Fiduciary Alliance LLC grew its stake in Quanta Services, Inc. (NYSE:PWR - Free Report) by 17.1% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 21,227 shares of the construction company's stock after purchasing an additional 3,097 shares during the period. Fiduciary Alliance LLC's holdings in Quanta Services were worth $6,329,000 as of its most recent filing with the Securities and Exchange Commission.

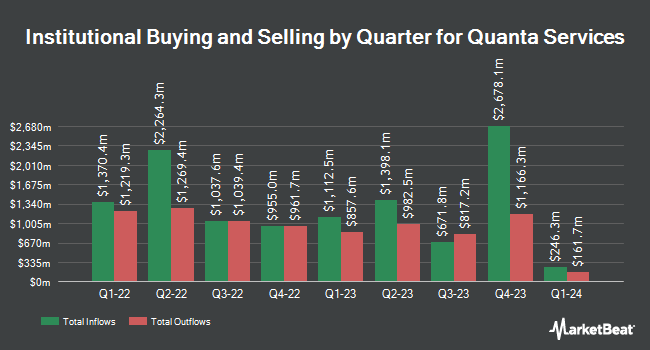

Other hedge funds also recently made changes to their positions in the company. Vanguard Group Inc. boosted its position in Quanta Services by 0.6% during the 1st quarter. Vanguard Group Inc. now owns 16,341,230 shares of the construction company's stock worth $4,245,452,000 after buying an additional 105,355 shares during the period. JPMorgan Chase & Co. boosted its position in Quanta Services by 2.4% during the 1st quarter. JPMorgan Chase & Co. now owns 6,760,260 shares of the construction company's stock worth $1,756,316,000 after buying an additional 156,627 shares during the period. Capital World Investors boosted its position in Quanta Services by 10.7% during the 1st quarter. Capital World Investors now owns 6,643,733 shares of the construction company's stock worth $1,726,042,000 after buying an additional 643,011 shares during the period. Electron Capital Partners LLC boosted its position in Quanta Services by 395.1% during the 2nd quarter. Electron Capital Partners LLC now owns 2,622,142 shares of the construction company's stock worth $666,260,000 after buying an additional 2,092,519 shares during the period. Finally, Massachusetts Financial Services Co. MA boosted its position in Quanta Services by 17.8% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,235,655 shares of the construction company's stock worth $313,968,000 after buying an additional 186,306 shares during the period. 90.49% of the stock is currently owned by institutional investors and hedge funds.

Quanta Services Trading Up 0.5 %

Shares of Quanta Services stock traded up $1.56 on Monday, hitting $310.98. The stock had a trading volume of 387,332 shares, compared to its average volume of 900,290. The company has a quick ratio of 1.25, a current ratio of 1.30 and a debt-to-equity ratio of 0.45. Quanta Services, Inc. has a one year low of $153.74 and a one year high of $313.56. The stock has a market cap of $45.52 billion, a price-to-earnings ratio of 60.27 and a beta of 1.01. The stock's 50-day simple moving average is $277.20 and its two-hundred day simple moving average is $267.72.

Quanta Services (NYSE:PWR - Get Free Report) last announced its quarterly earnings data on Thursday, August 1st. The construction company reported $1.90 EPS for the quarter, beating the consensus estimate of $1.75 by $0.15. Quanta Services had a return on equity of 16.29% and a net margin of 3.59%. The business had revenue of $5.59 billion during the quarter, compared to analyst estimates of $5.51 billion. During the same quarter last year, the firm posted $1.47 earnings per share. The company's revenue for the quarter was up 10.8% on a year-over-year basis. As a group, sell-side analysts predict that Quanta Services, Inc. will post 7.81 EPS for the current year.

Quanta Services Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, October 11th. Stockholders of record on Tuesday, October 1st were given a dividend of $0.09 per share. The ex-dividend date of this dividend was Tuesday, October 1st. This represents a $0.36 annualized dividend and a dividend yield of 0.12%. Quanta Services's payout ratio is 6.98%.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on the stock. Citigroup lifted their target price on shares of Quanta Services from $302.00 to $348.00 and gave the stock a "buy" rating in a research report on Friday, October 4th. TD Cowen raised their price target on shares of Quanta Services from $270.00 to $280.00 and gave the stock a "buy" rating in a report on Thursday, August 8th. JPMorgan Chase & Co. started coverage on shares of Quanta Services in a report on Monday, October 7th. They set a "neutral" rating and a $297.00 price target for the company. Wolfe Research started coverage on shares of Quanta Services in a report on Thursday, September 19th. They set an "outperform" rating and a $313.00 price target for the company. Finally, Stifel Nicolaus raised their price target on shares of Quanta Services from $283.00 to $342.00 and gave the stock a "buy" rating in a report on Thursday. Four equities research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the stock. According to MarketBeat.com, Quanta Services presently has a consensus rating of "Moderate Buy" and an average target price of $299.93.

Get Our Latest Report on PWR

Insider Activity

In other Quanta Services news, CEO Earl C. Jr. Austin sold 130,000 shares of Quanta Services stock in a transaction on Wednesday, August 14th. The shares were sold at an average price of $262.21, for a total transaction of $34,087,300.00. Following the completion of the transaction, the chief executive officer now directly owns 593,402 shares of the company's stock, valued at $155,595,938.42. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other Quanta Services news, CEO Earl C. Jr. Austin sold 130,000 shares of Quanta Services stock in a transaction dated Wednesday, August 14th. The stock was sold at an average price of $262.21, for a total value of $34,087,300.00. Following the transaction, the chief executive officer now owns 593,402 shares in the company, valued at $155,595,938.42. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, COO James Redgie Probst sold 34,000 shares of Quanta Services stock in a transaction dated Friday, August 9th. The shares were sold at an average price of $260.03, for a total value of $8,841,020.00. Following the completion of the transaction, the chief operating officer now owns 29,002 shares in the company, valued at $7,541,390.06. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 202,357 shares of company stock worth $53,115,572 over the last ninety days. Corporate insiders own 1.10% of the company's stock.

About Quanta Services

(

Free Report)

Quanta Services, Inc provides infrastructure solutions for the electric and gas utility, renewable energy, communications, and pipeline and energy industries in the United States, Canada, Australia, and internationally. The company's Electric Power Infrastructure Solutions segment engages in the design, procurement, construction, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure and substation facilities; installation, maintenance, and upgrade of electric power infrastructure projects; installation of smart grid technologies on electric power networks; and design, installation, maintenance, and repair of commercial and industrial wirings.

Featured Stories

Before you consider Quanta Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quanta Services wasn't on the list.

While Quanta Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report