Lecap Asset Management Ltd. trimmed its holdings in shares of Rexford Industrial Realty, Inc. (NYSE:REXR - Free Report) by 71.9% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 10,359 shares of the real estate investment trust's stock after selling 26,455 shares during the period. Lecap Asset Management Ltd.'s holdings in Rexford Industrial Realty were worth $521,000 at the end of the most recent quarter.

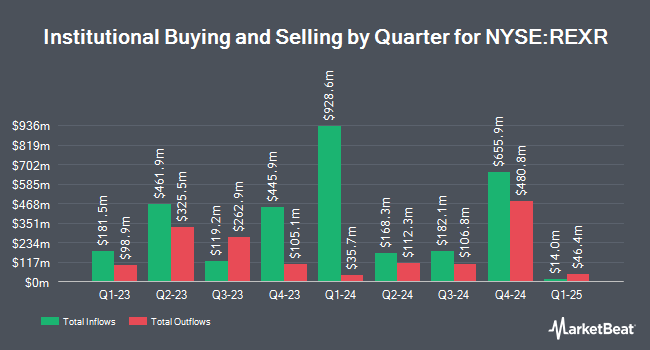

A number of other large investors also recently modified their holdings of REXR. Capital International Investors boosted its stake in shares of Rexford Industrial Realty by 687.7% during the 1st quarter. Capital International Investors now owns 19,590,676 shares of the real estate investment trust's stock worth $985,411,000 after buying an additional 17,103,653 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its stake in Rexford Industrial Realty by 26.7% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 19,933,431 shares of the real estate investment trust's stock valued at $1,002,654,000 after purchasing an additional 4,197,907 shares during the last quarter. Canada Pension Plan Investment Board lifted its stake in Rexford Industrial Realty by 262.7% in the 1st quarter. Canada Pension Plan Investment Board now owns 2,237,288 shares of the real estate investment trust's stock valued at $112,536,000 after purchasing an additional 1,620,378 shares during the last quarter. Massachusetts Financial Services Co. MA lifted its stake in Rexford Industrial Realty by 38.0% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 2,907,560 shares of the real estate investment trust's stock valued at $129,648,000 after purchasing an additional 800,137 shares during the last quarter. Finally, Vanguard Group Inc. lifted its stake in Rexford Industrial Realty by 2.6% in the 1st quarter. Vanguard Group Inc. now owns 29,734,952 shares of the real estate investment trust's stock valued at $1,495,668,000 after purchasing an additional 753,098 shares during the last quarter. 99.52% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several brokerages recently issued reports on REXR. StockNews.com downgraded shares of Rexford Industrial Realty from a "hold" rating to a "sell" rating in a research note on Monday. JPMorgan Chase & Co. raised their target price on shares of Rexford Industrial Realty from $47.00 to $52.00 and gave the company a "neutral" rating in a research note on Thursday, July 25th. Industrial Alliance Securities set a $55.00 target price on shares of Rexford Industrial Realty in a research note on Friday, October 18th. Mizuho cut their target price on shares of Rexford Industrial Realty from $50.00 to $49.00 and set a "neutral" rating for the company in a research note on Thursday, September 5th. Finally, Evercore ISI reissued an "outperform" rating on shares of Rexford Industrial Realty in a report on Friday, October 18th. Two investment analysts have rated the stock with a sell rating, six have issued a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $51.45.

Get Our Latest Stock Analysis on REXR

Rexford Industrial Realty Stock Performance

Shares of REXR traded down $1.23 during mid-day trading on Friday, hitting $43.35. 1,848,001 shares of the company's stock were exchanged, compared to its average volume of 1,717,407. Rexford Industrial Realty, Inc. has a 52 week low of $41.56 and a 52 week high of $58.02. The stock's 50-day simple moving average is $49.50 and its 200-day simple moving average is $47.24. The firm has a market cap of $9.44 billion, a price-to-earnings ratio of 40.90, a price-to-earnings-growth ratio of 2.13 and a beta of 0.93. The company has a quick ratio of 1.73, a current ratio of 1.20 and a debt-to-equity ratio of 0.40.

Rexford Industrial Realty (NYSE:REXR - Get Free Report) last announced its earnings results on Wednesday, October 16th. The real estate investment trust reported $0.30 EPS for the quarter, missing the consensus estimate of $0.58 by ($0.28). Rexford Industrial Realty had a return on equity of 3.35% and a net margin of 30.40%. The business had revenue of $241.84 million for the quarter, compared to the consensus estimate of $235.81 million. During the same period in the prior year, the business posted $0.56 earnings per share. The firm's revenue for the quarter was up 17.7% compared to the same quarter last year. On average, equities research analysts expect that Rexford Industrial Realty, Inc. will post 2.34 EPS for the current year.

Rexford Industrial Realty Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be issued a dividend of $0.4175 per share. The ex-dividend date is Tuesday, December 31st. This represents a $1.67 annualized dividend and a dividend yield of 3.85%. Rexford Industrial Realty's dividend payout ratio is presently 153.21%.

Insider Transactions at Rexford Industrial Realty

In related news, CFO Laura E. Clark sold 14,185 shares of Rexford Industrial Realty stock in a transaction that occurred on Tuesday, September 10th. The shares were sold at an average price of $50.15, for a total value of $711,377.75. The sale was disclosed in a legal filing with the SEC, which is available through the SEC website. Insiders own 1.20% of the company's stock.

Rexford Industrial Realty Profile

(

Free Report)

Rexford Industrial creates value by investing in, operating and redeveloping industrial properties throughout infill Southern California, the world's fourth largest industrial market and consistently the highest-demand with lowest-supply major market in the nation. The Company's highly differentiated strategy enables internal and external growth opportunities through its proprietary value creation and asset management capabilities.

Further Reading

Before you consider Rexford Industrial Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rexford Industrial Realty wasn't on the list.

While Rexford Industrial Realty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.