet Fitness will post 2.43 EPS for the current fiscal year.

Insider Buying and Selling

In related news, CAO Brian O'donnell sold 6,424 shares of Planet Fitness stock in a transaction dated Wednesday, August 7th. The stock was sold at an average price of $77.39, for a total value of $497,153.36. Following the sale, the chief accounting officer now directly owns 6,778 shares in the company, valued at approximately $524,549.42. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. 5.94% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Fidelis Capital Partners LLC purchased a new stake in shares of Planet Fitness during the 1st quarter valued at approximately $27,000. GAMMA Investing LLC raised its position in shares of Planet Fitness by 478.8% during the 2nd quarter. GAMMA Investing LLC now owns 382 shares of the company's stock valued at $28,000 after buying an additional 316 shares during the period. LRI Investments LLC raised its position in shares of Planet Fitness by 61.2% during the 2nd quarter. LRI Investments LLC now owns 403 shares of the company's stock valued at $30,000 after buying an additional 153 shares during the period. Quarry LP raised its position in shares of Planet Fitness by 174.7% during the 2nd quarter. Quarry LP now owns 500 shares of the company's stock valued at $37,000 after buying an additional 318 shares during the period. Finally, V Square Quantitative Management LLC raised its position in shares of Planet Fitness by 69.8% during the 3rd quarter. V Square Quantitative Management LLC now owns 489 shares of the company's stock valued at $40,000 after buying an additional 201 shares during the period. 95.53% of the stock is currently owned by institutional investors and hedge funds.

About Planet Fitness

(

Get Free Report)

Planet Fitness, Inc, together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand. The company operates through three segments: Franchise, Corporate-Owned Stores, and Equipment. The company is involved in franchising business in the United States, Puerto Rico, Canada, Panama, Mexico, and Australia.

See Also

Before you consider Planet Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Fitness wasn't on the list.

While Planet Fitness currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.