Parsons (NYSE:PSN - Get Free Report) had its target price boosted by equities researchers at KeyCorp from $116.00 to $122.00 in a research report issued on Thursday, Benzinga reports. The brokerage presently has an "overweight" rating on the stock. KeyCorp's price target points to a potential upside of 12.14% from the company's current price.

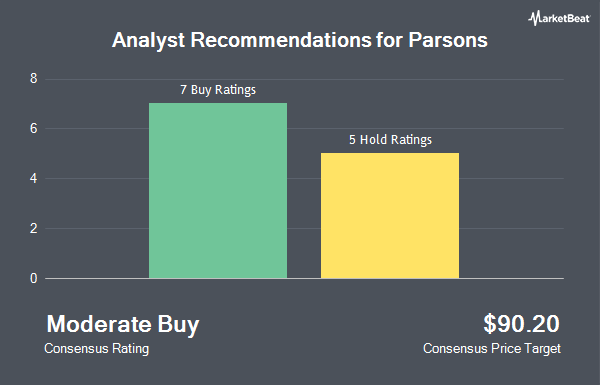

Several other equities analysts have also recently weighed in on PSN. Benchmark lifted their price objective on shares of Parsons from $68.00 to $101.00 and gave the stock a "buy" rating in a research report on Thursday, August 1st. Robert W. Baird increased their price objective on Parsons from $103.00 to $125.00 and gave the stock an "outperform" rating in a report on Thursday. Raymond James lowered Parsons from a "strong-buy" rating to an "outperform" rating and set a $115.00 target price on the stock. in a research report on Wednesday, October 23rd. Finally, Truist Financial reiterated a "buy" rating and issued a $108.00 price objective (up from $100.00) on shares of Parsons in a report on Thursday, August 1st. One equities research analyst has rated the stock with a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $102.11.

Read Our Latest Stock Analysis on Parsons

Parsons Stock Performance

Shares of PSN traded down $1.21 during midday trading on Thursday, hitting $108.79. 509,654 shares of the stock traded hands, compared to its average volume of 891,769. The company has a debt-to-equity ratio of 0.54, a quick ratio of 1.80 and a current ratio of 1.80. Parsons has a 1-year low of $56.04 and a 1-year high of $112.19. The business's 50 day moving average price is $101.29 and its two-hundred day moving average price is $87.68. The firm has a market capitalization of $15.96 billion, a PE ratio of 604.00, a price-to-earnings-growth ratio of 2.24 and a beta of 0.80.

Parsons (NYSE:PSN - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $0.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.73 by $0.07. Parsons had a return on equity of 12.09% and a net margin of 0.89%. The business had revenue of $1.81 billion for the quarter, compared to analysts' expectations of $1.63 billion. Equities research analysts predict that Parsons will post 2.89 EPS for the current fiscal year.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in the stock. Vanguard Group Inc. increased its stake in Parsons by 10.2% during the first quarter. Vanguard Group Inc. now owns 4,544,866 shares of the company's stock valued at $376,997,000 after acquiring an additional 421,085 shares during the period. Earnest Partners LLC boosted its stake in Parsons by 2.4% during the second quarter. Earnest Partners LLC now owns 2,168,598 shares of the company's stock worth $177,413,000 after buying an additional 49,891 shares in the last quarter. Allspring Global Investments Holdings LLC increased its holdings in Parsons by 61.7% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 1,123,366 shares of the company's stock valued at $116,471,000 after buying an additional 428,662 shares during the period. Principal Financial Group Inc. raised its stake in shares of Parsons by 0.5% in the 2nd quarter. Principal Financial Group Inc. now owns 1,009,826 shares of the company's stock valued at $82,614,000 after buying an additional 4,686 shares in the last quarter. Finally, Wedge Capital Management L L P NC bought a new position in shares of Parsons during the 3rd quarter worth about $62,514,000. Institutional investors and hedge funds own 98.02% of the company's stock.

About Parsons

(

Get Free Report)

Parsons Corporation provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally. The company operates through Federal Solutions and Critical Infrastructure segments. The Federal Solutions segment provides critical technologies, such as cybersecurity; missile defense; intelligence; space launch and ground systems; space and weapon system resiliency; geospatial intelligence; signals intelligence; environmental remediation; border security, critical infrastructure protection; counter unmanned air systems; biometrics and bio surveillance solutions to U.S.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Parsons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parsons wasn't on the list.

While Parsons currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.