Revvity (NYSE:RVTY - Free Report) had its target price upped by Robert W. Baird from $136.00 to $138.00 in a report released on Tuesday, Benzinga reports. The brokerage currently has an outperform rating on the stock.

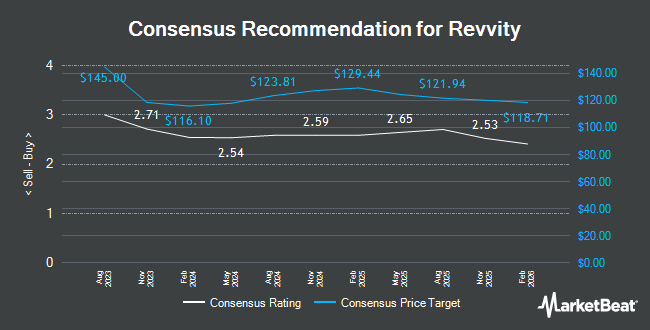

A number of other analysts also recently issued reports on the company. TD Cowen raised their target price on Revvity from $130.00 to $141.00 and gave the stock a "buy" rating in a research note on Tuesday, July 30th. Wells Fargo & Company initiated coverage on shares of Revvity in a research note on Tuesday, August 27th. They issued an "equal weight" rating and a $130.00 price target for the company. Jefferies Financial Group lifted their price target on shares of Revvity from $115.00 to $125.00 and gave the company a "hold" rating in a research report on Monday, July 29th. Leerink Partnrs upgraded Revvity to a "strong-buy" rating in a research report on Monday, July 8th. Finally, Citigroup increased their price target on Revvity from $135.00 to $145.00 and gave the stock a "buy" rating in a report on Tuesday, July 30th. Seven research analysts have rated the stock with a hold rating, nine have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $132.07.

Read Our Latest Analysis on RVTY

Revvity Price Performance

Shares of Revvity stock traded up $1.14 during trading hours on Tuesday, reaching $125.96. 855,889 shares of the company's stock were exchanged, compared to its average volume of 825,612. The business has a fifty day moving average of $121.46 and a two-hundred day moving average of $114.29. The company has a market capitalization of $15.54 billion, a P/E ratio of 90.85, a price-to-earnings-growth ratio of 3.34 and a beta of 1.05. The company has a quick ratio of 1.98, a current ratio of 2.27 and a debt-to-equity ratio of 0.40. Revvity has a 1 year low of $82.17 and a 1 year high of $128.83.

Revvity (NYSE:RVTY - Get Free Report) last released its earnings results on Monday, November 4th. The company reported $1.28 earnings per share for the quarter, topping analysts' consensus estimates of $1.13 by $0.15. The business had revenue of $684.10 million for the quarter, compared to analyst estimates of $679.66 million. Revvity had a net margin of 6.26% and a return on equity of 7.34%. The business's revenue was up 2.1% on a year-over-year basis. During the same period last year, the company posted $1.18 EPS. As a group, research analysts predict that Revvity will post 4.75 earnings per share for the current fiscal year.

Revvity announced that its Board of Directors has approved a share buyback plan on Monday, November 4th that permits the company to repurchase $1.00 billion in outstanding shares. This repurchase authorization permits the company to repurchase up to 6.5% of its shares through open market purchases. Shares repurchase plans are generally an indication that the company's management believes its stock is undervalued.

Revvity Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, February 7th. Investors of record on Friday, January 17th will be issued a $0.07 dividend. The ex-dividend date is Friday, January 17th. This represents a $0.28 annualized dividend and a yield of 0.22%. Revvity's dividend payout ratio (DPR) is 20.29%.

Insider Activity

In other Revvity news, insider Tajinder S. Vohra sold 2,153 shares of the firm's stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of $122.09, for a total transaction of $262,859.77. Following the sale, the insider now owns 23,960 shares of the company's stock, valued at approximately $2,925,276.40. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In other news, insider Tajinder S. Vohra sold 2,154 shares of the stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $121.73, for a total value of $262,206.42. Following the completion of the sale, the insider now directly owns 19,652 shares of the company's stock, valued at approximately $2,392,237.96. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Tajinder S. Vohra sold 2,153 shares of the company's stock in a transaction on Monday, October 7th. The shares were sold at an average price of $122.09, for a total transaction of $262,859.77. Following the completion of the sale, the insider now owns 23,960 shares of the company's stock, valued at approximately $2,925,276.40. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 7,807 shares of company stock worth $937,576. 0.60% of the stock is currently owned by insiders.

Institutional Trading of Revvity

A number of hedge funds have recently added to or reduced their stakes in the stock. CX Institutional lifted its stake in shares of Revvity by 1.1% in the 3rd quarter. CX Institutional now owns 7,984 shares of the company's stock worth $1,020,000 after acquiring an additional 86 shares during the period. Garrison Asset Management LLC boosted its holdings in Revvity by 0.5% in the 2nd quarter. Garrison Asset Management LLC now owns 21,328 shares of the company's stock valued at $2,236,000 after purchasing an additional 103 shares in the last quarter. TriaGen Wealth Management LLC increased its position in Revvity by 2.3% during the 2nd quarter. TriaGen Wealth Management LLC now owns 4,767 shares of the company's stock worth $500,000 after purchasing an additional 107 shares during the period. Guinness Asset Management LTD raised its stake in shares of Revvity by 3.3% during the 2nd quarter. Guinness Asset Management LTD now owns 3,587 shares of the company's stock worth $376,000 after buying an additional 116 shares in the last quarter. Finally, Inspire Investing LLC lifted its holdings in shares of Revvity by 2.9% in the 1st quarter. Inspire Investing LLC now owns 4,190 shares of the company's stock valued at $440,000 after buying an additional 117 shares during the period. 86.65% of the stock is owned by institutional investors and hedge funds.

Revvity Company Profile

(

Get Free Report)

Revvity, Inc provides health sciences solutions, technologies, and services in the Americas, Europe, and Asia, and internationally. The Life Sciences segment provides instruments, reagents, informatics, software, subscriptions, detection, imaging technologies, warranties, training, and services. Its Diagnostics segment provides instruments, reagents, assay platforms, and software products for the early detection of genetic disorders, such as pregnancy and early childhood, as well as infectious disease testing in the diagnostics market.

Read More

Before you consider Revvity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revvity wasn't on the list.

While Revvity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report