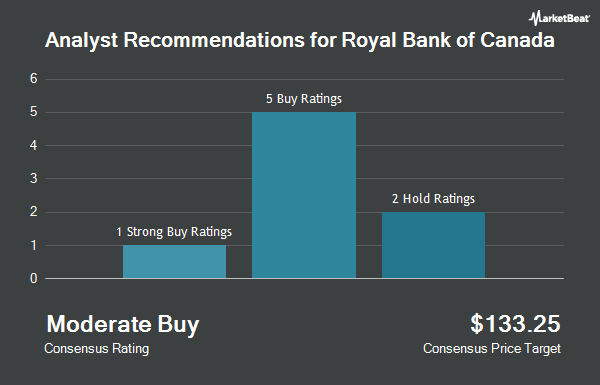

Royal Bank of Canada (NYSE:RY - Get Free Report) TSE: RY has earned an average recommendation of "Buy" from the seven analysts that are currently covering the firm, Marketbeat.com reports. One research analyst has rated the stock with a hold recommendation, five have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 12-month price target among brokers that have issued a report on the stock in the last year is $142.50.

A number of analysts have recently commented on RY shares. StockNews.com cut Royal Bank of Canada from a "hold" rating to a "sell" rating in a research report on Saturday, July 20th. UBS Group began coverage on Royal Bank of Canada in a research report on Tuesday, July 2nd. They set a "buy" rating on the stock. Finally, BMO Capital Markets boosted their price target on Royal Bank of Canada from $151.00 to $165.00 and gave the company an "outperform" rating in a research report on Thursday, August 29th.

View Our Latest Stock Report on Royal Bank of Canada

Royal Bank of Canada Stock Down 0.4 %

Royal Bank of Canada stock traded down $0.49 during midday trading on Tuesday, reaching $123.54. The company's stock had a trading volume of 659,051 shares, compared to its average volume of 1,085,415. Royal Bank of Canada has a fifty-two week low of $79.03 and a fifty-two week high of $126.96. The company has a quick ratio of 0.87, a current ratio of 0.87 and a debt-to-equity ratio of 0.12. The company has a market cap of $174.64 billion, a P/E ratio of 14.94, a P/E/G ratio of 2.00 and a beta of 0.86. The business has a 50-day simple moving average of $121.97 and a 200-day simple moving average of $111.47.

Royal Bank of Canada (NYSE:RY - Get Free Report) TSE: RY last posted its quarterly earnings results on Wednesday, August 28th. The financial services provider reported $2.38 earnings per share for the quarter, beating analysts' consensus estimates of $2.15 by $0.23. Royal Bank of Canada had a return on equity of 15.17% and a net margin of 12.28%. The company had revenue of $10.68 billion for the quarter, compared to analysts' expectations of $10.40 billion. On average, research analysts expect that Royal Bank of Canada will post 8.91 earnings per share for the current fiscal year.

Royal Bank of Canada Cuts Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 22nd. Shareholders of record on Thursday, October 24th will be issued a $1.028 dividend. This represents a $4.11 dividend on an annualized basis and a yield of 3.33%. The ex-dividend date is Thursday, October 24th. Royal Bank of Canada's dividend payout ratio is presently 50.67%.

Institutional Investors Weigh In On Royal Bank of Canada

A number of institutional investors have recently added to or reduced their stakes in RY. Pembroke Management LTD boosted its stake in shares of Royal Bank of Canada by 3.8% during the 3rd quarter. Pembroke Management LTD now owns 10,492 shares of the financial services provider's stock worth $1,309,000 after acquiring an additional 384 shares in the last quarter. Farther Finance Advisors LLC boosted its stake in shares of Royal Bank of Canada by 42.0% during the 3rd quarter. Farther Finance Advisors LLC now owns 8,907 shares of the financial services provider's stock worth $1,111,000 after acquiring an additional 2,636 shares in the last quarter. Americana Partners LLC boosted its stake in shares of Royal Bank of Canada by 0.5% during the 3rd quarter. Americana Partners LLC now owns 29,508 shares of the financial services provider's stock worth $3,681,000 after acquiring an additional 145 shares in the last quarter. US Bancorp DE boosted its stake in shares of Royal Bank of Canada by 0.3% during the 3rd quarter. US Bancorp DE now owns 86,594 shares of the financial services provider's stock worth $10,801,000 after acquiring an additional 250 shares in the last quarter. Finally, SteelPeak Wealth LLC purchased a new stake in shares of Royal Bank of Canada during the 3rd quarter worth approximately $222,000. Hedge funds and other institutional investors own 45.31% of the company's stock.

Royal Bank of Canada Company Profile

(

Get Free ReportRoyal Bank of Canada operates as a diversified financial service company worldwide. The company's Personal & Commercial Banking segment offers checking and savings accounts, home equity financing, personal lending, private banking, indirect lending, including auto financing, mutual funds and self-directed brokerage accounts, guaranteed investment certificates, credit cards, and payment products and solutions; and lending, leasing, deposit, investment, foreign exchange, cash management, auto dealer financing, trade products, and services to small and medium-sized commercial businesses.

Further Reading

Before you consider Royal Bank of Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Bank of Canada wasn't on the list.

While Royal Bank of Canada currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.