Iridian Asset Management LLC CT reduced its position in shares of Post Holdings, Inc. (NYSE:POST - Free Report) by 19.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 171,188 shares of the company's stock after selling 41,569 shares during the period. Post makes up about 4.2% of Iridian Asset Management LLC CT's portfolio, making the stock its 7th biggest holding. Iridian Asset Management LLC CT owned approximately 0.29% of Post worth $19,815,000 at the end of the most recent reporting period.

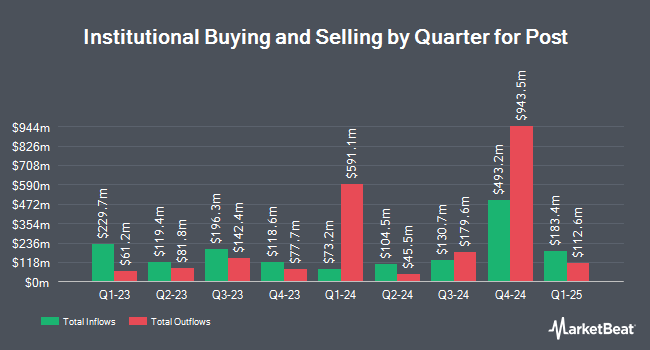

Several other institutional investors have also added to or reduced their stakes in the company. Opal Wealth Advisors LLC bought a new position in shares of Post during the second quarter worth approximately $27,000. V Square Quantitative Management LLC bought a new position in Post during the 3rd quarter worth $27,000. New Covenant Trust Company N.A. acquired a new position in Post in the 1st quarter valued at $29,000. Bessemer Group Inc. grew its holdings in shares of Post by 263.8% during the 1st quarter. Bessemer Group Inc. now owns 342 shares of the company's stock worth $36,000 after purchasing an additional 248 shares in the last quarter. Finally, Point72 Asia Singapore Pte. Ltd. acquired a new position in Post in the second quarter valued at about $62,000. 94.85% of the stock is currently owned by institutional investors.

Insider Transactions at Post

In other news, Director Thomas C. Erb acquired 2,000 shares of the firm's stock in a transaction dated Tuesday, August 13th. The stock was bought at an average cost of $112.94 per share, for a total transaction of $225,880.00. Following the completion of the transaction, the director now directly owns 35,475 shares in the company, valued at $4,006,546.50. This represents a 0.00 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. 10.70% of the stock is owned by corporate insiders.

Post Trading Down 0.2 %

NYSE POST traded down $0.22 during trading hours on Thursday, reaching $109.21. The company's stock had a trading volume of 417,210 shares, compared to its average volume of 516,122. Post Holdings, Inc. has a 52 week low of $79.78 and a 52 week high of $118.96. The company has a debt-to-equity ratio of 1.62, a current ratio of 2.05 and a quick ratio of 1.12. The stock has a market cap of $6.38 billion, a P/E ratio of 20.37 and a beta of 0.63. The firm has a fifty day simple moving average of $114.65 and a 200-day simple moving average of $109.33.

Post (NYSE:POST - Get Free Report) last issued its quarterly earnings data on Thursday, August 1st. The company reported $1.54 earnings per share for the quarter, topping the consensus estimate of $1.21 by $0.33. Post had a net margin of 4.46% and a return on equity of 10.91%. The company had revenue of $1.95 billion for the quarter, compared to analysts' expectations of $2.02 billion. During the same quarter in the previous year, the firm posted $1.52 earnings per share. Post's revenue for the quarter was up 4.7% on a year-over-year basis. Equities analysts forecast that Post Holdings, Inc. will post 5.95 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

POST has been the subject of a number of recent analyst reports. Evercore ISI upped their price target on shares of Post from $122.00 to $123.00 and gave the stock an "outperform" rating in a report on Monday, August 5th. Wells Fargo & Company raised their price objective on Post from $108.00 to $120.00 and gave the company an "equal weight" rating in a research note on Monday, August 5th. Stifel Nicolaus increased their target price on shares of Post from $120.00 to $130.00 and gave the stock a "buy" rating in a report on Monday, August 5th. Finally, JPMorgan Chase & Co. lifted their price target on shares of Post from $118.00 to $125.00 and gave the company an "overweight" rating in a report on Tuesday, August 6th. One analyst has rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $124.33.

Get Our Latest Analysis on Post

Post Company Profile

(

Free Report)

Post Holdings, Inc operates as a consumer packaged goods holding company in the United States and internationally. It operates through four segments: Post Consumer Brands, Weetabix, Foodservice, and Refrigerated Retail. The Post Consumer Brands segment manufactures, markets, and sells branded and private label ready-to-eat (RTE) cereals under Honey Bunches of Oats, Pebbles, and Malt-O-Meal brand names; hot cereal; peanut butter under the Peter Pan brand; and branded and private label dog and cat food products under Rachael Ray Nutrish, Nature's Recipe, 9Lives, Kibbles 'n Bits and Gravy Train brand names.

Featured Stories

Before you consider Post, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Post wasn't on the list.

While Post currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.