Taylor Frigon Capital Management LLC bought a new position in Ryman Hospitality Properties, Inc. (NYSE:RHP - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 15,168 shares of the real estate investment trust's stock, valued at approximately $1,627,000.

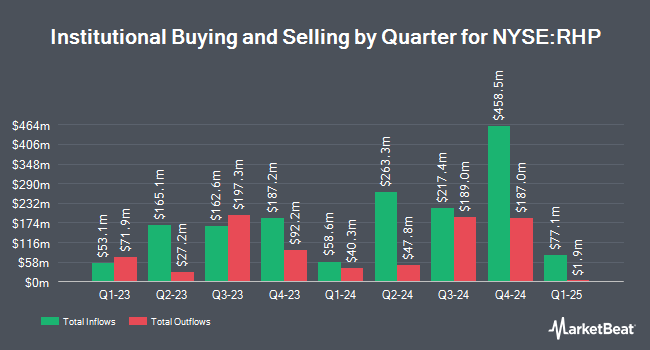

Other large investors have also made changes to their positions in the company. Greystone Financial Group LLC lifted its stake in Ryman Hospitality Properties by 46.5% in the 3rd quarter. Greystone Financial Group LLC now owns 6,387 shares of the real estate investment trust's stock worth $685,000 after acquiring an additional 2,026 shares in the last quarter. Copeland Capital Management LLC lifted its position in shares of Ryman Hospitality Properties by 45.4% in the third quarter. Copeland Capital Management LLC now owns 343,503 shares of the real estate investment trust's stock worth $36,837,000 after purchasing an additional 107,269 shares in the last quarter. Raymond James & Associates boosted its holdings in shares of Ryman Hospitality Properties by 34.3% during the third quarter. Raymond James & Associates now owns 25,679 shares of the real estate investment trust's stock worth $2,754,000 after purchasing an additional 6,563 shares during the period. Schubert & Co purchased a new position in Ryman Hospitality Properties during the third quarter valued at approximately $582,000. Finally, Blue Trust Inc. increased its stake in Ryman Hospitality Properties by 183.1% in the 3rd quarter. Blue Trust Inc. now owns 685 shares of the real estate investment trust's stock valued at $68,000 after buying an additional 443 shares during the period. Institutional investors and hedge funds own 94.48% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently commented on the stock. StockNews.com upgraded shares of Ryman Hospitality Properties from a "sell" rating to a "hold" rating in a report on Friday, August 9th. Wells Fargo & Company dropped their target price on Ryman Hospitality Properties from $127.00 to $115.00 and set an "overweight" rating on the stock in a research report on Friday, September 13th. Finally, JPMorgan Chase & Co. raised their price target on Ryman Hospitality Properties from $104.00 to $105.00 and gave the stock a "neutral" rating in a research note on Friday, August 2nd. Two research analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat, Ryman Hospitality Properties currently has an average rating of "Moderate Buy" and a consensus target price of $124.20.

Check Out Our Latest Stock Analysis on Ryman Hospitality Properties

Insiders Place Their Bets

In other news, Chairman Colin V. Reed purchased 8,077 shares of the company's stock in a transaction dated Tuesday, August 6th. The shares were bought at an average price of $97.78 per share, with a total value of $789,769.06. Following the completion of the transaction, the chairman now directly owns 827,220 shares in the company, valued at $80,885,571.60. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other Ryman Hospitality Properties news, Chairman Colin V. Reed acquired 8,077 shares of the company's stock in a transaction dated Tuesday, August 6th. The shares were acquired at an average cost of $97.78 per share, for a total transaction of $789,769.06. Following the completion of the purchase, the chairman now owns 827,220 shares of the company's stock, valued at approximately $80,885,571.60. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Alvin L. Bowles, Jr. sold 900 shares of the stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $107.32, for a total value of $96,588.00. Following the sale, the director now owns 3,148 shares of the company's stock, valued at approximately $337,843.36. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 3.00% of the company's stock.

Ryman Hospitality Properties Stock Up 1.7 %

Ryman Hospitality Properties stock traded up $1.85 during mid-day trading on Thursday, hitting $107.61. 418,412 shares of the company's stock were exchanged, compared to its average volume of 450,272. Ryman Hospitality Properties, Inc. has a 1-year low of $81.90 and a 1-year high of $122.91. The stock has a 50 day moving average of $105.77 and a two-hundred day moving average of $103.96. The company has a current ratio of 1.92, a quick ratio of 1.92 and a debt-to-equity ratio of 5.96. The stock has a market cap of $6.44 billion, a P/E ratio of 22.29, a P/E/G ratio of 2.36 and a beta of 1.66.

Ryman Hospitality Properties Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were issued a $1.10 dividend. The ex-dividend date of this dividend was Monday, September 30th. This represents a $4.40 annualized dividend and a yield of 4.09%. Ryman Hospitality Properties's dividend payout ratio (DPR) is currently 91.10%.

About Ryman Hospitality Properties

(

Free Report)

Ryman Hospitality Properties, Inc NYSE: RHP is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences. The Company's holdings include Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; Gaylord National Resort & Convention Center; and Gaylord Rockies Resort & Convention Center, five of the top seven largest non-gaming convention center hotels in the United States based on total indoor meeting space.

Further Reading

Before you consider Ryman Hospitality Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryman Hospitality Properties wasn't on the list.

While Ryman Hospitality Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.