SG Americas Securities LLC lowered its stake in Primerica, Inc. (NYSE:PRI - Free Report) by 88.4% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 439 shares of the financial services provider's stock after selling 3,337 shares during the period. SG Americas Securities LLC's holdings in Primerica were worth $116,000 as of its most recent filing with the SEC.

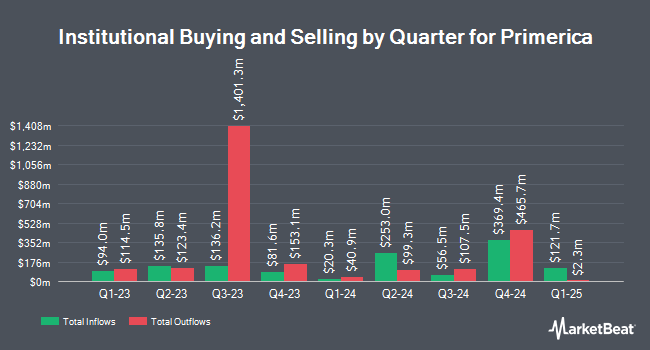

Several other institutional investors also recently modified their holdings of PRI. Van ECK Associates Corp raised its stake in Primerica by 36.5% during the 1st quarter. Van ECK Associates Corp now owns 12,506 shares of the financial services provider's stock valued at $3,164,000 after purchasing an additional 3,345 shares during the period. Blair William & Co. IL raised its stake in Primerica by 24.5% during the 1st quarter. Blair William & Co. IL now owns 12,159 shares of the financial services provider's stock valued at $3,076,000 after purchasing an additional 2,393 shares during the period. Harbor Capital Advisors Inc. raised its stake in Primerica by 456.8% during the 2nd quarter. Harbor Capital Advisors Inc. now owns 9,149 shares of the financial services provider's stock valued at $2,164,000 after purchasing an additional 7,506 shares during the period. Envestnet Portfolio Solutions Inc. raised its stake in Primerica by 136.5% during the 1st quarter. Envestnet Portfolio Solutions Inc. now owns 6,322 shares of the financial services provider's stock valued at $1,599,000 after purchasing an additional 3,649 shares during the period. Finally, Edgestream Partners L.P. acquired a new stake in Primerica during the 1st quarter valued at $979,000. Institutional investors own 90.88% of the company's stock.

Primerica Trading Down 1.3 %

Shares of PRI traded down $3.67 during mid-day trading on Friday, hitting $275.69. 92,629 shares of the company traded hands, compared to its average volume of 155,578. Primerica, Inc. has a one year low of $184.76 and a one year high of $284.37. The business has a 50-day moving average of $265.44 and a 200 day moving average of $244.09. The stock has a market capitalization of $9.33 billion, a price-to-earnings ratio of 22.07 and a beta of 1.09.

Primerica (NYSE:PRI - Get Free Report) last released its quarterly earnings results on Wednesday, August 7th. The financial services provider reported $4.71 EPS for the quarter, beating the consensus estimate of $4.47 by $0.24. Primerica had a net margin of 14.85% and a return on equity of 27.81%. The business had revenue of $803.38 million for the quarter, compared to analysts' expectations of $748.88 million. During the same period in the prior year, the firm earned $3.99 earnings per share. Primerica's revenue was up 16.7% compared to the same quarter last year. As a group, analysts anticipate that Primerica, Inc. will post 18.13 earnings per share for the current year.

Primerica Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, September 12th. Shareholders of record on Wednesday, August 21st were paid a $0.90 dividend. The ex-dividend date of this dividend was Wednesday, August 21st. This is a boost from Primerica's previous quarterly dividend of $0.75. This represents a $3.60 dividend on an annualized basis and a yield of 1.31%. Primerica's dividend payout ratio (DPR) is presently 28.82%.

Analysts Set New Price Targets

Several equities analysts have recently commented on PRI shares. TD Cowen started coverage on shares of Primerica in a report on Wednesday, October 9th. They set a "buy" rating and a $314.00 price target on the stock. Morgan Stanley boosted their price target on shares of Primerica from $257.00 to $269.00 and gave the company an "equal weight" rating in a report on Monday, August 19th. Keefe, Bruyette & Woods boosted their price target on shares of Primerica from $255.00 to $275.00 and gave the company a "market perform" rating in a report on Wednesday, July 17th. Jefferies Financial Group boosted their price target on shares of Primerica from $239.00 to $249.00 and gave the company a "hold" rating in a report on Thursday, July 18th. Finally, StockNews.com upgraded shares of Primerica from a "hold" rating to a "buy" rating in a report on Friday, October 4th. Five equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $281.67.

Read Our Latest Stock Analysis on PRI

Insider Buying and Selling at Primerica

In other Primerica news, CEO Glenn J. Williams sold 3,000 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The shares were sold at an average price of $252.55, for a total value of $757,650.00. Following the transaction, the chief executive officer now directly owns 45,322 shares of the company's stock, valued at approximately $11,446,071.10. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other Primerica news, Director John A. Jr. Addison sold 2,000 shares of the stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $253.85, for a total value of $507,700.00. Following the sale, the director now directly owns 15,151 shares in the company, valued at approximately $3,846,081.35. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CEO Glenn J. Williams sold 3,000 shares of the stock in a transaction on Monday, August 12th. The stock was sold at an average price of $252.55, for a total transaction of $757,650.00. Following the completion of the sale, the chief executive officer now owns 45,322 shares in the company, valued at approximately $11,446,071.10. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 6,500 shares of company stock valued at $1,657,015. 0.85% of the stock is currently owned by insiders.

Primerica Profile

(

Free Report)

Primerica, Inc, together with its subsidiaries, provides financial products and services to middle-income households in the United States and Canada. The company operates in four segments: Term Life Insurance; Investment and Savings Products; Senior Health; and Corporate and Other Distributed Products.

Recommended Stories

Before you consider Primerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Primerica wasn't on the list.

While Primerica currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.