Transocean (NYSE:RIG - Get Free Report) had its price target dropped by Susquehanna from $7.00 to $6.50 in a research report issued to clients and investors on Friday, Benzinga reports. The brokerage presently has a "positive" rating on the offshore drilling services provider's stock. Susquehanna's price objective points to a potential upside of 53.48% from the company's previous close.

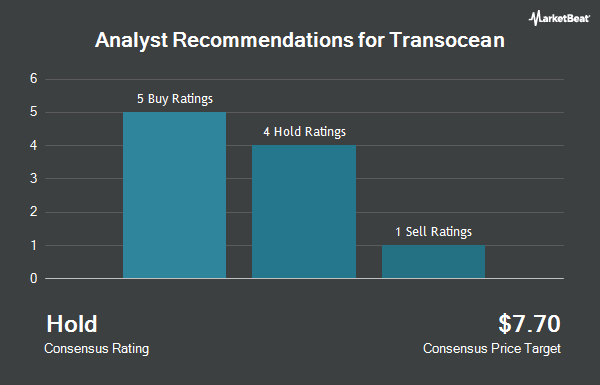

A number of other research analysts have also weighed in on the stock. DNB Markets raised shares of Transocean from a "hold" rating to a "buy" rating in a research note on Tuesday, September 3rd. StockNews.com upgraded Transocean to a "sell" rating in a research report on Thursday, October 10th. Benchmark cut Transocean from a "buy" rating to a "hold" rating in a research report on Tuesday, October 15th. Citigroup lowered Transocean from a "buy" rating to a "neutral" rating in a report on Thursday, September 12th. Finally, Barclays dropped their target price on shares of Transocean from $6.00 to $4.50 and set an "equal weight" rating for the company in a report on Wednesday, October 23rd. Two investment analysts have rated the stock with a sell rating, five have given a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $6.63.

Get Our Latest Stock Report on RIG

Transocean Price Performance

RIG traded down $0.10 during trading on Friday, hitting $4.24. The company's stock had a trading volume of 27,829,845 shares, compared to its average volume of 18,468,711. The firm has a market capitalization of $3.71 billion, a price-to-earnings ratio of -5.88 and a beta of 2.79. Transocean has a twelve month low of $3.85 and a twelve month high of $7.05. The business's fifty day simple moving average is $4.36 and its 200 day simple moving average is $5.10. The company has a current ratio of 1.36, a quick ratio of 1.08 and a debt-to-equity ratio of 0.63.

Transocean (NYSE:RIG - Get Free Report) last issued its quarterly earnings results on Wednesday, July 31st. The offshore drilling services provider reported ($0.15) EPS for the quarter, missing the consensus estimate of ($0.08) by ($0.07). Transocean had a negative return on equity of 1.47% and a negative net margin of 18.81%. The company had revenue of $861.00 million during the quarter, compared to analysts' expectations of $862.25 million. During the same period in the previous year, the firm posted ($0.15) EPS. Transocean's revenue was up 18.1% compared to the same quarter last year. On average, equities research analysts forecast that Transocean will post -0.18 EPS for the current fiscal year.

Insider Activity at Transocean

In other news, Director Perestroika bought 1,500,000 shares of Transocean stock in a transaction on Thursday, September 12th. The shares were bought at an average cost of $4.13 per share, with a total value of $6,195,000.00. Following the completion of the purchase, the director now directly owns 91,074,894 shares of the company's stock, valued at approximately $376,139,312.22. This trade represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 13.16% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Transocean

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Capital World Investors increased its position in shares of Transocean by 18.8% during the 1st quarter. Capital World Investors now owns 46,334,990 shares of the offshore drilling services provider's stock worth $290,984,000 after purchasing an additional 7,320,672 shares during the last quarter. Dimensional Fund Advisors LP raised its stake in shares of Transocean by 19.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 36,725,995 shares of the offshore drilling services provider's stock valued at $196,484,000 after acquiring an additional 5,856,414 shares during the period. Assenagon Asset Management S.A. acquired a new position in shares of Transocean in the 2nd quarter worth approximately $16,179,000. American Century Companies Inc. lifted its holdings in shares of Transocean by 24.3% in the 2nd quarter. American Century Companies Inc. now owns 13,437,572 shares of the offshore drilling services provider's stock worth $71,891,000 after acquiring an additional 2,623,615 shares during the last quarter. Finally, Bank of New York Mellon Corp boosted its position in shares of Transocean by 18.3% during the 2nd quarter. Bank of New York Mellon Corp now owns 16,858,264 shares of the offshore drilling services provider's stock worth $90,192,000 after purchasing an additional 2,606,017 shares during the period. Institutional investors and hedge funds own 67.73% of the company's stock.

Transocean Company Profile

(

Get Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Featured Stories

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.