Hillsdale Investment Management Inc. grew its stake in shares of Proto Labs, Inc. (NYSE:PRLB - Free Report) by 17.7% in the first quarter, according to its most recent filing with the SEC. The fund owned 118,094 shares of the industrial products company's stock after acquiring an additional 17,720 shares during the period. Hillsdale Investment Management Inc. owned about 0.47% of Proto Labs worth $4,222,000 at the end of the most recent reporting period.

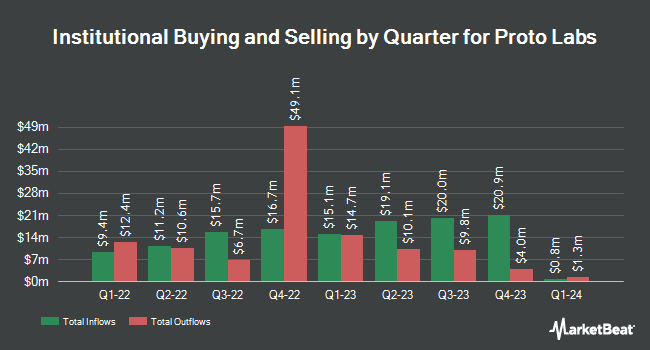

A number of other institutional investors and hedge funds also recently modified their holdings of the stock. Acadian Asset Management LLC acquired a new stake in Proto Labs during the 1st quarter valued at $1,560,000. Vanguard Group Inc. raised its stake in Proto Labs by 2.0% during the 1st quarter. Vanguard Group Inc. now owns 2,980,157 shares of the industrial products company's stock valued at $106,541,000 after purchasing an additional 57,894 shares during the period. Jupiter Asset Management Ltd. raised its stake in Proto Labs by 89.3% during the 1st quarter. Jupiter Asset Management Ltd. now owns 147,011 shares of the industrial products company's stock valued at $5,256,000 after purchasing an additional 69,347 shares during the period. State Board of Administration of Florida Retirement System raised its stake in Proto Labs by 58.3% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 11,969 shares of the industrial products company's stock valued at $397,000 after purchasing an additional 4,410 shares during the period. Finally, QRG Capital Management Inc. raised its stake in Proto Labs by 11.9% during the 1st quarter. QRG Capital Management Inc. now owns 29,020 shares of the industrial products company's stock valued at $1,037,000 after purchasing an additional 3,084 shares during the period. Institutional investors and hedge funds own 84.54% of the company's stock.

Proto Labs Stock Up 3.0 %

PRLB stock traded up $0.99 during mid-day trading on Monday, reaching $33.60. 108,826 shares of the stock traded hands, compared to its average volume of 157,883. Proto Labs, Inc. has a 52 week low of $23.01 and a 52 week high of $41.87. The business has a 50-day moving average of $31.30 and a two-hundred day moving average of $33.55. The firm has a market capitalization of $850.62 million, a PE ratio of 43.64 and a beta of 1.33.

Proto Labs (NYSE:PRLB - Get Free Report) last released its earnings results on Friday, May 3rd. The industrial products company reported $0.20 earnings per share for the quarter, beating the consensus estimate of $0.13 by $0.07. Proto Labs had a net margin of 3.92% and a return on equity of 2.88%. The business had revenue of $127.89 million during the quarter, compared to analysts' expectations of $123.81 million. On average, equities research analysts anticipate that Proto Labs, Inc. will post 0.69 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on PRLB. Cantor Fitzgerald began coverage on shares of Proto Labs in a research note on Wednesday, June 5th. They issued an "overweight" rating and a $44.00 price target on the stock. Craig Hallum dropped their price target on shares of Proto Labs from $38.00 to $34.00 and set a "hold" rating on the stock in a research note on Monday, May 6th. Needham & Company LLC reaffirmed a "hold" rating on shares of Proto Labs in a research note on Monday, May 6th. Finally, Benchmark reaffirmed a "buy" rating and issued a $45.00 price target on shares of Proto Labs in a research note on Wednesday, May 29th. Two analysts have rated the stock with a hold rating, three have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, Proto Labs has a consensus rating of "Moderate Buy" and a consensus target price of $41.25.

View Our Latest Stock Analysis on Proto Labs

About Proto Labs

(

Free Report)

Proto Labs, Inc, together with its subsidiaries, operates as a digital manufacturer of custom parts in the United States and Europe. The company offers injection molding; computer numerical control machining; three-dimensional printing; and sheet metal fabrication products. It serves developers and engineers, who use 3D computer-aided design software to design products across a range of end-markets.

Read More

Want to see what other hedge funds are holding PRLB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Proto Labs, Inc. (NYSE:PRLB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Proto Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Proto Labs wasn't on the list.

While Proto Labs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.