Global Trust Asset Management LLC grew its holdings in Rockwell Automation, Inc. (NYSE:ROK - Free Report) by 230.4% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,772 shares of the industrial products company's stock after purchasing an additional 1,933 shares during the period. Global Trust Asset Management LLC's holdings in Rockwell Automation were worth $744,000 as of its most recent SEC filing.

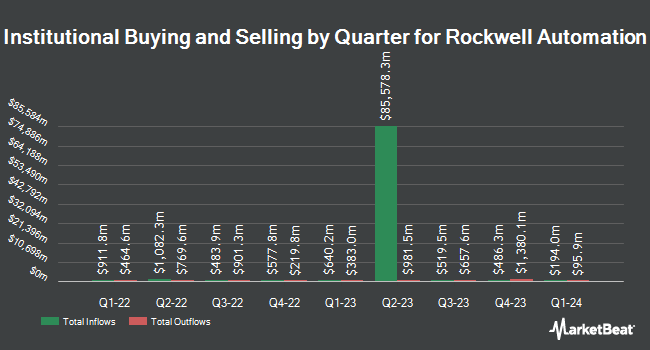

Other hedge funds have also made changes to their positions in the company. IFM Investors Pty Ltd boosted its position in Rockwell Automation by 1.8% during the third quarter. IFM Investors Pty Ltd now owns 22,646 shares of the industrial products company's stock valued at $6,080,000 after purchasing an additional 402 shares during the last quarter. International Assets Investment Management LLC lifted its holdings in shares of Rockwell Automation by 29,591.7% during the 3rd quarter. International Assets Investment Management LLC now owns 936,178 shares of the industrial products company's stock valued at $251,326,000 after buying an additional 933,025 shares during the last quarter. Courier Capital LLC grew its stake in shares of Rockwell Automation by 1.5% in the 3rd quarter. Courier Capital LLC now owns 5,996 shares of the industrial products company's stock valued at $1,610,000 after buying an additional 86 shares in the last quarter. Greenleaf Trust increased its holdings in Rockwell Automation by 77.2% in the third quarter. Greenleaf Trust now owns 5,422 shares of the industrial products company's stock worth $1,456,000 after buying an additional 2,363 shares during the last quarter. Finally, Commerzbank Aktiengesellschaft FI bought a new position in Rockwell Automation during the third quarter valued at approximately $547,000. 75.75% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

ROK has been the subject of several recent research reports. Barclays decreased their target price on shares of Rockwell Automation from $250.00 to $245.00 and set an "underweight" rating for the company in a research report on Wednesday, July 10th. TD Cowen decreased their price objective on shares of Rockwell Automation from $220.00 to $215.00 and set a "sell" rating for the company in a report on Thursday, August 8th. Redburn Atlantic started coverage on Rockwell Automation in a report on Monday, July 8th. They set a "neutral" rating and a $256.00 target price on the stock. Bank of America upped their price target on Rockwell Automation from $270.00 to $285.00 and gave the stock a "neutral" rating in a research note on Thursday, October 17th. Finally, JPMorgan Chase & Co. cut their price objective on Rockwell Automation from $245.00 to $227.00 and set an "underweight" rating on the stock in a research note on Monday, August 12th. Three analysts have rated the stock with a sell rating, six have assigned a hold rating and six have given a buy rating to the stock. According to data from MarketBeat, Rockwell Automation has an average rating of "Hold" and an average price target of $286.47.

Get Our Latest Analysis on ROK

Rockwell Automation Stock Performance

Shares of ROK traded up $2.27 during trading hours on Friday, reaching $269.95. 380,694 shares of the company traded hands, compared to its average volume of 873,659. Rockwell Automation, Inc. has a 1-year low of $242.81 and a 1-year high of $312.76. The stock has a market cap of $30.78 billion, a P/E ratio of 26.36, a price-to-earnings-growth ratio of 4.68 and a beta of 1.36. The stock's fifty day moving average is $265.64 and its 200 day moving average is $267.38. The company has a debt-to-equity ratio of 0.73, a quick ratio of 0.68 and a current ratio of 1.04.

Rockwell Automation (NYSE:ROK - Get Free Report) last announced its quarterly earnings data on Wednesday, August 7th. The industrial products company reported $2.71 EPS for the quarter, topping analysts' consensus estimates of $2.08 by $0.63. The company had revenue of $2.05 billion during the quarter, compared to the consensus estimate of $2.03 billion. Rockwell Automation had a return on equity of 34.09% and a net margin of 11.56%. The company's quarterly revenue was down 8.4% on a year-over-year basis. During the same quarter last year, the company earned $3.01 EPS. Equities research analysts anticipate that Rockwell Automation, Inc. will post 9.65 earnings per share for the current fiscal year.

Rockwell Automation announced that its Board of Directors has authorized a stock repurchase plan on Thursday, September 5th that allows the company to buyback $1.00 billion in outstanding shares. This buyback authorization allows the industrial products company to repurchase up to 3.4% of its stock through open market purchases. Stock buyback plans are generally an indication that the company's board believes its shares are undervalued.

Rockwell Automation Company Profile

(

Free Report)

Rockwell Automation, Inc provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through three segments, Intelligent Devices, Software & Control, and Lifecycle Services. Its solutions include hardware and software products and services.

Featured Articles

Before you consider Rockwell Automation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rockwell Automation wasn't on the list.

While Rockwell Automation currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.