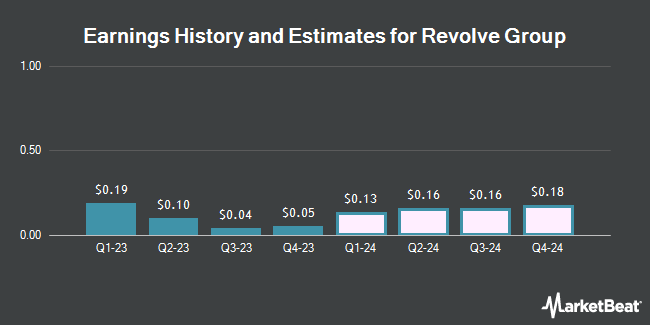

Revolve Group, Inc. (NYSE:RVLV - Free Report) - Equities research analysts at Roth Capital lifted their Q3 2024 EPS estimates for Revolve Group in a report released on Tuesday, October 29th. Roth Capital analyst M. Koranda now anticipates that the company will earn $0.12 per share for the quarter, up from their prior estimate of $0.10. The consensus estimate for Revolve Group's current full-year earnings is $0.55 per share. Roth Capital also issued estimates for Revolve Group's Q3 2025 earnings at $0.18 EPS and FY2025 earnings at $0.67 EPS.

Several other research analysts have also issued reports on RVLV. Roth Mkm increased their price target on Revolve Group from $26.00 to $29.00 and gave the stock a "buy" rating in a report on Wednesday. Wedbush reaffirmed a "neutral" rating and issued a $19.00 price objective on shares of Revolve Group in a research note on Wednesday, August 7th. Robert W. Baird upped their target price on shares of Revolve Group from $23.00 to $24.00 and gave the stock a "neutral" rating in a report on Wednesday, August 14th. Piper Sandler reiterated an "overweight" rating and set a $30.00 price target on shares of Revolve Group in a research note on Friday, August 23rd. Finally, UBS Group lifted their target price on Revolve Group from $21.00 to $25.00 and gave the company a "neutral" rating in a research report on Thursday, October 17th. Two equities research analysts have rated the stock with a sell rating, eight have given a hold rating and seven have given a buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $22.44.

View Our Latest Analysis on RVLV

Revolve Group Stock Up 0.6 %

RVLV traded up $0.14 during midday trading on Friday, hitting $24.96. The company had a trading volume of 732,453 shares, compared to its average volume of 992,776. The stock's 50 day moving average price is $24.36 and its 200 day moving average price is $20.85. Revolve Group has a 52 week low of $12.42 and a 52 week high of $26.72. The company has a market capitalization of $1.76 billion, a price-to-earnings ratio of 55.19, a PEG ratio of 2.44 and a beta of 2.05.

Revolve Group (NYSE:RVLV - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The company reported $0.21 EPS for the quarter, topping the consensus estimate of $0.13 by $0.08. The company had revenue of $282.50 million during the quarter, compared to the consensus estimate of $277.06 million. Revolve Group had a net margin of 3.08% and a return on equity of 8.35%. The company's quarterly revenue was up 3.2% on a year-over-year basis. During the same quarter last year, the firm posted $0.10 EPS.

Institutional Investors Weigh In On Revolve Group

Large investors have recently added to or reduced their stakes in the business. Farther Finance Advisors LLC boosted its position in shares of Revolve Group by 249.7% during the 3rd quarter. Farther Finance Advisors LLC now owns 1,126 shares of the company's stock valued at $28,000 after acquiring an additional 804 shares during the last quarter. Benjamin F. Edwards & Company Inc. grew its stake in Revolve Group by 91.1% in the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 4,069 shares of the company's stock worth $65,000 after buying an additional 1,940 shares in the last quarter. Quarry LP bought a new position in shares of Revolve Group in the 2nd quarter worth $68,000. American Century Companies Inc. purchased a new stake in shares of Revolve Group during the 2nd quarter valued at $165,000. Finally, nVerses Capital LLC purchased a new stake in Revolve Group during the third quarter valued at about $171,000. Institutional investors own 67.60% of the company's stock.

Insider Buying and Selling

In other Revolve Group news, major shareholder Mmmk Development, Inc. sold 6,493 shares of the stock in a transaction dated Thursday, September 19th. The shares were sold at an average price of $25.92, for a total transaction of $168,298.56. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In related news, CEO Michael Mente sold 48,346 shares of the business's stock in a transaction that occurred on Thursday, October 17th. The shares were sold at an average price of $26.32, for a total transaction of $1,272,466.72. Following the completion of the transaction, the chief executive officer now owns 73,000 shares of the company's stock, valued at approximately $1,921,360. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, major shareholder Mmmk Development, Inc. sold 6,493 shares of the stock in a transaction that occurred on Thursday, September 19th. The stock was sold at an average price of $25.92, for a total transaction of $168,298.56. The disclosure for this sale can be found here. In the last quarter, insiders have sold 124,573 shares of company stock valued at $3,260,634. 46.56% of the stock is owned by company insiders.

About Revolve Group

(

Get Free Report)

Revolve Group, Inc operates as an online fashion retailer for millennial and generation z consumers in the United States and internationally. The company operates in two segments, REVOLVE and FWRD. It operates a platform that connects consumers and global fashion influencers, as well as emerging, established, and owned brands.

Featured Stories

Before you consider Revolve Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revolve Group wasn't on the list.

While Revolve Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.