Millennium Management LLC grew its holdings in shares of Resideo Technologies, Inc. (NYSE:REZI - Free Report) by 57.2% during the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 378,908 shares of the company's stock after buying an additional 137,876 shares during the period. Millennium Management LLC owned 0.26% of Resideo Technologies worth $7,411,000 as of its most recent SEC filing.

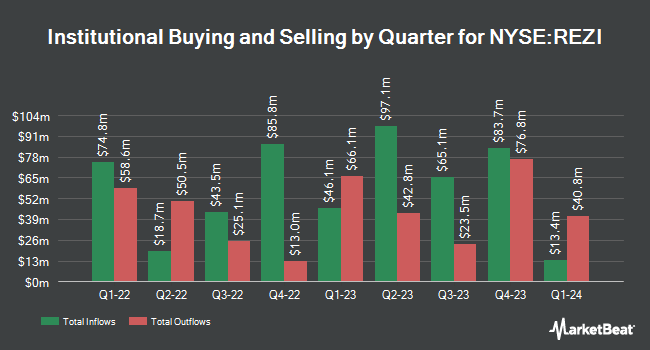

A number of other hedge funds have also recently modified their holdings of REZI. Pacer Advisors Inc. increased its position in shares of Resideo Technologies by 14.8% during the 2nd quarter. Pacer Advisors Inc. now owns 6,104,301 shares of the company's stock valued at $119,400,000 after purchasing an additional 787,934 shares during the last quarter. D. E. Shaw & Co. Inc. increased its stake in Resideo Technologies by 53.4% in the second quarter. D. E. Shaw & Co. Inc. now owns 1,214,375 shares of the company's stock worth $23,753,000 after purchasing an additional 422,730 shares during the period. Dimensional Fund Advisors LP increased its stake in Resideo Technologies by 5.4% in the second quarter. Dimensional Fund Advisors LP now owns 7,822,902 shares of the company's stock worth $153,015,000 after purchasing an additional 397,864 shares during the period. Cubist Systematic Strategies LLC increased its stake in shares of Resideo Technologies by 167.2% during the second quarter. Cubist Systematic Strategies LLC now owns 542,409 shares of the company's stock valued at $10,610,000 after buying an additional 339,434 shares during the period. Finally, Hillsdale Investment Management Inc. bought a new stake in Resideo Technologies during the first quarter valued at about $4,733,000. Institutional investors own 91.71% of the company's stock.

Resideo Technologies Stock Performance

Shares of NYSE:REZI traded down $0.03 during midday trading on Thursday, reaching $19.94. The company's stock had a trading volume of 514,255 shares, compared to its average volume of 874,004. The firm has a market capitalization of $2.92 billion, a PE ratio of 14.99 and a beta of 2.07. The company has a quick ratio of 1.06, a current ratio of 1.81 and a debt-to-equity ratio of 0.70. The stock has a fifty day moving average of $19.35 and a 200 day moving average of $20.31. Resideo Technologies, Inc. has a twelve month low of $14.19 and a twelve month high of $23.43.

Resideo Technologies (NYSE:REZI - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported $0.62 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.42 by $0.20. The business had revenue of $1.59 billion for the quarter, compared to the consensus estimate of $1.53 billion. Resideo Technologies had a net margin of 2.85% and a return on equity of 10.32%. The company's revenue was down .8% compared to the same quarter last year. During the same period last year, the firm posted $0.34 earnings per share. On average, equities analysts expect that Resideo Technologies, Inc. will post 1.92 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, Evercore ISI initiated coverage on shares of Resideo Technologies in a research report on Friday, August 9th. They set an "outperform" rating and a $25.00 target price for the company.

Read Our Latest Research Report on REZI

Resideo Technologies Profile

(

Free Report)

Resideo Technologies, Inc develops, manufactures, and sells comfort, energy management, and safety and security solutions to the commercial and residential end markets in the United States, Europe, and internationally. The company operates in two segments, Products and Solutions, and ADI Global Distribution.

Read More

Before you consider Resideo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Resideo Technologies wasn't on the list.

While Resideo Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.