JFS Wealth Advisors LLC raised its holdings in The PNC Financial Services Group, Inc. (NYSE:PNC - Free Report) by 242.6% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 10,341 shares of the financial services provider's stock after buying an additional 7,323 shares during the quarter. JFS Wealth Advisors LLC's holdings in The PNC Financial Services Group were worth $1,912,000 at the end of the most recent quarter.

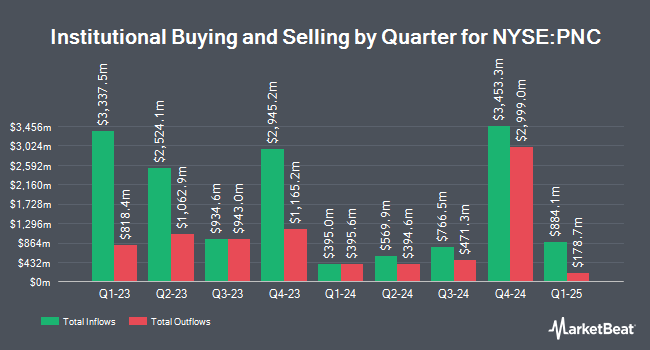

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in PNC. Sumitomo Mitsui Trust Holdings Inc. grew its holdings in The PNC Financial Services Group by 0.6% in the 1st quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 940,225 shares of the financial services provider's stock valued at $151,940,000 after buying an additional 5,785 shares during the last quarter. State of Alaska Department of Revenue grew its holdings in shares of The PNC Financial Services Group by 0.4% during the 1st quarter. State of Alaska Department of Revenue now owns 43,183 shares of the financial services provider's stock worth $6,978,000 after purchasing an additional 165 shares in the last quarter. Norden Group LLC grew its holdings in shares of The PNC Financial Services Group by 2,511.7% during the 1st quarter. Norden Group LLC now owns 44,999 shares of the financial services provider's stock worth $7,271,000 after purchasing an additional 43,276 shares in the last quarter. Advisor Resource Council acquired a new stake in shares of The PNC Financial Services Group during the 1st quarter worth approximately $236,000. Finally, First Trust Direct Indexing L.P. grew its holdings in shares of The PNC Financial Services Group by 11.1% during the 1st quarter. First Trust Direct Indexing L.P. now owns 11,057 shares of the financial services provider's stock worth $1,787,000 after purchasing an additional 1,102 shares in the last quarter. Institutional investors and hedge funds own 83.53% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently weighed in on the company. The Goldman Sachs Group decreased their price objective on The PNC Financial Services Group from $189.00 to $180.00 and set a "neutral" rating on the stock in a report on Wednesday, September 11th. Wells Fargo & Company lifted their price objective on The PNC Financial Services Group from $204.00 to $215.00 and gave the stock an "overweight" rating in a report on Wednesday, October 16th. Barclays lifted their price objective on The PNC Financial Services Group from $209.00 to $229.00 and gave the stock an "overweight" rating in a report on Wednesday, October 16th. Compass Point lowered The PNC Financial Services Group from a "strong-buy" rating to a "hold" rating in a report on Thursday, August 22nd. Finally, Citigroup boosted their price target on The PNC Financial Services Group from $175.00 to $200.00 and gave the company a "buy" rating in a research note on Wednesday, July 17th. Two investment analysts have rated the stock with a sell rating, seven have assigned a hold rating and nine have issued a buy rating to the company. Based on data from MarketBeat, The PNC Financial Services Group currently has an average rating of "Hold" and a consensus target price of $185.71.

Check Out Our Latest Stock Report on The PNC Financial Services Group

The PNC Financial Services Group Price Performance

PNC traded down $1.99 during trading on Thursday, hitting $188.23. The company's stock had a trading volume of 1,802,091 shares, compared to its average volume of 1,854,746. The firm's 50 day moving average price is $183.49 and its two-hundred day moving average price is $168.94. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 1.22. The PNC Financial Services Group, Inc. has a 12 month low of $112.36 and a 12 month high of $196.64. The stock has a market capitalization of $74.90 billion, a price-to-earnings ratio of 15.98, a price-to-earnings-growth ratio of 1.98 and a beta of 1.14.

The PNC Financial Services Group (NYSE:PNC - Get Free Report) last issued its quarterly earnings data on Tuesday, October 15th. The financial services provider reported $3.49 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.30 by $0.19. The PNC Financial Services Group had a return on equity of 10.88% and a net margin of 14.97%. The firm had revenue of $5.43 billion during the quarter, compared to the consensus estimate of $5.39 billion. During the same quarter in the previous year, the company posted $3.60 EPS. The business's revenue for the quarter was up 3.8% compared to the same quarter last year. Sell-side analysts forecast that The PNC Financial Services Group, Inc. will post 13.34 earnings per share for the current fiscal year.

The PNC Financial Services Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, November 5th. Stockholders of record on Wednesday, October 16th will be given a dividend of $1.60 per share. The ex-dividend date is Wednesday, October 16th. This represents a $6.40 dividend on an annualized basis and a dividend yield of 3.40%. The PNC Financial Services Group's payout ratio is currently 53.74%.

Insider Transactions at The PNC Financial Services Group

In other news, CEO William S. Demchak sold 1,242 shares of the business's stock in a transaction on Friday, October 25th. The stock was sold at an average price of $190.27, for a total transaction of $236,315.34. Following the completion of the sale, the chief executive officer now owns 544,765 shares in the company, valued at $103,652,436.55. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. In other news, Director Martin Pfinsgraff sold 859 shares of the business's stock in a transaction on Tuesday, October 22nd. The stock was sold at an average price of $186.12, for a total transaction of $159,877.08. Following the completion of the sale, the director now owns 915 shares in the company, valued at $170,299.80. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, CEO William S. Demchak sold 1,242 shares of the business's stock in a transaction on Friday, October 25th. The stock was sold at an average price of $190.27, for a total value of $236,315.34. Following the sale, the chief executive officer now owns 544,765 shares of the company's stock, valued at approximately $103,652,436.55. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 14,521 shares of company stock worth $2,634,475 over the last 90 days. 0.42% of the stock is owned by insiders.

The PNC Financial Services Group Profile

(

Free Report)

The PNC Financial Services Group, Inc operates as a diversified financial services company in the United States. It operates through three segments: Retail Banking, Corporate & Institutional Banking, and Asset Management Group segments. The company's Retail Banking segment offers checking, savings, and money market accounts, as well as time deposit; residential mortgages, home equity loans and lines of credit, auto loans, credit cards, education loans, and personal and small business loans and lines of credit; and brokerage, insurance, and investment and cash management services.

See Also

Before you consider The PNC Financial Services Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The PNC Financial Services Group wasn't on the list.

While The PNC Financial Services Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report