LiveRamp (NYSE:RAMP - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Wednesday, November 6th. Analysts expect the company to announce earnings of $0.38 per share for the quarter. LiveRamp has set its FY 2025 guidance at EPS and its Q2 2025 guidance at EPS.Individual that are interested in participating in the company's earnings conference call can do so using this link.

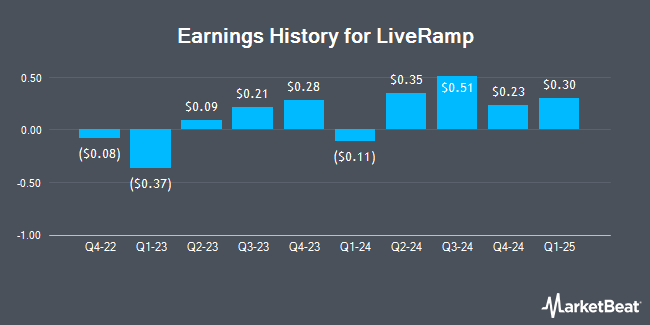

LiveRamp (NYSE:RAMP - Get Free Report) last posted its quarterly earnings results on Wednesday, August 7th. The company reported $0.35 EPS for the quarter, beating the consensus estimate of $0.31 by $0.04. LiveRamp had a return on equity of 2.14% and a net margin of 0.88%. The business had revenue of $175.96 million during the quarter, compared to analysts' expectations of $171.92 million. During the same period last year, the firm earned $0.09 EPS. The company's quarterly revenue was up 14.2% compared to the same quarter last year. On average, analysts expect LiveRamp to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

LiveRamp Stock Up 1.8 %

RAMP stock traded up $0.46 on Wednesday, reaching $25.40. 425,665 shares of the company's stock were exchanged, compared to its average volume of 650,571. LiveRamp has a twelve month low of $21.45 and a twelve month high of $42.66. The stock has a fifty day moving average of $24.96 and a 200-day moving average of $28.55. The firm has a market cap of $1.69 billion, a PE ratio of 141.11 and a beta of 0.96.

Wall Street Analyst Weigh In

A number of equities analysts have recently issued reports on RAMP shares. Craig Hallum cut their price target on shares of LiveRamp from $55.00 to $43.00 and set a "buy" rating for the company in a report on Thursday, August 8th. Wells Fargo & Company started coverage on shares of LiveRamp in a research report on Monday. They set an "equal weight" rating and a $25.00 price target for the company. StockNews.com cut LiveRamp from a "strong-buy" rating to a "buy" rating in a report on Tuesday, July 16th. Benchmark reduced their price objective on LiveRamp from $56.00 to $48.00 and set a "buy" rating for the company in a report on Monday, October 7th. Finally, Macquarie raised LiveRamp to a "strong-buy" rating in a report on Thursday, August 8th. One investment analyst has rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Buy" and an average price target of $41.83.

View Our Latest Report on LiveRamp

Insider Buying and Selling at LiveRamp

In other news, CTO Mohsin Hussain sold 5,773 shares of the business's stock in a transaction on Friday, August 30th. The stock was sold at an average price of $25.98, for a total value of $149,982.54. Following the completion of the transaction, the chief technology officer now directly owns 73,614 shares of the company's stock, valued at $1,912,491.72. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. In related news, insider Kimberly Bloomston sold 4,000 shares of the company's stock in a transaction that occurred on Thursday, September 26th. The shares were sold at an average price of $25.17, for a total transaction of $100,680.00. Following the transaction, the insider now owns 117,247 shares of the company's stock, valued at approximately $2,951,106.99. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CTO Mohsin Hussain sold 5,773 shares of LiveRamp stock in a transaction that occurred on Friday, August 30th. The stock was sold at an average price of $25.98, for a total transaction of $149,982.54. Following the completion of the sale, the chief technology officer now directly owns 73,614 shares of the company's stock, valued at $1,912,491.72. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 19,538 shares of company stock worth $495,471. 3.39% of the stock is owned by insiders.

About LiveRamp

(

Get Free Report)

LiveRamp Holdings, Inc, a technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally. The company operates LiveRamp Data Collaboration platform enables an organization to unify customer and prospect data to build a single view of the customer in a way that protects consumer privacy.

Recommended Stories

Before you consider LiveRamp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LiveRamp wasn't on the list.

While LiveRamp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.