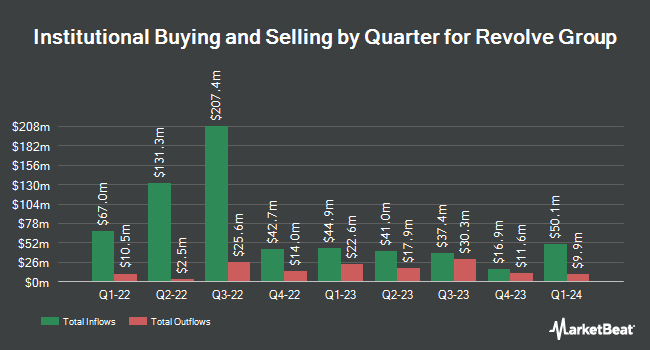

Millennium Management LLC raised its position in Revolve Group, Inc. (NYSE:RVLV - Free Report) by 68.1% in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 342,084 shares of the company's stock after purchasing an additional 138,600 shares during the quarter. Millennium Management LLC owned 0.48% of Revolve Group worth $5,443,000 as of its most recent SEC filing.

Other hedge funds have also recently made changes to their positions in the company. Westfield Capital Management Co. LP bought a new position in Revolve Group during the 1st quarter worth $33,735,000. Norden Group LLC raised its position in shares of Revolve Group by 2,269.6% during the first quarter. Norden Group LLC now owns 367,200 shares of the company's stock worth $7,774,000 after acquiring an additional 351,704 shares during the last quarter. Marshall Wace LLP lifted its stake in shares of Revolve Group by 141.2% in the second quarter. Marshall Wace LLP now owns 478,623 shares of the company's stock worth $7,615,000 after acquiring an additional 280,151 shares during the period. Comerica Bank boosted its holdings in Revolve Group by 12,630.9% in the first quarter. Comerica Bank now owns 179,888 shares of the company's stock valued at $3,808,000 after acquiring an additional 178,475 shares during the last quarter. Finally, Silvercrest Asset Management Group LLC increased its position in Revolve Group by 55.7% during the 1st quarter. Silvercrest Asset Management Group LLC now owns 376,620 shares of the company's stock valued at $7,973,000 after purchasing an additional 134,775 shares during the period. 67.60% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of brokerages have recently issued reports on RVLV. TD Cowen boosted their price target on shares of Revolve Group from $25.00 to $28.00 and gave the stock a "buy" rating in a research report on Monday, August 26th. Wedbush reaffirmed a "neutral" rating and set a $19.00 price target on shares of Revolve Group in a research report on Wednesday, August 7th. Evercore ISI lifted their price objective on Revolve Group from $20.00 to $21.00 and gave the stock an "in-line" rating in a research report on Wednesday, August 7th. BTIG Research upped their target price on Revolve Group from $24.00 to $26.00 and gave the company a "buy" rating in a research report on Friday, August 16th. Finally, Barclays raised their target price on Revolve Group from $15.00 to $17.00 and gave the stock an "underweight" rating in a research note on Wednesday, October 2nd. Two analysts have rated the stock with a sell rating, eight have issued a hold rating and seven have given a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $21.63.

Get Our Latest Analysis on RVLV

Revolve Group Stock Performance

Shares of Revolve Group stock traded up $0.46 during trading hours on Friday, reaching $25.35. The company's stock had a trading volume of 691,095 shares, compared to its average volume of 1,024,429. The company has a market capitalization of $1.79 billion, a P/E ratio of 56.33, a P/E/G ratio of 2.37 and a beta of 2.05. The stock's fifty day simple moving average is $23.45 and its two-hundred day simple moving average is $20.31. Revolve Group, Inc. has a one year low of $12.42 and a one year high of $26.14.

Revolve Group (NYSE:RVLV - Get Free Report) last announced its quarterly earnings results on Tuesday, August 6th. The company reported $0.21 earnings per share for the quarter, beating the consensus estimate of $0.13 by $0.08. The business had revenue of $282.50 million for the quarter, compared to analysts' expectations of $277.06 million. Revolve Group had a net margin of 3.08% and a return on equity of 8.35%. The firm's revenue for the quarter was up 3.2% compared to the same quarter last year. During the same quarter last year, the firm earned $0.10 EPS. As a group, research analysts forecast that Revolve Group, Inc. will post 0.55 earnings per share for the current year.

Insider Activity at Revolve Group

In related news, major shareholder Mmmk Development, Inc. sold 6,493 shares of the stock in a transaction on Thursday, September 19th. The stock was sold at an average price of $25.92, for a total value of $168,298.56. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. 46.56% of the stock is owned by insiders.

Revolve Group Profile

(

Free Report)

Revolve Group, Inc operates as an online fashion retailer for millennial and generation z consumers in the United States and internationally. The company operates in two segments, REVOLVE and FWRD. It operates a platform that connects consumers and global fashion influencers, as well as emerging, established, and owned brands.

Recommended Stories

Before you consider Revolve Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revolve Group wasn't on the list.

While Revolve Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.