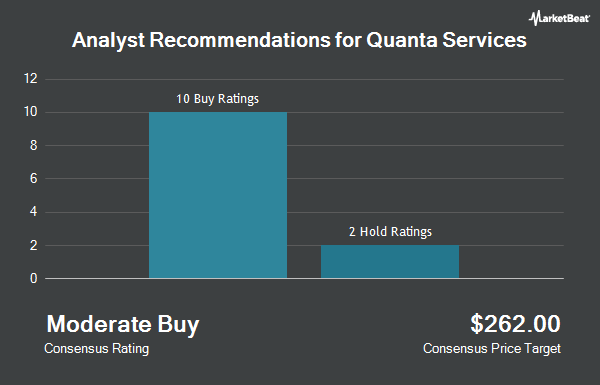

Quanta Services, Inc. (NYSE:PWR - Get Free Report) has been given an average recommendation of "Moderate Buy" by the fourteen brokerages that are currently covering the stock, MarketBeat.com reports. Three equities research analysts have rated the stock with a hold recommendation and eleven have assigned a buy recommendation to the company. The average 12 month target price among brokerages that have covered the stock in the last year is $290.23.

Several equities research analysts have recently commented on PWR shares. Robert W. Baird increased their price objective on Quanta Services from $287.00 to $288.00 and gave the company an "outperform" rating in a report on Friday, July 19th. Truist Financial reissued a "buy" rating and issued a $319.00 price objective (up previously from $305.00) on shares of Quanta Services in a research report on Monday, August 5th. TD Cowen raised their target price on shares of Quanta Services from $270.00 to $280.00 and gave the company a "buy" rating in a research note on Thursday, August 8th. Jefferies Financial Group began coverage on Quanta Services in a research report on Wednesday, September 4th. They set a "hold" rating and a $256.00 price target on the stock. Finally, Wolfe Research began coverage on shares of Quanta Services in a research report on Thursday, September 19th. They issued an "outperform" rating and a $313.00 price objective on the stock.

Get Our Latest Research Report on Quanta Services

Quanta Services Stock Up 2.5 %

Shares of NYSE PWR traded up $7.32 during midday trading on Friday, reaching $305.72. The company's stock had a trading volume of 619,574 shares, compared to its average volume of 726,089. The stock has a 50 day simple moving average of $270.34 and a 200-day simple moving average of $265.58. The company has a current ratio of 1.30, a quick ratio of 1.25 and a debt-to-equity ratio of 0.45. The stock has a market capitalization of $45.04 billion, a price-to-earnings ratio of 59.25 and a beta of 1.01. Quanta Services has a fifty-two week low of $153.74 and a fifty-two week high of $306.50.

Quanta Services (NYSE:PWR - Get Free Report) last posted its quarterly earnings data on Thursday, August 1st. The construction company reported $1.90 EPS for the quarter, topping analysts' consensus estimates of $1.75 by $0.15. The company had revenue of $5.59 billion during the quarter, compared to the consensus estimate of $5.51 billion. Quanta Services had a net margin of 3.59% and a return on equity of 16.29%. The company's quarterly revenue was up 10.8% on a year-over-year basis. During the same period in the prior year, the business posted $1.47 EPS. Equities research analysts predict that Quanta Services will post 7.82 earnings per share for the current year.

Quanta Services Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, October 11th. Shareholders of record on Tuesday, October 1st will be paid a dividend of $0.09 per share. The ex-dividend date of this dividend is Tuesday, October 1st. This represents a $0.36 dividend on an annualized basis and a yield of 0.12%. Quanta Services's payout ratio is 6.98%.

Insider Activity

In related news, insider Gerald A. Ducey, Jr. sold 15,000 shares of Quanta Services stock in a transaction that occurred on Friday, August 9th. The shares were sold at an average price of $257.93, for a total value of $3,868,950.00. Following the transaction, the insider now directly owns 21,286 shares of the company's stock, valued at $5,490,297.98. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. In other Quanta Services news, insider Gerald A. Ducey, Jr. sold 15,000 shares of Quanta Services stock in a transaction dated Friday, August 9th. The stock was sold at an average price of $257.93, for a total value of $3,868,950.00. Following the transaction, the insider now owns 21,286 shares in the company, valued at $5,490,297.98. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, COO James Redgie Probst sold 34,000 shares of the stock in a transaction dated Friday, August 9th. The stock was sold at an average price of $260.03, for a total transaction of $8,841,020.00. Following the completion of the transaction, the chief operating officer now directly owns 29,002 shares of the company's stock, valued at $7,541,390.06. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 202,357 shares of company stock worth $53,115,572. 1.10% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. Rafferty Asset Management LLC raised its position in Quanta Services by 5.6% in the fourth quarter. Rafferty Asset Management LLC now owns 12,186 shares of the construction company's stock valued at $2,630,000 after purchasing an additional 642 shares during the last quarter. CIBC Private Wealth Group LLC boosted its position in Quanta Services by 16.5% during the 4th quarter. CIBC Private Wealth Group LLC now owns 3,017 shares of the construction company's stock worth $651,000 after buying an additional 427 shares during the period. Tower Research Capital LLC TRC grew its holdings in Quanta Services by 88.0% during the 4th quarter. Tower Research Capital LLC TRC now owns 18,463 shares of the construction company's stock worth $3,984,000 after acquiring an additional 8,644 shares during the last quarter. Cibc World Markets Corp increased its position in Quanta Services by 133.3% in the 4th quarter. Cibc World Markets Corp now owns 18,695 shares of the construction company's stock valued at $4,034,000 after acquiring an additional 10,681 shares during the period. Finally, Vinva Investment Management Ltd bought a new position in shares of Quanta Services during the fourth quarter valued at $1,095,000. 90.49% of the stock is currently owned by institutional investors and hedge funds.

About Quanta Services

(

Get Free ReportQuanta Services, Inc provides infrastructure solutions for the electric and gas utility, renewable energy, communications, and pipeline and energy industries in the United States, Canada, Australia, and internationally. The company's Electric Power Infrastructure Solutions segment engages in the design, procurement, construction, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure and substation facilities; installation, maintenance, and upgrade of electric power infrastructure projects; installation of smart grid technologies on electric power networks; and design, installation, maintenance, and repair of commercial and industrial wirings.

Featured Articles

Before you consider Quanta Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quanta Services wasn't on the list.

While Quanta Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report