Portland General Electric (NYSE:POR - Free Report) - Stock analysts at KeyCorp reduced their FY2027 earnings per share estimates for shares of Portland General Electric in a research report issued on Monday, October 21st. KeyCorp analyst S. Karp now forecasts that the utilities provider will earn $3.55 per share for the year, down from their prior estimate of $3.57. KeyCorp currently has a "Overweight" rating on the stock. The consensus estimate for Portland General Electric's current full-year earnings is $3.09 per share. KeyCorp also issued estimates for Portland General Electric's FY2028 earnings at $3.65 EPS.

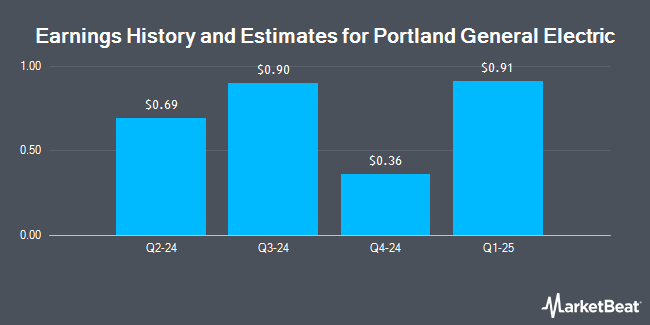

Portland General Electric (NYSE:POR - Get Free Report) last announced its quarterly earnings data on Friday, July 26th. The utilities provider reported $0.69 EPS for the quarter, topping analysts' consensus estimates of $0.62 by $0.07. The firm had revenue of $758.00 million during the quarter, compared to analyst estimates of $716.43 million. Portland General Electric had a return on equity of 9.15% and a net margin of 9.24%. The business's quarterly revenue was up 17.0% compared to the same quarter last year. During the same period last year, the company posted $0.44 EPS.

A number of other research analysts also recently commented on the company. JPMorgan Chase & Co. boosted their target price on Portland General Electric from $54.00 to $55.00 and gave the company an "overweight" rating in a research note on Wednesday. Jefferies Financial Group began coverage on Portland General Electric in a report on Friday, September 20th. They issued a "hold" rating and a $48.00 price objective on the stock. Bank of America began coverage on shares of Portland General Electric in a research note on Thursday, September 12th. They issued an "underperform" rating and a $47.00 target price for the company. Barclays lowered shares of Portland General Electric from an "overweight" rating to an "equal weight" rating and increased their price target for the stock from $48.00 to $49.00 in a research note on Wednesday, September 18th. Finally, StockNews.com raised shares of Portland General Electric from a "sell" rating to a "hold" rating in a research note on Tuesday, September 24th. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and five have assigned a buy rating to the company. According to MarketBeat, the company has an average rating of "Hold" and a consensus price target of $48.25.

View Our Latest Stock Analysis on Portland General Electric

Portland General Electric Stock Down 0.4 %

POR stock traded down $0.18 during midday trading on Thursday, reaching $48.82. The company had a trading volume of 1,011,234 shares, compared to its average volume of 947,934. The company has a 50 day moving average of $47.76 and a two-hundred day moving average of $45.37. The company has a current ratio of 1.00, a quick ratio of 0.86 and a debt-to-equity ratio of 1.33. Portland General Electric has a 1 year low of $39.13 and a 1 year high of $49.45. The company has a market capitalization of $5.03 billion, a P/E ratio of 16.78, a PEG ratio of 1.37 and a beta of 0.59.

Institutional Trading of Portland General Electric

Institutional investors have recently modified their holdings of the company. Vaughan Nelson Investment Management L.P. acquired a new stake in Portland General Electric during the second quarter worth $31,557,000. Marshall Wace LLP boosted its position in shares of Portland General Electric by 657.0% during the 2nd quarter. Marshall Wace LLP now owns 314,688 shares of the utilities provider's stock valued at $13,607,000 after acquiring an additional 273,118 shares in the last quarter. Vanguard Group Inc. increased its stake in Portland General Electric by 1.9% in the fourth quarter. Vanguard Group Inc. now owns 11,146,037 shares of the utilities provider's stock valued at $483,069,000 after acquiring an additional 212,981 shares during the period. Systematic Financial Management LP raised its position in Portland General Electric by 83.4% in the second quarter. Systematic Financial Management LP now owns 424,701 shares of the utilities provider's stock worth $18,364,000 after purchasing an additional 193,164 shares in the last quarter. Finally, Point72 Asset Management L.P. bought a new position in Portland General Electric during the second quarter worth about $7,459,000.

Insider Buying and Selling

In other Portland General Electric news, VP John Teeruk Kochavatr sold 1,100 shares of Portland General Electric stock in a transaction that occurred on Wednesday, August 7th. The stock was sold at an average price of $46.25, for a total value of $50,875.00. Following the transaction, the vice president now directly owns 22,606 shares of the company's stock, valued at $1,045,527.50. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In other Portland General Electric news, VP John Teeruk Kochavatr sold 1,100 shares of the firm's stock in a transaction on Wednesday, August 7th. The shares were sold at an average price of $46.25, for a total value of $50,875.00. Following the sale, the vice president now directly owns 22,606 shares in the company, valued at $1,045,527.50. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, SVP Maria Angelica Espinosa sold 2,500 shares of the company's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $48.30, for a total transaction of $120,750.00. Following the transaction, the senior vice president now directly owns 14,263 shares of the company's stock, valued at $688,902.90. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.54% of the stock is owned by insiders.

Portland General Electric Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 24th will be paid a $0.50 dividend. The ex-dividend date of this dividend is Tuesday, December 24th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 4.10%. Portland General Electric's payout ratio is presently 68.73%.

About Portland General Electric

(

Get Free Report)

Portland General Electric Company, an integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon. It operates six thermal plants, three wind farms, and seven hydroelectric facilities. As of December 31, 2023, the company owned an electric transmission system consisting of 1,254 circuit miles, including 287 circuit miles of 500 kilovolt line, 413 circuit miles of 230 kilovolt line, and 554 miles of 115 kilovolt line; and served 934 thousand retail customers in 51 cities.

Featured Stories

Before you consider Portland General Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Portland General Electric wasn't on the list.

While Portland General Electric currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.