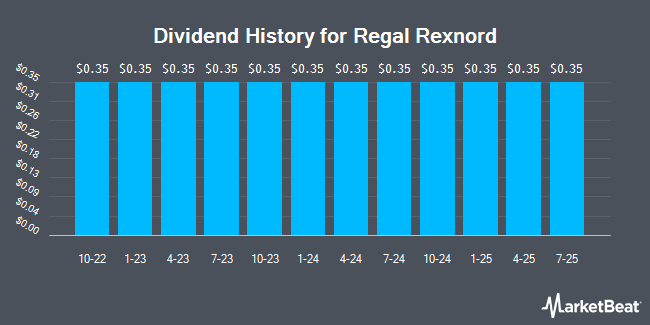

Regal Rexnord Co. (NYSE:RRX - Get Free Report) declared a quarterly dividend on Thursday, October 24th, Zacks reports. Shareholders of record on Tuesday, December 31st will be paid a dividend of 0.35 per share on Tuesday, January 14th. This represents a $1.40 annualized dividend and a yield of 0.84%. The ex-dividend date of this dividend is Tuesday, December 31st.

Regal Rexnord has raised its dividend payment by an average of 5.3% per year over the last three years and has raised its dividend annually for the last 19 consecutive years. Regal Rexnord has a payout ratio of 12.3% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect Regal Rexnord to earn $11.38 per share next year, which means the company should continue to be able to cover its $1.40 annual dividend with an expected future payout ratio of 12.3%.

Regal Rexnord Stock Performance

NYSE RRX traded down $1.62 during trading on Friday, hitting $166.43. The company's stock had a trading volume of 343,176 shares, compared to its average volume of 447,386. The company has a quick ratio of 1.38, a current ratio of 2.45 and a debt-to-equity ratio of 0.91. The firm has a 50 day moving average price of $164.34 and a 200 day moving average price of $155.90. The firm has a market cap of $11.07 billion, a P/E ratio of -346.73, a price-to-earnings-growth ratio of 1.79 and a beta of 1.04. Regal Rexnord has a 52 week low of $97.18 and a 52 week high of $183.85.

Regal Rexnord (NYSE:RRX - Get Free Report) last released its quarterly earnings data on Wednesday, July 31st. The company reported $2.29 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.14 by $0.15. The business had revenue of $1.55 billion for the quarter, compared to analysts' expectations of $1.51 billion. Regal Rexnord had a positive return on equity of 9.16% and a negative net margin of 0.02%. Regal Rexnord's quarterly revenue was down 12.5% on a year-over-year basis. During the same period in the previous year, the business posted $2.56 earnings per share. Equities research analysts forecast that Regal Rexnord will post 9.48 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several analysts recently commented on RRX shares. Robert W. Baird boosted their price target on Regal Rexnord from $208.00 to $213.00 and gave the company an "outperform" rating in a research note on Friday, August 2nd. StockNews.com raised Regal Rexnord from a "hold" rating to a "buy" rating in a research note on Wednesday, October 16th. Raymond James started coverage on Regal Rexnord in a research note on Friday, June 28th. They issued a "market perform" rating on the stock. KeyCorp decreased their price target on Regal Rexnord from $210.00 to $190.00 and set an "overweight" rating on the stock in a research note on Monday, July 15th. Finally, Barclays boosted their price target on Regal Rexnord from $180.00 to $190.00 and gave the company an "overweight" rating in a research note on Wednesday, October 2nd. One research analyst has rated the stock with a hold rating and nine have issued a buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $193.63.

Check Out Our Latest Report on Regal Rexnord

About Regal Rexnord

(

Get Free Report)

Regal Rexnord Corporation manufactures and sells industrial powertrain solutions, power transmission components, electric motors and electronic controls, air moving products, and specialty electrical components and systems worldwide. The Industrial Powertrain Solutions segment provides mounted and unmounted bearings, couplings, mechanical power transmission drives and components, gearboxes, gear motors, clutches, brakes, special, and industrial powertrain components and solutions for food and beverage, bulk material handling, eCommerce/warehouse distribution, energy, mining, marine, agricultural machinery, turf and garden, and general industrial markets.

Recommended Stories

Before you consider Regal Rexnord, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regal Rexnord wasn't on the list.

While Regal Rexnord currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.