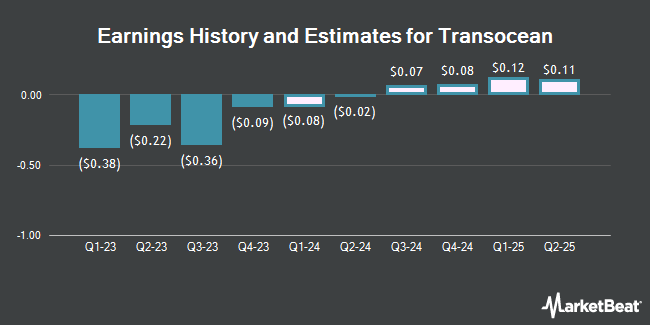

Transocean Ltd. (NYSE:RIG - Free Report) - Equities researchers at Capital One Financial dropped their FY2024 earnings per share (EPS) estimates for shares of Transocean in a research report issued to clients and investors on Thursday, October 31st. Capital One Financial analyst D. Becker now forecasts that the offshore drilling services provider will post earnings per share of ($0.16) for the year, down from their prior forecast of ($0.14). The consensus estimate for Transocean's current full-year earnings is ($0.18) per share. Capital One Financial also issued estimates for Transocean's Q4 2024 earnings at $0.05 EPS.

Several other research firms also recently commented on RIG. Citigroup downgraded shares of Transocean from a "buy" rating to a "neutral" rating in a research report on Thursday, September 12th. Benchmark cut shares of Transocean from a "buy" rating to a "hold" rating in a report on Tuesday, October 15th. Susquehanna cut their target price on Transocean from $7.00 to $6.50 and set a "positive" rating on the stock in a report on Friday. Barclays decreased their price target on Transocean from $6.00 to $4.50 and set an "equal weight" rating for the company in a research note on Wednesday, October 23rd. Finally, Morgan Stanley raised their price objective on Transocean from $5.00 to $6.00 and gave the company an "equal weight" rating in a research note on Thursday, October 3rd. Two analysts have rated the stock with a sell rating, five have given a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $6.63.

Read Our Latest Stock Analysis on Transocean

Transocean Stock Up 4.0 %

NYSE:RIG traded up $0.17 during mid-day trading on Monday, reaching $4.41. The stock had a trading volume of 19,779,046 shares, compared to its average volume of 18,474,980. The stock has a market cap of $3.86 billion, a P/E ratio of -5.88 and a beta of 2.78. The business's 50 day moving average is $4.34 and its 200 day moving average is $5.07. The company has a debt-to-equity ratio of 0.64, a current ratio of 1.64 and a quick ratio of 1.08. Transocean has a fifty-two week low of $3.85 and a fifty-two week high of $6.94.

Insider Activity at Transocean

In other Transocean news, Director Perestroika purchased 1,500,000 shares of the business's stock in a transaction dated Thursday, September 12th. The stock was bought at an average cost of $4.13 per share, for a total transaction of $6,195,000.00. Following the completion of the acquisition, the director now directly owns 91,074,894 shares in the company, valued at $376,139,312.22. This represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 13.16% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Northwestern Mutual Wealth Management Co. grew its position in Transocean by 138.8% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 4,633 shares of the offshore drilling services provider's stock worth $25,000 after buying an additional 2,693 shares in the last quarter. Nisa Investment Advisors LLC acquired a new stake in shares of Transocean during the 2nd quarter worth approximately $30,000. Atria Investments Inc bought a new stake in shares of Transocean during the third quarter valued at approximately $51,000. Fiducient Advisors LLC acquired a new position in shares of Transocean in the first quarter valued at $63,000. Finally, SG Americas Securities LLC bought a new position in Transocean in the second quarter worth $64,000. Institutional investors own 67.73% of the company's stock.

Transocean Company Profile

(

Get Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Featured Stories

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.