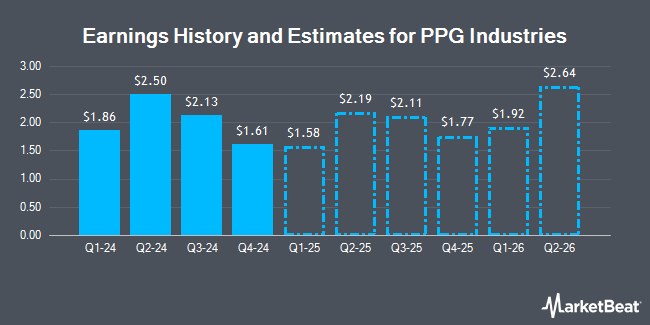

PPG Industries, Inc. (NYSE:PPG - Free Report) - Stock analysts at Seaport Res Ptn reduced their FY2024 EPS estimates for PPG Industries in a research note issued to investors on Wednesday, October 16th. Seaport Res Ptn analyst M. Harrison now anticipates that the specialty chemicals company will post earnings of $8.17 per share for the year, down from their prior estimate of $8.23. The consensus estimate for PPG Industries' current full-year earnings is $8.24 per share. Seaport Res Ptn also issued estimates for PPG Industries' Q4 2024 earnings at $1.67 EPS, Q1 2025 earnings at $1.96 EPS, Q3 2025 earnings at $2.43 EPS, Q4 2025 earnings at $1.86 EPS and FY2025 earnings at $9.00 EPS.

Several other research analysts have also recently commented on the company. Royal Bank of Canada reduced their target price on PPG Industries from $140.00 to $139.00 and set a "sector perform" rating for the company in a research report on Tuesday, July 23rd. Bank of America decreased their target price on shares of PPG Industries from $152.00 to $150.00 and set a "buy" rating on the stock in a research report on Monday, July 22nd. UBS Group raised their price target on shares of PPG Industries from $140.00 to $142.00 and gave the stock a "neutral" rating in a research note on Friday, July 19th. BMO Capital Markets set a $160.00 price objective on PPG Industries in a research note on Thursday. Finally, Citigroup decreased their price target on PPG Industries from $145.00 to $144.00 and set a "buy" rating on the stock in a research note on Monday, July 22nd. Six investment analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $150.50.

Read Our Latest Stock Analysis on PPG

PPG Industries Stock Performance

Shares of PPG stock traded down $0.43 during mid-day trading on Friday, reaching $130.93. The stock had a trading volume of 2,043,158 shares, compared to its average volume of 1,601,597. PPG Industries has a one year low of $118.07 and a one year high of $151.16. The firm has a market cap of $30.55 billion, a PE ratio of 21.46, a P/E/G ratio of 1.73 and a beta of 1.26. The firm's 50 day simple moving average is $127.21 and its 200 day simple moving average is $129.19. The company has a quick ratio of 1.05, a current ratio of 1.49 and a debt-to-equity ratio of 0.73.

PPG Industries (NYSE:PPG - Get Free Report) last announced its quarterly earnings data on Wednesday, October 16th. The specialty chemicals company reported $2.13 EPS for the quarter, missing analysts' consensus estimates of $2.15 by ($0.02). PPG Industries had a net margin of 7.98% and a return on equity of 23.57%. The company had revenue of $4.58 billion for the quarter, compared to analyst estimates of $4.66 billion. During the same period in the prior year, the company posted $2.07 EPS. The firm's quarterly revenue was down 1.5% on a year-over-year basis.

Hedge Funds Weigh In On PPG Industries

Large investors have recently made changes to their positions in the company. Kingsview Wealth Management LLC boosted its stake in PPG Industries by 0.9% in the first quarter. Kingsview Wealth Management LLC now owns 8,312 shares of the specialty chemicals company's stock valued at $1,204,000 after acquiring an additional 76 shares during the last quarter. Applied Capital LLC FL grew its stake in shares of PPG Industries by 1.3% during the first quarter. Applied Capital LLC FL now owns 6,402 shares of the specialty chemicals company's stock worth $928,000 after purchasing an additional 82 shares during the period. Oregon Public Employees Retirement Fund grew its stake in shares of PPG Industries by 0.4% during the second quarter. Oregon Public Employees Retirement Fund now owns 20,244 shares of the specialty chemicals company's stock worth $2,549,000 after purchasing an additional 82 shares during the period. Klingman & Associates LLC increased its holdings in PPG Industries by 2.6% in the second quarter. Klingman & Associates LLC now owns 3,326 shares of the specialty chemicals company's stock valued at $419,000 after purchasing an additional 83 shares during the last quarter. Finally, Fragasso Financial Advisors Inc lifted its stake in PPG Industries by 0.6% in the second quarter. Fragasso Financial Advisors Inc now owns 13,958 shares of the specialty chemicals company's stock valued at $1,757,000 after buying an additional 84 shares during the period. Institutional investors and hedge funds own 81.86% of the company's stock.

PPG Industries Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Tuesday, November 12th will be given a $0.68 dividend. This represents a $2.72 annualized dividend and a yield of 2.08%. The ex-dividend date is Tuesday, November 12th. PPG Industries's dividend payout ratio (DPR) is presently 44.59%.

About PPG Industries

(

Get Free Report)

PPG Industries, Inc manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through two segments, Performance Coatings and Industrial Coatings. The Performance Coatings segment offers coatings, solvents, adhesives, sealants, sundries, and software for automotive and commercial transport/fleet repair and refurbishing, light industrial coatings, and specialty coatings for signs; wood stains; paints, thermoplastics, pavement marking products, and other advanced technologies for pavement marking for government, commercial infrastructure, painting, and maintenance contractors; and coatings, sealants, transparencies, transparent armor, adhesives, engineered materials, and packaging and chemical management services for commercial, military, regional jet, and general aviation aircraft.

Featured Stories

Before you consider PPG Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PPG Industries wasn't on the list.

While PPG Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.